In the grand social circle of global finance, two most illustrious gentlemen have conspired to deliver tidings most curious: the prudent lady or gentleman should, indeed, purchase when the market is in a state of most profound unease-rather than prance about at rallies inspired lusciously by greed. How droll! Binance‘s esteemed founder, Mr. Changpeng Zhao, affectionately dubbed CZ, honestly advises that one should accumulate when horror overtakes confidence, and not as the crowd rushes about in feverish greed.

Unpopular, perhaps, but it is evidently wiser to sell when the scent of greed fills the air, and to buy when fear reigns supreme. 🤷♂️

– CZ 🔶 BNB (@cz_binance) November 29, 2025

Simultaneously, the venerable Mr. Robert Kiyosaki-author of the most practical guide, Rich Dad, Poor Dad-has issued a caution most grave. He declares that Japan’s long-standing and mysterious carry trade, a beast behind many inflated assets and unseen riches, has shattered. Consequently, he counsels investment in Bitcoin, Ethereum, gold, and silver-those steadfast guardians against what he deems as perilous times.

All the while, the Fear and Greed Index, that revered barometer of investor spirit, stands at a modest 20, bespeaking dread and trepidation among the cryptofolk. Yet, the quiet whispers among analysts suggest that Bitcoin is simply settling into a state of “quiet equilibrium”-a polite pause before the next grand adventure.

The Collapse of Japan’s Hidden Lever

For nearly thirty years, Japan’s inexpensive yen, like an invisible puppet master, was guiding the world’s fortunes. Countries borrowed near zero percent interest, pouring fortune after fortune into risk-laden treasures-be they stocks, bonds, or our own favourite, crypto. But alas! That treacherous foundation has begun to crack, with the Bank of Japan’s rate hikes elevating bond yields past the 1.7% mark-an amount unseen since the dark days of 2008. Borrowers now find their liabilities mounting while their treasures abroad diminish, leaving many to hurriedly liquidate their holdings, as if trying to escape an embarrassing society scandal.

Bitcoin’s Whimsical Reset, Not a Desperate Divergence

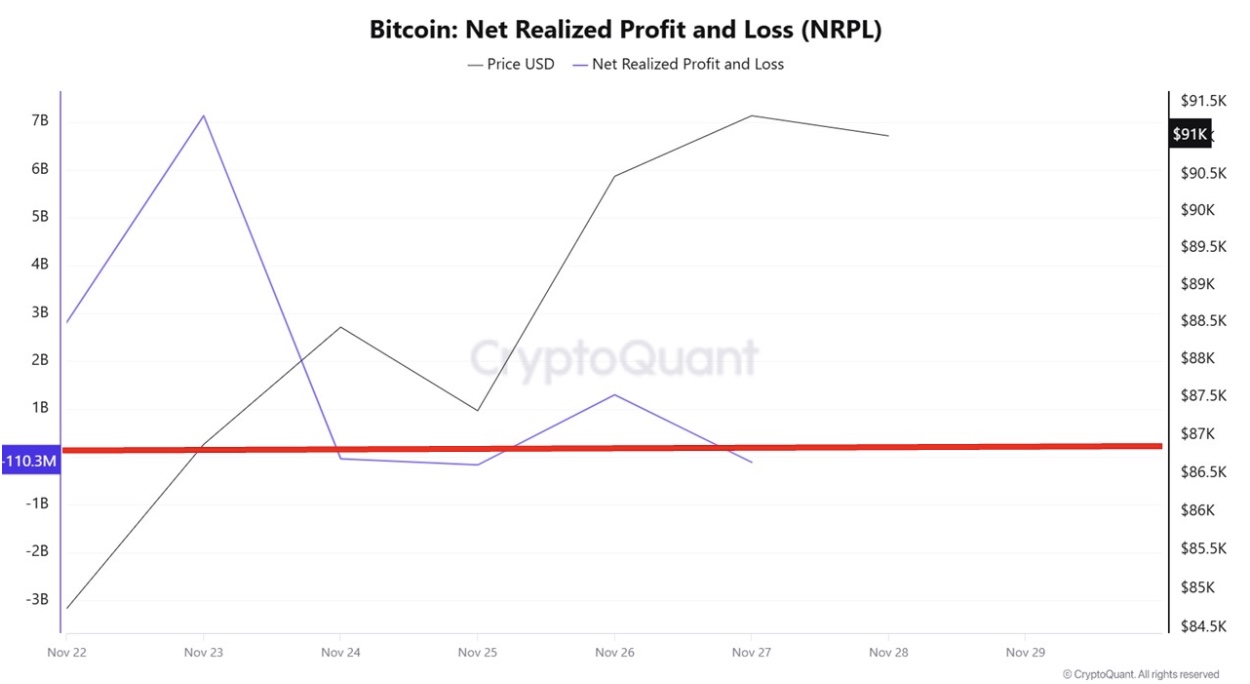

The learned analysts at CryptoQuant have observed that Bitcoin’s Net Realized Profit and Loss are gently retreating towards neutrality-not plunging into ruin, but rather relaxing after the tumult of recent spikes. This humble pattern suggests an end to reckless selling, and the dawn of a serene, neutral phase. Prices hovering around the lofty $90,000 mark reflect a truce-buyers and sellers alike have put down their quarreling fans and are currently enjoying a moment of mutual peace.

BTC NRPL | Source: CryptoQuant

The learned gentlemen kindly describe this as the “equilibrium zone”-a placid, almost Zen-like interval where investors muse about their next move. Should the NRPL remain above zero, one might proclaim the market’s recovery to be at full, if somewhat lazy, speed. Yet, if it dips into negative terrain, we may well observe signs of fragility-like a lady’s delicate fan trembling in the breeze.

And what of undervaluation? Ah, the warm underbelly of Bitcoin seems undermined, having slipped below levels tied to notable events-such as the whimsical election of a certain Donald Trump, or the notable halving. Clearly, the investors are preparing a modest aggregation-like a finely dressed gathering settling into their seats for an elegant ball.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- USD ILS PREDICTION

- Silent Whales: Bitcoin’s Shadow War on Binance

- USD THB PREDICTION

- Dash Crypto Implodes: Will It Crash Like a Mel Brooks Movie?

- The Universe’s 3 Favorite Ways to Crash Crypto (And Why Yen Just Won)

- Bitcoin, Baby! 🤯 Asia’s Wild Ride into the Crypto-Void 🌪️

- Fed’s $55B Injection: Will XRP Hit $3? 🚀

2025-11-29 17:30