Ah, mon ami, let us delve into the delightful chaos of this week’s crypto calamity! Bitcoin, that fickle lover of fortunes, has plummeted to a mere $60,500-a price not seen since October 2024, when the moon still had more value than a promise from a Parisian boulevardier. The grand total of all cryptocurrencies? A paltry $2.2 trillion, a sum that would make even the most jaded banker yawn.

- The crypto crash, like a poorly written farce, has reached its crescendo this week.

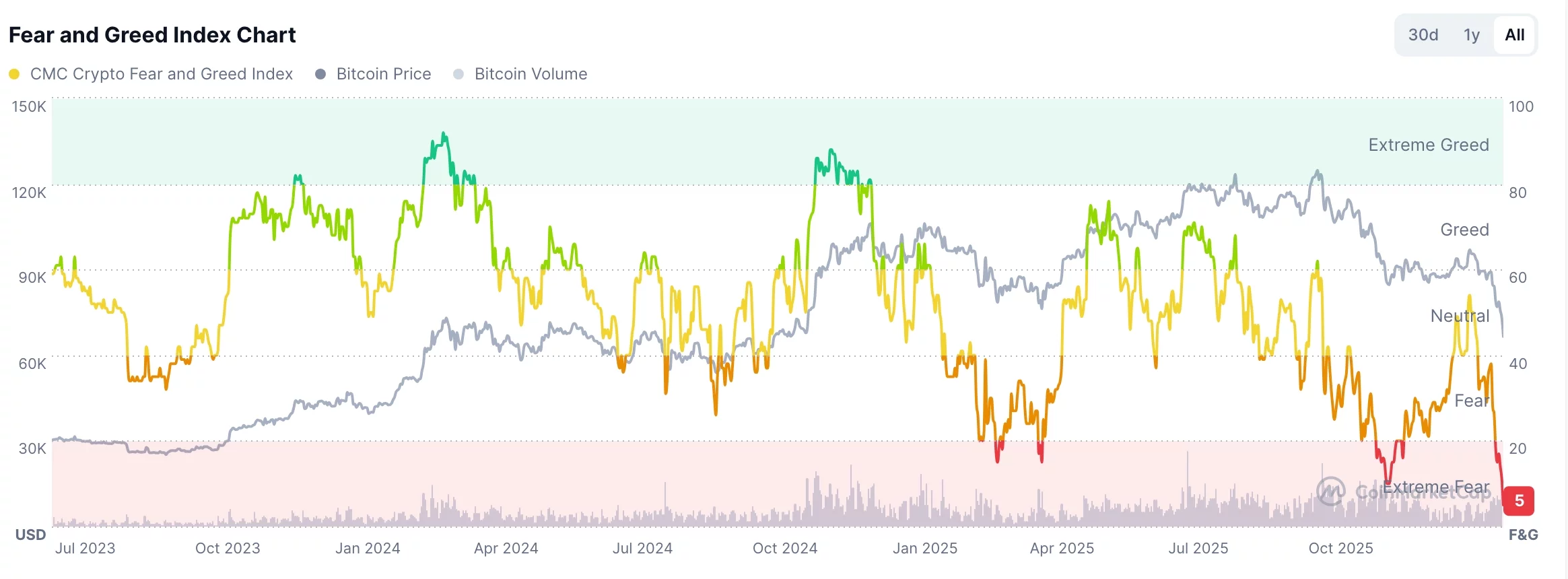

- The Fear and Greed Index? It’s now so low, it could fit in a confessional.

- Technical analysis whispers, “C’est trop!”-the market is highly oversold.

Pourquoi ce crash? Une Tragédie en Cinq Actes

The ongoing retreat of our crypto comrades is driven by a curious blend of global economic worries and investor sentiment. The U.S. and Iran, in their eternal dance of threats, have sown seeds of uncertainty-though one might argue their duels are more theatrical than real. Still, the mere possibility of oil price tremors has sent crypto prices tumbling like a marquise’s reputation after a scandal.

Bitcoin and altcoins, ever the party crashers, have been dumped by investors fleeing risk assets. Where did they go? Into the arms of the stock market, where the Nasdaq 100 Index now slumps while value ETFs, like the Vanguard Value ETF, soar to heights previously reserved for the Eiffel Tower at midnight.

And let us not forget the ETF outflows, which have shed fortunes this year. Spot Bitcoin ETFs have lost $689 million, and Ethereum ETFs? A meager $149 million. As for liquidations, they’ve surged 122% in 24 hours, totaling $2 billion-a sum that could buy enough champagne to drown the entire market in bubbly despair.

Du Bon Côté de la Monnaie

Yet, dear reader, there are glimmers of hope! The Crypto Fear and Greed Index has slumped to 5-the lowest since the days of powdered wigs and candlelit chandeliers. Historically, such extreme fear has been the prelude to bull runs, much like a thunderstorm before a rainbow. Recall December: when the index hit 10 (a mere whisper of greed), Bitcoin rebounded to near $100,000. And in April 2025, when fear reigned supreme, Trump’s tariff flip-flop sent prices soaring once more.

Technique, that sacred language of traders, also hints at a rebound. Bitcoin’s Relative Strength Index has hit 27, a level not seen since November 2022, when the market was still wearing its “optimism” hat. And the rising wedge? It’s now 42%-a number that would make even the most stoic mathematician raise an eyebrow.

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

- Altcoins Rise: BNB Hits New High, LINK Takes the Cake 🍰

- Silver Rate Forecast

- Bitcoin to $200K?! 🚀 The Experts Say YES!

- Crypto Chaos: Nasdaq’s $50M Wink to Gemini & Tether’s New Stablecoin Shenanigans!

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- Bitcoin’s Quiet Sabotage: Hidden Dangers and Mow’s Cryptic Wisdom

2026-02-06 20:44