In the summer of July, Bitcoin ascended to ethereal heights, yet two telltale whispers suggest a distinctly American camaraderie behind this meteorological rally.

A widening chasm between the tempest of US trading and the gentle breeze of Korean activity raises eyebrows about global fervor — and oh, the perils that may lurk in the shadows.

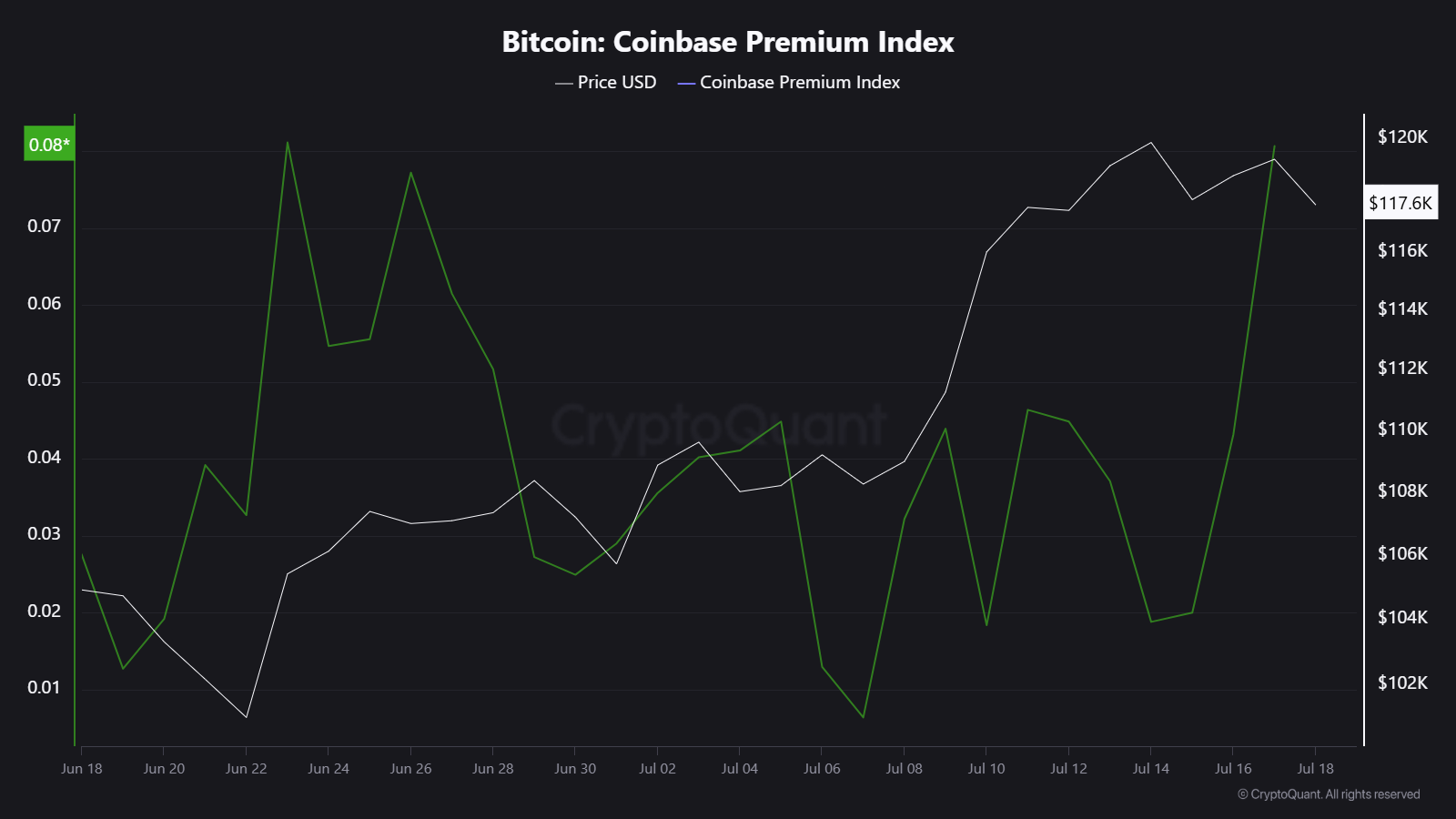

Coinbase Premium: The American Hangover?

Throughout July, our dear Coinbase Premium Index — that unrelenting detective of price discrepancies between Bitcoin on Coinbase (USD) and Binance (USDT) — has yanked itself upward, like a feral cat spotting a sunbeam.

It reached a whopping 0.08%, a beacon of US buying pressure that screams of greedier whales, ETF aficionados, or corporate chieftains sharpening their fangs.

With the tide of US spot Bitcoin ETFs washing in nearly $14.8 billion, our darling BTC flaunts its all-time high near $123,000. Just another day in paradise, or possibly the brink of an existential crisis?

From the benches of history, we see a stage set for American institutions to lead the dance, all thanks to sweet regulation and the endless access to capital—who knew compliance could be so sexy?

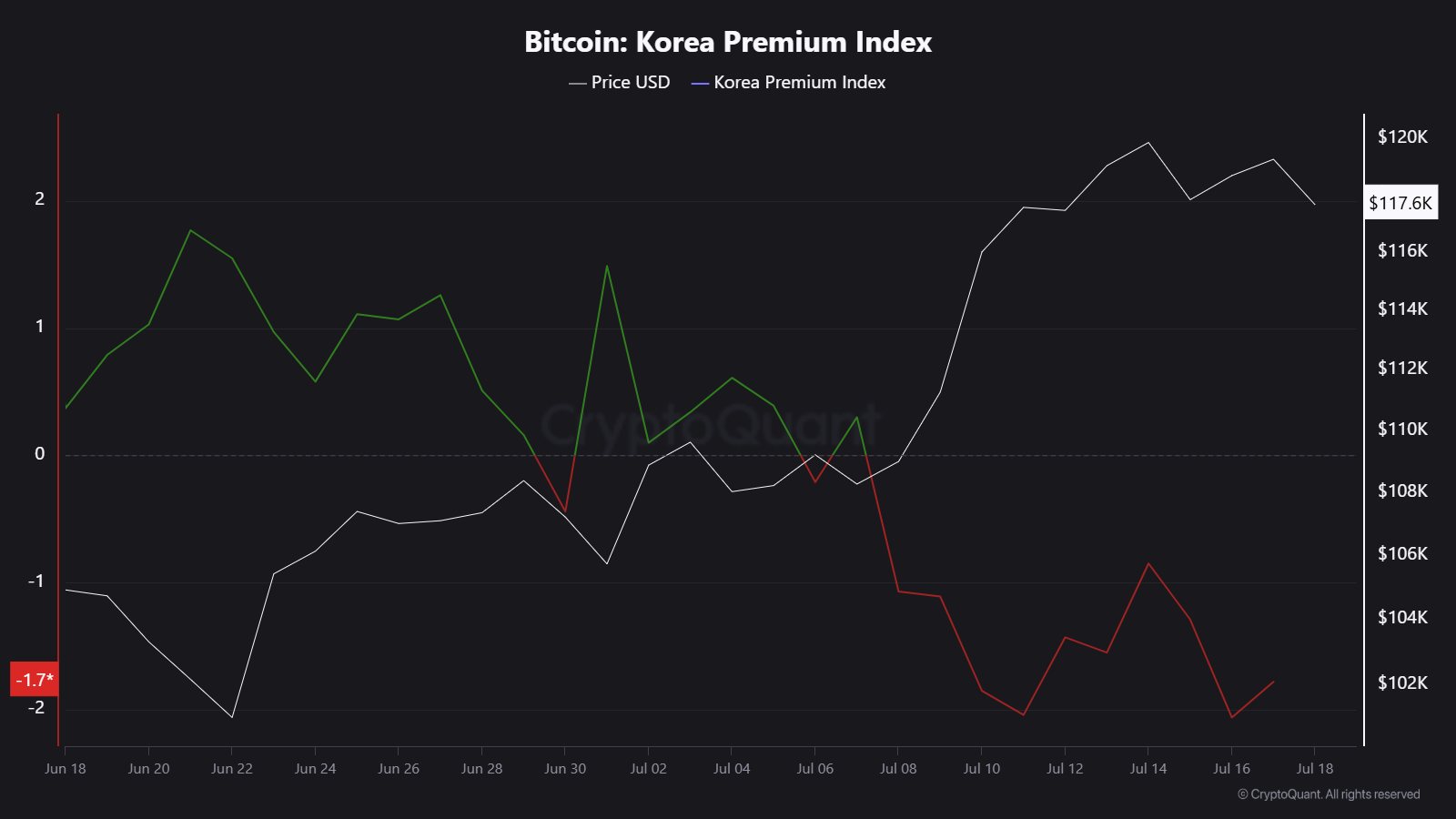

Korea: The Silent Observer

Meanwhile, the other side of the globe shows a different tale of woe. The Korea Premium Index, affectionately dubbed the “Kimchi Premium”, has taken a nosedive below zero.

Currently languishing around -1.7%, Bitcoin slinks around cheaper than street food in Seoul. It’s rather tragic, really—Korean retail demand appears to be on life support.

In the highs of yore (2017, 2021), Korea often danced with premiums of +10% or more, a retail frenzy fueled by unrestrained speculation. Today, however, the stage is empty, the lights dimmed, and the audience has left for better entertainment.

When Divergence Dances

This curious rift between the indices reveals a singular truth: Bitcoin’s current bull run is a US-centric affair—barely a flicker in the vibrant markets of Asia.

Historically, a healthy blend of retail enthusiasm churned the wheels of the bull — now, without it, we risk teetering on the edge, relying solely on robust institutional support, the proverbial solitary pillar in a precarious world.

Additionally, this might ruffle the feathers of altcoins, which find their moisture in the liquidity of Korean exchanges and the heartbeats of retail narratives.

If the Coinbase Premium remains positive amidst strong US demand, we’re in for a luxurious ride. But should it falter while the Korea Premium remains negative, don’t be surprised if we witness a drop as dramatic as a soap opera climax.

Should the Korea Premium turn the tide back to positivity, it might just beckon the retail crowd back into the fold, setting the stage for Bitcoin to reignite its ascent once more.

For now, however, Bitcoin’s chaotically romantic price dance will likely continue to be a US affair, conducted by ETFs, corporations, and wealth managers — quite the party, but where are the global retail investors?

Read More

- Gold Rate Forecast

- Crypto’s Wall Street Waltz 🕺

- Silver Rate Forecast

- Brent Oil Forecast

- Crypto Chaos Unveiled: Gains, Losses & More Drama Than Your Aunt’s Tea Party! ☕🪙

- Crypto ATMs: The Wild West of Fraud 🤑🚨

- USD HKD PREDICTION

- Ethereum Whales on a Buying Spree: Is $3,400 ETH Price Next? 🐳📈

- Centrifuge Hits $1B & My Mother Finally Asks “What’s a Token?” 😱

- CRV PREDICTION. CRV cryptocurrency

2025-07-18 21:36