In a world where the digital and the tangible often blur into an indistinguishable haze, MARA Holdings, once known as Marathon Digital Holdings, has emerged not just as a survivor but a veritable titan. With a flourish that would make any novelist envious, this corporation has reported earnings that could almost be mistaken for the plot of a fantastical tale.

- MARA Holdings reaped the benefits of the BTC reaching its all-time high (ATH).

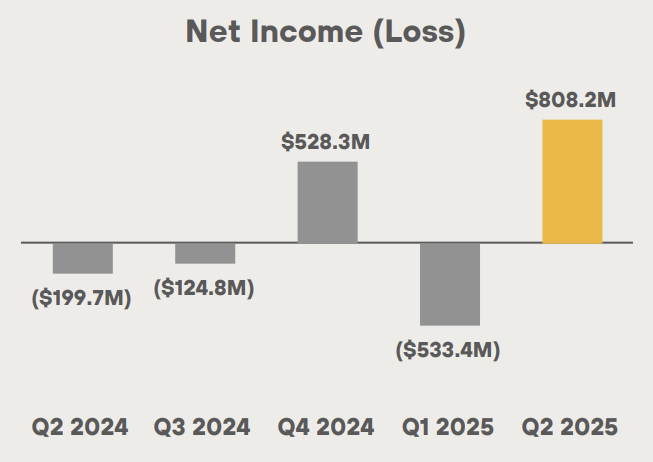

- Their net income soared to a staggering $808.2 million, a sum that would have made the old masters of finance weep with envy.

- In the grand league of corporate BTC holders, MARA Holdings stands just a step behind Strategy, a position that speaks volumes about its prowess and strategy. 🏆

The recent rally in the Bitcoin (BTC) market has had a profound effect on firms like MARA Holdings, which not only mine the elusive cryptocurrency but also hold substantial reserves. On the memorable day of Tuesday, July 29, 2025, MARA Holdings announced its earnings for the second quarter, a report that read like a chapter from a financial epic. The company’s success was fueled by a combination of reduced energy costs and the ever-climbing value of Bitcoin.

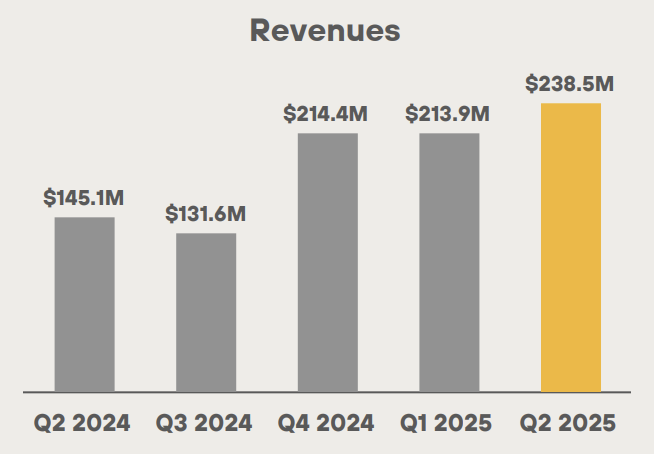

MARA Holdings boasted a total revenue of $238 million, marking a 64% increase year-over-year, a testament to the robust health of its Bitcoin mining operations. This growth was primarily driven by the rising price of Bitcoin, which, as if guided by a whimsical hand, hovered tantalizingly close to its all-time high. The average BTC price in Q2, up a remarkable 50% from the previous year, played a crucial role in bolstering mining revenues.

The company’s net income, a figure that would make even the most stoic financier crack a smile, stood at an impressive $808.2 million. This was a stark contrast to the $199.7 million loss recorded in the same quarter of the previous year. The transformation was largely attributed to a non-cash gain on Bitcoin holdings, amounting to a staggering $1.2 billion, a sum that seemed almost too fantastical to be true.

MARA Holdings continues to accumulate BTC

The company’s Bitcoin holdings saw a meteoric rise of 170%, now totaling 49,951 BTC. Just after the quarter’s end, MARA’s BTC holdings crossed the 50,000 BTC mark, cementing its position as the second-largest BTC treasury firm, a mere step behind Strategy. Unlike many of its peers, MARA Holdings refrains from selling the BTC it mines. Instead, it views these holdings as a strategic reserve, a treasure trove designed to enhance its share price over the long term. The company also employs stock offerings to further bolster its Bitcoin reserves, a strategy that is both shrewd and audacious.

With the regulatory landscape in the United States undergoing significant changes, Bitcoin has increasingly become a favored treasury asset. Companies are now leveraging their Bitcoin reserves to offer investors a gateway to the world of cryptocurrencies, a move that is as much about financial prudence as it is about embracing the future. 🚀

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- USD ILS PREDICTION

- EUR NZD PREDICTION

- Why Coinbase’s ‘Super App’ Might Be a Dud (But Buy $BEST Anyway!) 🤷♂️

- Ethereum’s Circus: $10B Reserve, Whales, and the Quest for $6K – Or Not

- EUR AED PREDICTION

- INJ PREDICTION. INJ cryptocurrency

- Bitcoin Ghosts, Rogue Bankers & The Not-So-Smart Crypto Circus: This Week’s Recap Will Make You Regret Not HODLing

2025-07-30 15:11