So, What’s the Deal?

- MrBeast is strutting into the banking world like he owns the place, making Gen Z choose creators over dusty old banks.

- Maxi Doge is like that rebellious teenager who trades boredom for chaos-think high-stakes trading instead of couch potato savings.

- This project is all about going viral while actually giving you something useful, like staking rewards and competitions. Because who doesn’t love a good contest?

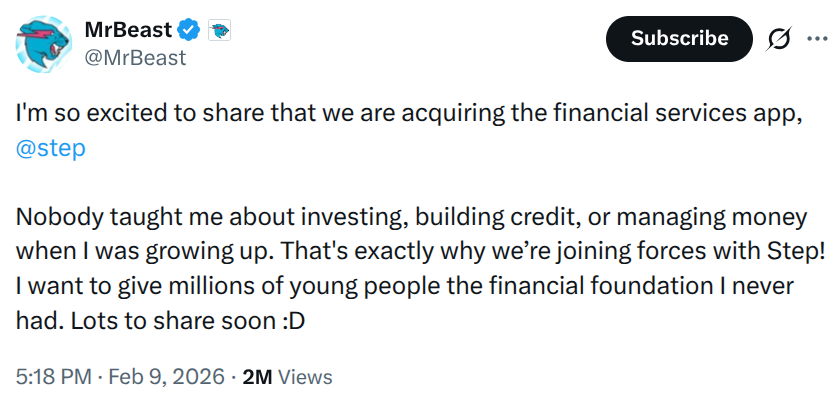

So we’ve hit a cultural boiling point, folks. When MrBeast (yes, the guy who gives away cars like they’re candy) decides to jump into finance, you know it’s about to get wild. His purchase of ‘Step’ isn’t just a quirky little move; it’s a strategic ninja attack on the stuffy world of traditional banking.

Imagine this: Old-school banks are spending a small fortune to convince people to open accounts for their pocket change. Meanwhile, MrBeast can snag millions with just one clickbait title. Talk about efficiency!

That’s right, this marks a seismic shift in how Gen Z views money. Forget fancy marble floors or those laughable 0.01% interest rates. They want gamified thrills, speed, and a sense of belonging. Honestly, this generation is so over boring savings-it’s all about living on the edge, baby!

In a recent tweet, our pal Jimmy explained that his financial awakening was a bit late to the party, and now he wants to sprinkle knowledge on today’s youth like confetti.

While MrBeast is rebranding traditional banking, the decentralized crowd is peeling it back to its rawest form: pure chaos and potential profit. As everyone shifts their cash from dusty accounts into the wild world of crypto, projects like Maxi Doge ($MAXI) are riding the wave.

Forget the boring ‘safe’ narrative; Maxi Doge is all about high stakes and bigger gains, serving as a rebellious counterpoint to the sanitized version of Gen Z finance.

Maxi Doge: The Gym Buddy of Decentralized Finance

While traditional apps are trying to make saving feel less painful, the crypto crowd wants the financial equivalent of a double shot of espresso. Maxi Doge goes for the retail trader who thinks regular market action is as exciting as watching paint dry. It’s like a 240-lb dog with a gym bro mentality, pushing through the bear market grind just to explode during the bull run.

But wait, there’s more! This isn’t just about looking cute. Maxi Doge is rolling out the ‘Leverage King Culture’-basically turning trading into a competitive sport. Instead of just sitting on your assets, they’re encouraging you to get up and play!

These competitions will feature live leaderboards where top traders can show off their skills for treasury prizes. It’s like eSports but with money, which sounds alarmingly like my new favorite hobby.

And don’t worry, the Maxi Fund treasury is here to keep things stable-ish, adding some much-needed structure to the meme madness. By budgeting for liquidity boosts and partnerships, the project creates a cycle that keeps the excitement rolling.

CHECK OUT THE MAXI DOGE COMMUNITY-seriously, they’re fun!

Smart Money Loves the ‘Maxi’ Vibe

The market’s hunger for this adrenaline-pumping model is clear. Retail traders are all about the branding, but the big fish are eyeing those staking perks. With a dynamic APY (currently 68%) from a 5% staking pool, it’s rewarding those who stick around instead of playing musical chairs with their investments.

Big wallets are moving in. Etherscan data shows two high-rollers dropping $628K, each snagging a cool $314K. These whales are clearly anticipating the big shift where cash flows out of sleepy assets and into the wild side of higher returns.

Sales numbers back this up-Maxi Doge ($MAXI) has raked in over $4.5M already, which means everyone and their dog wants in. With tokens priced at $0.0002803, it’s an easy entry point before the inevitable rollercoaster begins. The surge of whale support and steady fundraising indicates that everyone is on board with the ‘Maxi’ approach to decentralized finance.

BUY YOUR $MAXI HERE-because why not? Live a little!

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- tag under 100 characters. No tags, no colors, retain images, add humor and sarcasm with emojis. Also, the title shouldn’t be repeated in the body. First, I need to understand Bill Bryson’s style. He’s known for witty, engaging, and slightly irreverent commentary, often with a mix of humor and informative content. I should infuse that into the rewritten text. The original text is about crypto pundits being bullish on Bitcoin despite stagflation fears and Fed rate cut hopes. The title needs to be catchy and clickbait. Let me brainstorm some options. Maybe something like “Bitcoin’s Bull Run: Will Stagflation Spoil the Party? 🚀💸” That’s under 100 characters and includes emojis. It’s catchy and hints at the conflict between bullish crypto and economic concerns. Next, the body. Replace technical jargon with more conversational and humorous language. For example, instead of “sluggish growth,” maybe “economic snoozefest.” Use emojis to add flair.Analyzing the situation… Ensure the structure remains the same, keeping all the images in place. Add some sarcastic remarks, like comparing economic data to a reality TV show or mentioning that experts are “optimistic despite the chaos.” Check for any tags and remove them. Don’t apply any color styles. Make sure the title is only in the tag and not repeated elsewhere. Verify that all images are retained and the HTML structure is correct. Also, ensure the humor and sarcasm are present without being too over the top. Maybe add a joke about the Fed’s rate cuts being a “magic wand” or stagflation being a “ghost story.” Finally, proofread to ensure the character count for the title is under 100 and that the HTML is valid. Make sure the rewritten text flows naturally in Bryson’s style, with a mix of informative content and light-hearted commentary. Done in 8s. Bitcoin’s Bull Run: Will Stagflation Spoil the Party? 🚀💸 What to know: The U.S. economy is playing a game of hot potato with stagflation, mixing stagnant growth and rising prices like a bad reality TV show. Crypto gurus are still bullish on Bitcoin, eyeing Fed rate cuts and a “structural bull run” that makes Wall Street look like a toddler’s scribble. They’ve already picked their favorite altcoins to ride the next crypto rollercoaster. Spoiler: Solana is the golden child. Thursday’s economic data dropped a bombshell: the U.S. might be flirting with stagflation. You know, that 1970s nightmare of stagnant growth, job market limbo, and inflation that makes your coffee cost $50? Yeah, it’s back. But crypto enthusiasts? They’re sipping margaritas on a digital beach, ignoring the storm. 🏖️ Why the optimism? Because the Federal Reserve is expected to play magician, pulling rate cuts out of a hat to keep the market’s heart beating. Meanwhile, the S&P 500 is hitting all-time highs like it’s a TikTok dance challenge, and the dollar index is on a downward spiral faster than my Wi-Fi during a Zoom call. 💀 Shane Molidor of Forgd, a crypto oracle with a side of swagger, told CoinDesk, “Bitcoin’s the new gold-plated piggy bank for people who hate fiat money. It’s not just a gamble-it’s a hedge against your savings being turned into confetti by governments.” August’s inflation report? A 0.4% monthly spike, pushing the annual rate to 2.9%. Meanwhile, unemployment claims hit a four-year high. Oh, and the BLS just admitted they miscalculated jobs data for 2025. Classic! 🤷♂️ Bitcoin briefly hit $116,000-because why not?-while altcoins like Solana (SOL), Chainlink (LINK), and Dogecoin are doing cartwheels. Traders are betting the Fed will cut rates by 25 basis points in September, and who are we to argue? They’ve been cutting rates since the invention of the wheel. 🚀 Le Shi of Auros made a point so obvious it’s almost profound: the “Magnificent 7” stocks are stagflation-proof because they’re spending billions on AI. If you can’t beat the economy, outsource your problems to robots. 🤖 Sam Gaer of Monarq Asset Management summed it up: “Stagflation is a ghost story. The Fed’s magic wand (aka rate cuts) will calm the markets, and crypto will keep climbing like it’s on a sugar high.” Markus Thielen of 10x Research added, “Inflation’s about to take a nosedive. Risk assets? They’re dancing on a tightrope while the Fed waves a green flag. Buckle up for the ride.” Standout tokens Bitcoin’s not the only star in the crypto galaxy. Solana (SOL) is the new kid on the block, with demand so hot it could melt a Bitcoin miner’s GPU. SOLBTC is flirting with the 0.002 level, and investors are throwing money at it like it’s Black Friday in Web3. 🛒 Then there’s Ethena’s ENA token and its synthetic dollar, USDe, which is basically the crypto version of a money tree. And Hyperliquid’s HYPE token? It’s the go-to for young investors who think “high-risk, high-reward” is just a lifestyle. 🎢 Shane Molidor quipped, “Hyperliquid’s for people who want to trade like they’re in a casino, not a library. And Ethena? It’s the crypto equivalent of a free lunch when the Fed cuts rates. Who needs sleep when you’ve got yield?” So, will stagflation crash the party? Probably not. The Fed’s rate cuts are the ultimate party favor, and crypto’s the DJ spinning the tracks. Just don’t forget to bring sunscreen for the bull run. ☀️

- US & UK Team Up To Save Crypto – Or Just To Keep Up With Each Other?

- XRP’s Little Dip: Oh, the Drama! 🎭

- When Bitcoin Takes a Tumble, Who’s Laughing Now? 🤷♀️

- Gemini’s New XRP Credit Card Pays 4% – Swiping Never Felt So Crypto!

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- Schrödinger’s Bitcoin Ruse in El Salvador? 🤔

2026-02-10 16:35