Ah, Hyperliquid! A name that dances upon the lips of the crypto enthusiasts, a veritable siren song in the tumultuous sea of digital currencies. The price, like a restless spirit, has found solace at the $40 threshold, a bastion of support that has withstood the test of time-or at least a few retests. As it ascends toward the mid-$40s, one cannot help but wonder: is this the moment of reckoning? The bulls, those optimistic creatures, seem to be sharpening their horns for a potential breakout.

Hyperliquid: A Resilient Phoenix from the $40 Ashes

In a display of sheer audacity, Hyperliquid has rebounded sharply, defending its sacred ground between $40 and $42. This zone, now a fortress of support, has been tested repeatedly, and each time it has emerged victorious. The latest surge has propelled the price back into the mid-$45 range, a clear indication that momentum is shifting, or perhaps just taking a leisurely stroll.

With the ominous $47.50 looming as a near-term resistance, one can only speculate what lies beyond. A decisive break above this threshold could very well lead us to the fabled $50, where the next major supply zone awaits, perhaps with a cup of tea and a scone. ☕️

Our astute analyst, Trenches, observes that a staggering 99% of Hyperliquid’s revenue is being funneled into buybacks. It’s as if the company is saying, “Let’s keep the demand steady, shall we?” Meanwhile, the HyperEVM network expansion continues to attract attention like a moth to a flame. Volume spikes during these rebounds add weight to the bullish setup, suggesting that buyers are defending their territory with the ferocity of a mother bear. 🐻

Hyperliquid: Poised for a Breakout or Just Daydreaming?

HYPEBTC has been consolidating since June, testing the upper boundaries of its range like a cat testing the warmth of a sunbeam. The chart reveals a horizontal resistance band that, if breached, could trigger a decisive move higher. The Ichimoku Cloud support remains steadfast beneath the price, while the RSI hovers near overbought territory, a warning that traders should keep their eyes peeled for potential pullbacks-because who doesn’t love a good rollercoaster ride? 🎢

Volume has been gradually ticking up during these tests of resistance, and moving averages are beginning to flatten, reducing downward pressure. With consolidation now lasting multiple months, one might say the setup carries the hallmarks of an impending breakout-or perhaps just a long-winded nap.

Strong Revenues: The Wind Beneath Hyperliquid’s Wings

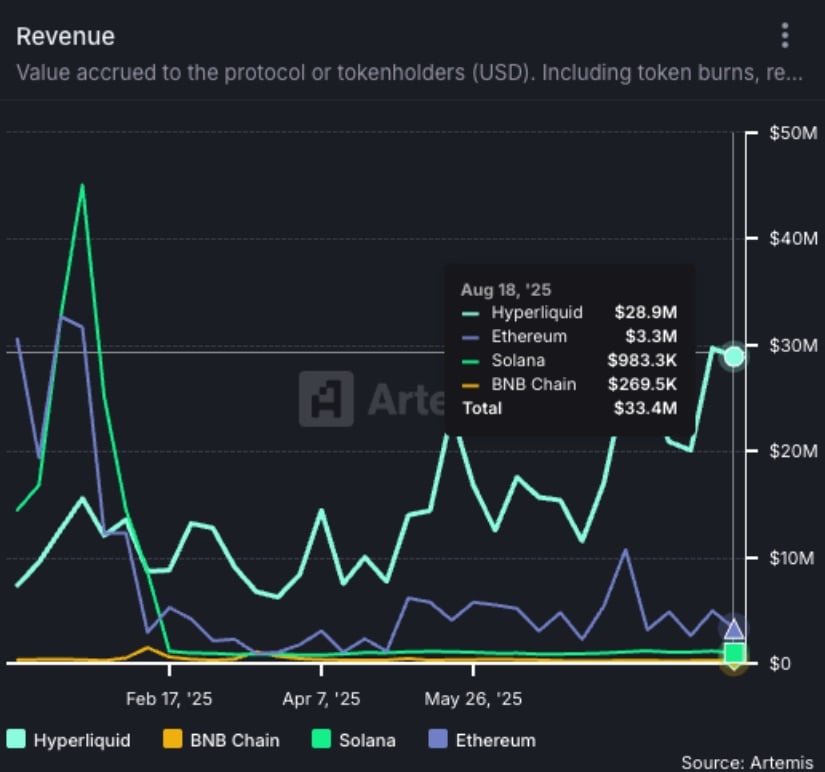

Fresh data from our insightful analyst, Aylo, reveals that Hyperliquid generated nearly $29M in protocol revenue on August 18, outpacing the likes of Ethereum and Solana. This surge not only highlights strong network demand but also underscores Hyperliquid’s growing role in the grand tapestry of trading activity. It’s like watching a toddler outpace their older siblings in a race-adorable yet astonishing! 🏃♂️💨

The combination of rising revenues, consistent buybacks, and a consolidating price structure creates a compelling backdrop for further upside. While some skeptics argue that valuation may already be stretched, the sustained ability to generate this level of income suggests Hyperliquid is far from cooling off-more like simmering with potential.

Big Weekend Numbers: Hyperliquid’s Moment in the Spotlight

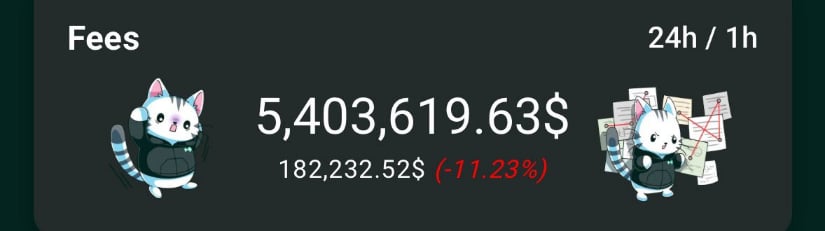

Hyperliquid continues to dazzle with eye-catching figures, with weekend fees alone annualizing to nearly $2B, a level that rivals some of the biggest centralized exchanges. Even more astonishing, its spot volume recently outpaced the combined activity of Coinbase and Bybit. It’s as if Hyperliquid is throwing a party and everyone is invited! 🎉

As our analyst Daz points out, these metrics reflect a market presence that’s growing faster than many expected. This kind of fundamental strength adds weight to the bullish technical picture already forming for HYPE, like a well-cooked borscht-rich and hearty.

Hyperliquid Price Prediction: Eyes on the $50 Prize

The chart reveals Hyperliquid testing the $45 to $46 resistance zone, a level that has capped multiple rallies over the past week. The recent push above the descending trendline is a constructive sign, hinting at breakout momentum-as long as the price can hold above this reclaimed level. With the 200 EMA sitting just below at $44, short-term structure remains supported, giving bulls a clear line to defend if momentum cools. It’s like a game of chess, but with more excitement and fewer existential crises.

Analyst Sigma Trader notes that clearing $46 decisively would put the $50 target back in play, where the next major resistance sits. Volume has started to rise on this move, suggesting that buyers are stepping in with aggression-like a hungry wolf at a buffet. 🐺

Final Thoughts: The Crossroads of Hyperliquid’s Fate

Hyperliquid now finds itself at a pivotal crossroads, with $46 emerging as the immediate level that could decide its short-term direction. A firm push through this barrier opens the path toward $50, while rejection could see the price drift back into the $42 to $44 consolidation zone. It’s a classic tale of triumph or tragedy, with market watchers closely observing volume expansion. A breakout without follow-through would risk another range-bound stretch, like a soap opera that just won’t end. On-chain and revenue metrics remain supportive, cushioning downside risks even if momentum cools. And so, the saga continues…

Read More

- Crypto’s Wall Street Waltz 🕺

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- Crypto ATMs: The Wild West of Fraud 🤑🚨

- Crypto Chaos Unveiled: Gains, Losses & More Drama Than Your Aunt’s Tea Party! ☕🪙

- ARB PREDICTION. ARB cryptocurrency

- Trump Jr.’s Thumzup Bags $50M-Because Why Mine Diamonds When You Can Mine Meme Coins? 💰🤑

- Deep Dive into Ethereum: Greed, Squeeze, and the Never-Ending Chase for All-Time Highs

- You Won’t Believe What DBS Just Did with Crypto! 😲💰

2025-08-26 23:11