Hyperliquid, or as I like to call it, “Hype-lot-of-letters,” might be on the brink of something big. Or small. Or sideways. Who knows? But with its solid fundamentals and a chart that looks like a rollercoaster ride gone wrong, we’re talking about a potential comeback. After taking a nosedive from its lofty perch at $49.89 to a not-so-lofty $42, HYPE has been chilling in a tight spot, just above a crucial support area. This little dance could set the stage for the next big move, assuming it doesn’t decide to take a nap instead. 🛌

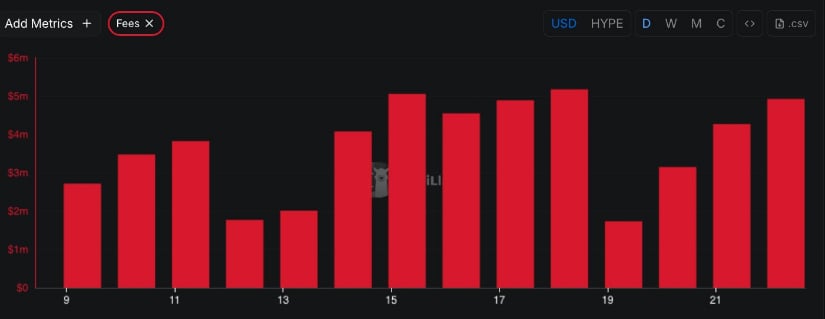

Hyperliquid Revenue Holds Steady

While everyone’s been distracted by the latest crypto drama, Hyperliquid has been quietly making bank. Over the past two weeks, the daily revenue has averaged a cool $3.7 million, with over half the days hitting the $4 million mark. Even on weekends, when most people are too busy binge-watching Netflix to trade, the revenue rarely dipped below $3 million. That’s like having a steady stream of cash, but without the hassle of actually working. 💸

This kind of consistency means Hyperliquid is on track to hit an annualized run rate of $1.35 billion. That’s enough to make even the top players in the space do a double-take. MetamateDaz thinks that while Hyperliquid is raking in the dough, its market cap is still relatively modest. This gap between usage and price could be a recipe for a big surprise. 🤔

HYPE Bounces off Key Support

Now, let’s talk tech. CryptosBatman (not the Batman you’re thinking of) points out that HYPE is testing a critical area where previous resistance meets a long-standing ascending trendline. It’s like a perfect storm of technical indicators, suggesting a high-probability bounce. Especially in a trending market, this could be the setup of the year. 🎉

The chart shows HYPE holding steady in a tight zone between $42 and $45, which now serves as immediate support. If this support holds, the next logical target is around $50, where the party was last seen. 🎉

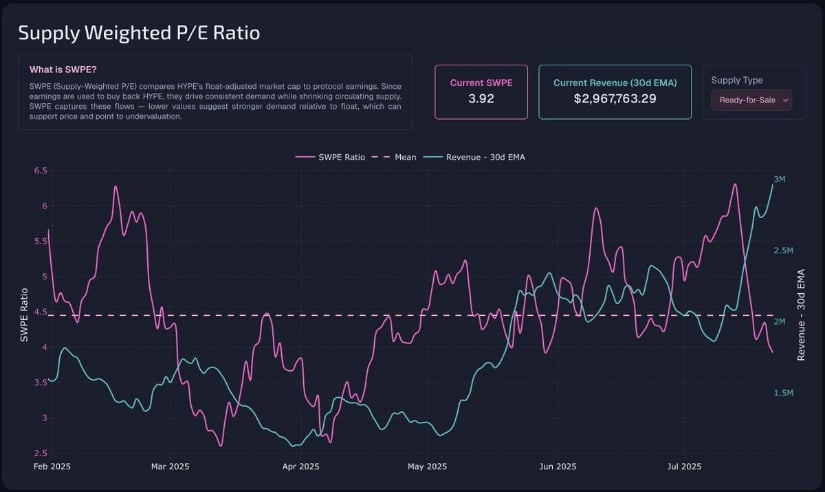

SWPE Ratio Drops Below 4, Suggesting Reversal Soon

Tobias Reisner, the guy who knows his ratios, notes that the SWPE (Supply-Weighted P/E) ratio has dipped below 4. Historically, this has been a sign of good things to come. Every time this ratio drops below 4, HYPE has rallied. So, if history repeats itself, we might be looking at a golden opportunity. 🏆

With strong fundamentals and a stable technical structure, this drop in the SWPE ratio could signal that HYPE is undervalued. If the past is any guide, current levels might be a great entry point before the next big move. 📈

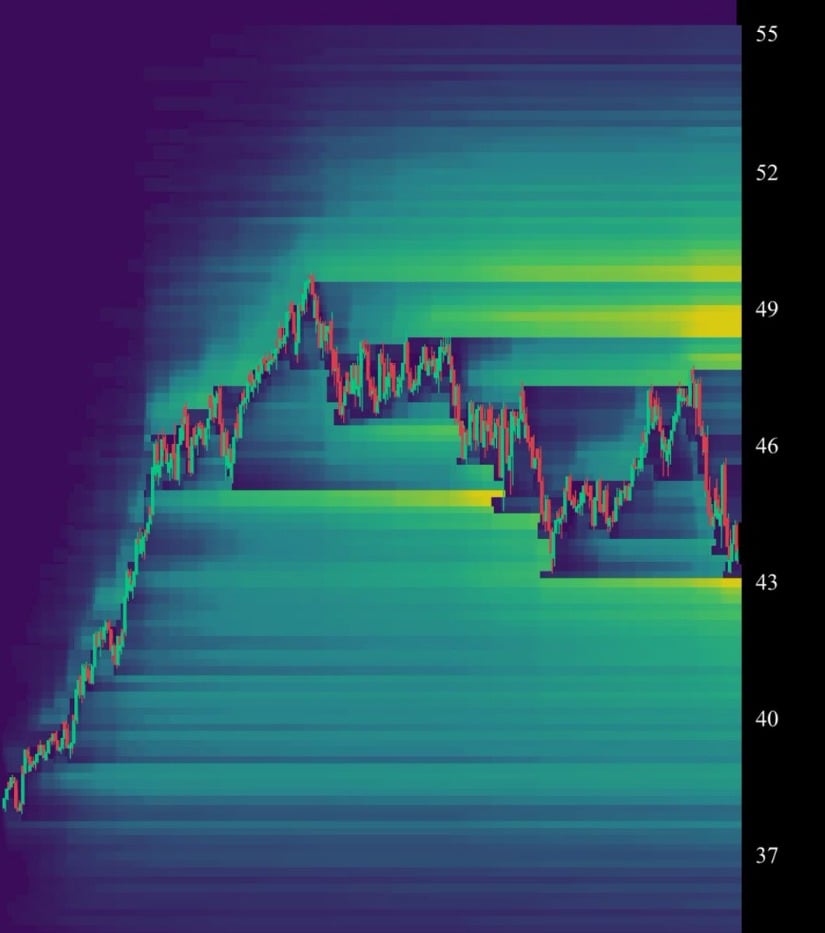

Liquidity Maps Hint at Final Sweep Before the Move

But wait, there’s more! HYPEconomist’s latest liquidity heatmap shows a concentration of liquidity just below current levels, especially around $43. This suggests a classic liquidity sweep setup, where the market might dip slightly to shake out the weak hands before a strong move higher. It’s like a game of musical chairs, but with money. 🎶💰

This dip could create a stronger base for a more sustainable rally, especially as many shorts are still exposed near the $49 to $52 band. It’s a bit of a “heads I win, tails you lose” situation for the bulls. 🐂

Technical Outlook: Hyperliquid To Possibly Dip Before Key Rally

Realm’s latest chart aligns with the liquidity heatmap, suggesting that HYPE might see one more leg down into the $37 to $41 accumulation zone before gearing up for a push toward $50. This expectation fits nicely with the earlier heatmap, showing heavy bid interest just below the current range. 📊

The chart hints at a potential higher low forming in the $37–$41 pocket, preserving the broader uptrend while giving bulls a cleaner base to work with. If this W-shaped recovery plays out, HYPE could be heading back to its 52-week highs as Q4 approaches. 🚀

Final Thoughts: Bullish Scenario or Bearish Outlook?

Hyperliquid’s setup is one of the most intriguing in the market right now. With strong and steady revenue, a deflationary token model, and supportive technicals, HYPE looks poised for a potential breakout. While a final dip is still possible, the broader structure suggests any weakness could just be a reset before the next leg higher. If the W-shaped recovery confirms and momentum builds into Q4, a return to 52-week highs seems more likely than a trip to the discount bin. 🛍️

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- EUR NZD PREDICTION

- Crypto Chaos Unveiled: Gains, Losses & More Drama Than Your Aunt’s Tea Party! ☕🪙

- The Universe’s 3 Favorite Ways to Crash Crypto (And Why Yen Just Won)

- USD THB PREDICTION

- EUR JPY PREDICTION

- EUR ARS PREDICTION

- USD GEL PREDICTION

2025-07-23 02:08