The week ended with a shaky situation for Bitcoin. Increased selling linked to Elon Musk, a security issue with a dollar-backed cryptocurrency, and problems with the Cloudflare network all happened at the same time, reducing available funds. This immediately put downward pressure on Bitcoin’s price, and there wasn’t much buying support below $93,000.

TL;DR

- SpaceX pushes $100 million BTC toward Coinbase amid thin liquidity.

- USPD stablecoin hit by a $1 million unauthorized mint exploit.

- Cloudflare outage takes Coinbase, Upbit, Kraken and major DeFi protocols offline.

SpaceX sends $100 million in Bitcoin to Coinbase

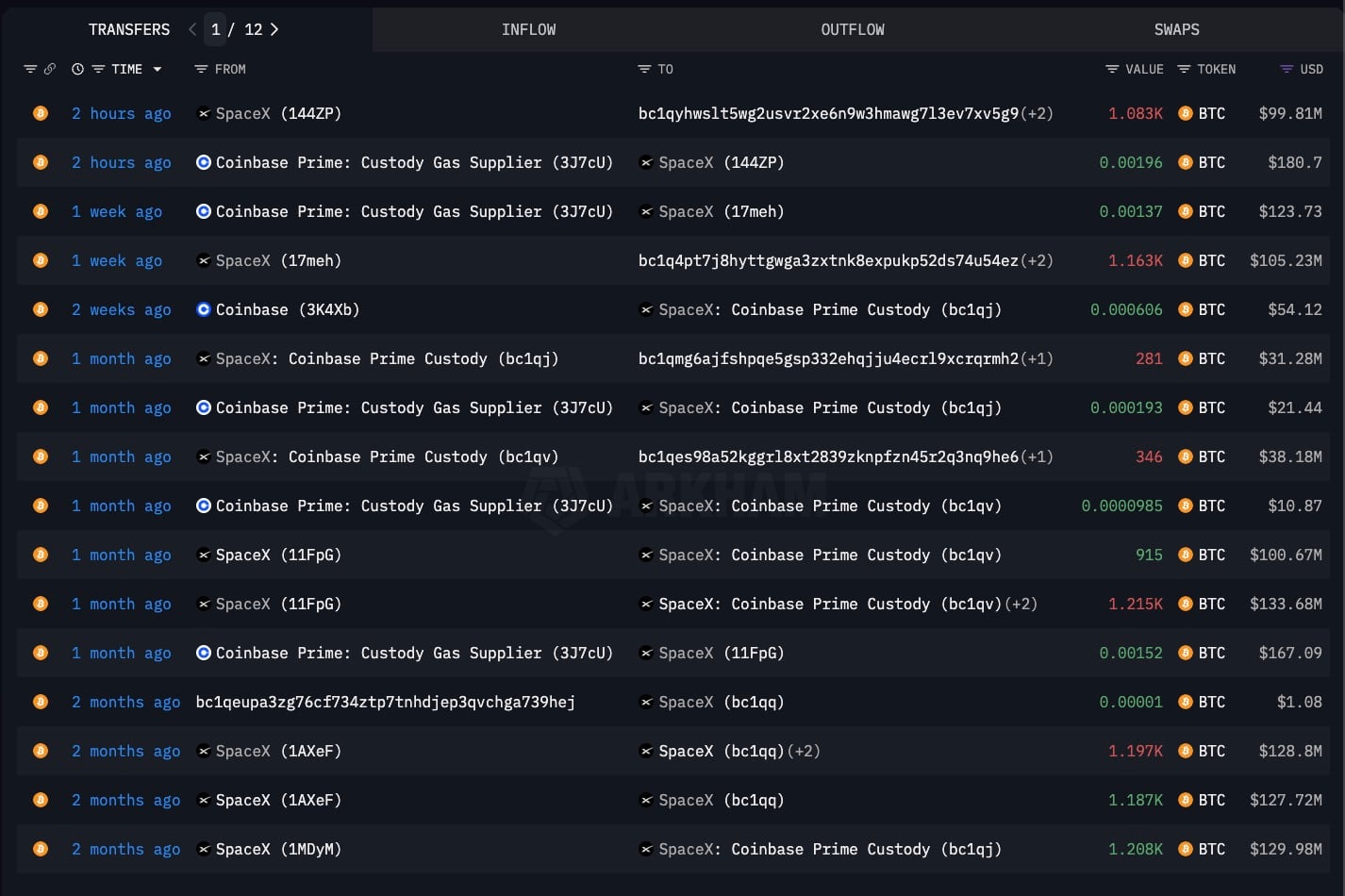

SpaceX, Elon Musk’s space company, remains a significant Bitcoin holder, currently possessing approximately 8,285 BTC, worth around $757 million. However, recent data from Arkham indicates that SpaceX has been transferring a substantial amount of its Bitcoin to Coinbase Prime Custody.

We recently observed a transfer of 1,083 Bitcoin, worth approximately $99.81 million, to addresses associated with cryptocurrency exchanges.

While this single trade won’t significantly impact market prices, the bigger concern is how it might signal future selling. When a large company engages with the market, investors immediately consider the possibility of a larger sell-off.

As a researcher, I’m observing a particularly sensitive market right now. Trading volume is low, and we saw a clear price drop in Bitcoin – from around $92,000 to $91,000 – right when Cloudflare experienced its outage. This suggests that even small shifts in how people *feel* about Bitcoin are having a bigger impact on the price than usual.

Neither Musk nor SpaceX have commented, and the market remains at a key turning point. Despite significant trading activity, the situation hasn’t become any clearer. Bitcoin has struggled for the last day and a half to break through the $93,000 level, and each failed attempt is making the outlook for Friday’s close increasingly uncertain.

USD stablecoin USPD suffers $1 million exploit

A major security problem has emerged with the US Permissionless Dollar (USPD), a digital dollar designed to be resistant to censorship and backed by stETH. Security firm PeckShield detected someone creating USPD without permission and stealing funds from the system. The project itself has warned people not to buy USPD right now.

USPD offered a straightforward solution: deposit stETH, and in return, receive a stablecoin backed by clear reserves and ongoing staking rewards. This system eliminates the need for intermediaries, identity verification, and relies solely on secure, verified smart contracts.

Security researchers at PeckShield have detected an issue with USDP_io, resulting in approximately $1 million lost. Users are advised to revoke any permissions granted to the USDP contract as a precaution.

— PeckShieldAlert (@PeckShieldAlert) December 5, 2025

However, the solution didn’t address the fundamental problem. The project revealed that USPD was hit by a sophisticated “CPIMP” attack, a complex method where an attacker takes control before the system fully starts up and secretly installs harmful code.

The timeline matters:

- Sept. 16, 2025: During deployment, the attacker used a Multicall3 transaction to seize admin rights.

- They inserted an implementation that emitted deceptive event payloads.

- Etherscan displayed the legitimate audited contract, while the attacker used the shadow logic underneath.

- The exploit remained hidden for months, enabling unauthorized minting.

The cryptocurrency address involved has been identified on major exchanges and decentralized platforms. The team behind USPD is offering a solution: return the funds, and they will halt any legal investigations, minus a 10% fee as a reward.

Currently, losses are around $1 million, but the damage to our reputation is much more substantial.

Cloudflare down again: Coinbase, Upbit, Kraken, OKX Wallet, Jupiter and Raydium break

Cloudflare experienced another widespread outage, affecting both its API and dashboard. This quickly caused problems for many cryptocurrency services. Major exchanges like Coinbase, Kraken, and Upbit (South Korea) went offline. Users also reported issues with wallet systems and tools within the Solana ecosystem, including Jupiter, Raydium, Meteora, and OKX Wallet.

As an analyst, I’ve been tracking the recent Cloudflare outage and its impact on the crypto market. While Cloudflare says they’ve fixed the issue and are actively monitoring things, it’s clear that when core infrastructure goes down, prices react. We saw this play out with Bitcoin, which dipped from $92,000 to $91,400 during the outage. The price charts showed a quick increase in selling, likely because of a lack of immediate buyers at those levels.

As a crypto investor, I’ve noticed that when the main order books get clogged up – basically, when things freeze up at the top levels – trading bots tend to step back. This causes those who *make* the market – the people placing limit orders – to remove their orders, and even small buy or sell activity can cause huge price swings. It’s a recipe for increased volatility!

People in the market have noticed Cloudflare outages are happening more often. It’s unclear if these issues are caused by a surge in overall internet traffic or problems with how Cloudflare manages its own systems. However, these repeated disruptions are now a real risk for traders, who need to account for them – especially during volatile weekend periods when infrastructure problems can worsen the situation.

Crypto market outlook

Bitcoin is starting the weekend facing several challenges: it’s hitting technical resistance, corporate selling is adding pressure, recent issues with stablecoins are causing concern, and widespread system outages are reducing trading activity. Unless Bitcoin can clearly break above $93,000, the market is likely to remain cautious and potentially move lower next week.

- Bitcoin remains under $93,000 and shows weakening reaction bids under $91,500.

- SpaceX flows toward Coinbase continue to inject directional uncertainty.

- Stablecoin trust premium takes a hit as USPD’s stealth exploit unfolds.

- Infrastructure reliability becomes a front-page macro factor after Cloudflare’s outages affect both CEX and DeFi interfaces.

- Liquidity mostly thin into the weekend, giving outsized impact to any large on-chain or exchange-routed moves.

The week closes with all structural risks exposed at the same time.

Read More

- Crypto’s Wall Street Waltz 🕺

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Crypto ATMs: The Wild West of Fraud 🤑🚨

- Crypto Chaos Unveiled: Gains, Losses & More Drama Than Your Aunt’s Tea Party! ☕🪙

- Dogecoin ETF Smashes Expectations! 🚀

- Bitcoin’s Wild Ride: $79B Futures & Sky-High Options-Brace for Impact! 🚀💥

- 🚀 Singapore’s Tokenized Takeover: $19 Trillion by 2033? 🤑

- Whale Watch: Chainlink’s LINK Soars as Giants Dive In 🐳📈

2025-12-05 17:47