Welcome to the US Crypto News Morning Briefing-your daily dose of financial drama, served with a side of sarcasm. 📰☕

Grab your coffee (or eggnog, we don’t judge) because the latest US labor data is here, and it’s as confusing as a fruitcake recipe. Jobs, wages, unemployment-it’s all over the place, and traders are spinning like dreidels trying to figure out what it means for Bitcoin and the rest of the risk-asset circus. 🎢🤹♂️

Crypto News of the Day: October Jobs Faceplant, November Does a Half-Hearted Cartwheel 🪀

The US Nonfarm Payrolls (NFP) report for October and November 2025 dropped, and let’s just say it’s giving “mixed signals” vibes. October lost 105,000 jobs-way more than the expected -25,000. November tried to save the day with a 64,000 gain, but unemployment climbed to 4.6%. So, yeah, it’s a real “one step forward, two steps sideways” situation. 🕺💼

According to the US Bureau of Labor Statistics (BLS), October’s numbers were basically a government-induced outlier. Thanks, delayed data collection! 🎉📉

*US OCT. NONFARM PAYROLLS FALL 105K M/M; EST. -25K

this is all govt and an outlier

– zerohedge (@zerohedge) December 16, 2025

November’s modest gain was slightly above expectations, but the unemployment rate rise is like that one awkward guest at the holiday party-nobody asked for it. 🎈🤦♀️

🚨 Just In: November Nonfarm Payrolls rise 64,000, above expectations for 40,000.

The U.S. Unemployment Rate rose from 4.4% to 4.6%, worse than estimates for 4.5%.

What will Jerome Powell do now? 🤔🎩

– Jesse Cohen (@JesseCohenInv) December 16, 2025

November’s numbers are like a lukewarm cup of cocoa-not terrible, but not exactly comforting either. 🍫🥴

Fed and Market Implications: Bitcoin’s Holiday Hangover? 🎁🤢

This data is basically a dovish Christmas gift for the Federal Reserve. Powell’s been eyeing a weakening labor market like it’s the last pie at a holiday potluck, and now he’s got the numbers to justify more rate cuts. Traders are like, “Liquidity, please!” but Bitcoin’s still stuck near $90,000, looking as indecisive as a last-minute gift shopper. 🛍️💸

A weak October followed by a meh November could send Bitcoin rallying toward $95,000-or it could trigger recession fears and send everything into a tailspin. Because why have a calm holiday season when you can have financial whiplash? 🎢🎄

“Markets love resolving uncertainty, but this data dump is like a bad Secret Santa gift-nobody knows what to do with it. Crypto might rally on Fed cut hopes, or it might crash on recession fears. It’s a real coin flip!” Jimmy Xue, COO and Co-founder at Axis, told BeInCrypto. 🎲💔

And let’s not forget algorithm-driven trading and thin liquidity-because nothing says “happy holidays” like amplified volatility. 🎉💥

Meanwhile, gold’s over there sipping eggnog like, “I’m the real safe haven now.” 🥇🍸

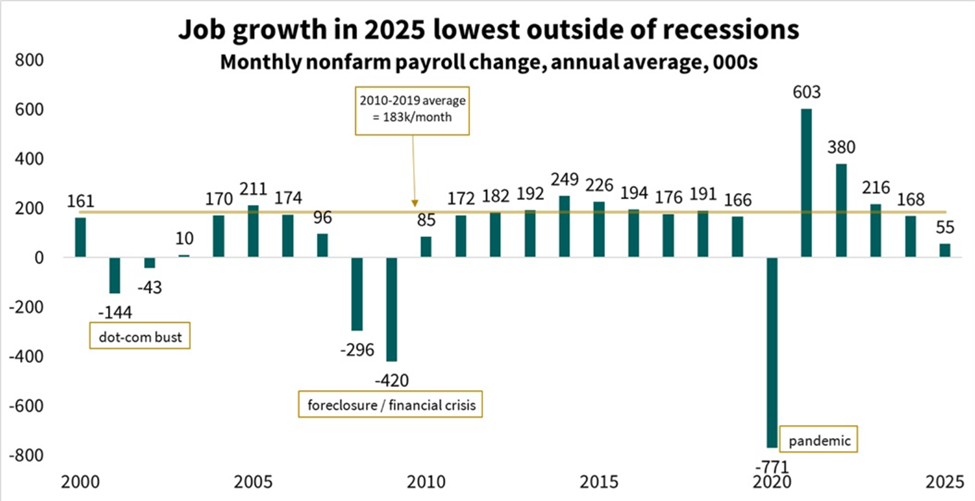

Chart of the Day 📈

Byte-Sized Alpha 🧮

Crypto Equities Pre-Market Overview 📊

| Company | At the Close of December 15 | Pre-Market Overview |

| Strategy (MSTR) | $162.08 | $165.23 (+1.94%) 🎉 |

| Coinbase (COIN) | $250.42 | $253.61 (+1.27%) 🚀 |

| Galaxy Digital Holdings (GLXY) | $24.54 | $24.59 (+0.20%) 🤷♀️ |

| MARA Holdings (MARA) | $10.70 | $10.82 (+1.12%) 🤑 |

| Riot Platforms (RIOT) | $13.71 | $13.81 (+0.73%) 🌟 |

| Core Scientific (CORZ) | $15.28 | $15.27 (-0.065%) 😴 |

Read More

- Gold Rate Forecast

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- BitMEX’s Great Crypto Pruning: 48 Contracts to Bite the Dust 🌡️🔥

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- XRP’s Little Dip: Oh, the Drama! 🎭

- ETH’s $2B Liquidation Drama: Will It Crash or Soar? 🚀💸

- Bitcoin’s Quiet Sabotage: Hidden Dangers and Mow’s Cryptic Wisdom

- Bullish Stock Soars 218% – Wall Street Finally Gets It (Or Is This a Joke?) 🐄💸

- When Bitcoin Takes a Tumble, Who’s Laughing Now? 🤷♀️

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

2025-12-16 19:38