Ikuyo, a company that makes parts for cars – you know, the things that actually make the cars go – has decided to throw two million dollars (or 300 million yen, which sounds much more serious) at a US firm called Galactic Holdings. Honestly, the name alone feels like a pitch for a terrible sci-fi movie. Are we sure this isn’t about building a Death Star?

Apparently, this is all about “blockchain payment transformation” which, to me, sounds like someone took all the buzzwords from 2017 and just threw them at a wall. Global supply chains, you see, are apparently *dying* for a little disruption. And blockchain is here to save them. Or something.

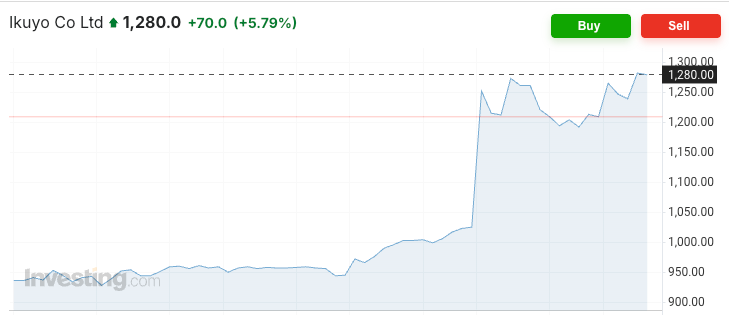

Stock Rallies to Unprecedented Highs

So Ikuyo invested in this… Galactic thing, and their stock went up. 🎉 It’s a heartwarming story about how throwing money at the latest tech trend can temporarily impress investors. The enthusiasm is “growing crypto appetite,” they say. I suspect it’s more like a sugar rush. We’ll see when the reality of actually, you know, *using* this takes hold.

The problem, as I understand it (and I understand remarkably little about finance) is that sending money across borders is slow and complicated, like trying to get a return approved at a department store. Digital currencies are supposed to fix this. Naturally. Because everything is always better with blockchain. I mean, it’s not like anyone has ever lost all their money on a digital currency before… 🙄

This investment is just the next step in a lovely little relationship Ikuyo started with Galactic back in June. It’s like a corporate arranged marriage. “Mommy, I don’t want to be operationally tied to a digital payment provider!” “Too bad, dear. It’s good for the portfolio.”

Stablecoin Essential for Global Operations

Galactic Holdings apparently shuffles money around Latin America. Which sounds…vaguely illicit? No? Okay. They skip the whole annoying process of converting currencies, which is lovely. Because who *likes* logic and reason? They boast about enhanced transparency, which is always a good sign when money’s involved, isn’t it?

Currently, Ikuyo’s Chinese branch has to deal with pesos and dollars. Apparently, it’s a whole ordeal. The article describes it as “inefficient.” I’d describe it as…how business has been done for decades. Now, blockchain will swoop in and streamline everything. Because, again, blockchain. I expect a wave of intern resignations as their entire college education becomes irrelevant.

Basically, everyone is realizing blockchain might be useful. Which is surprising. The early adopters, naturally, are positioning themselves as forward-thinking geniuses. The rest will probably wait until the whole thing is either ridiculously successful or a complete disaster. A conservative approach, I call it. 😉

The automotive parts industry, apparently, is especially desperate for stablecoin efficiency. Who knew? Analysts predict more corporations will jump on the bandwagon as regulations become… less chaotic. It’s all very exciting. For accountants. And blockchain enthusiasts. And anyone who enjoys watching large sums of money disappear into the digital ether.

Read More

- Crypto’s Wall Street Waltz 🕺

- Gold Rate Forecast

- Silver Rate Forecast

- Centrifuge Hits $1B & My Mother Finally Asks “What’s a Token?” 😱

- Brent Oil Forecast

- Crypto Chaos Unveiled: Gains, Losses & More Drama Than Your Aunt’s Tea Party! ☕🪙

- USD HKD PREDICTION

- Ethereum Whales on a Buying Spree: Is $3,400 ETH Price Next? 🐳📈

- Solana’s Breakout: Is $200 Just the Beginning? Find Out Now!

- Crypto Market: Cooling Demand and a Niche Party, Not a Full-Blown Alt-Season 🚨

2025-08-29 05:47