Oh, Bitcoin. You’re like that friend who insists on doing shots after everyone’s already called it a night. 🥴 The market’s slipping into what analysts are calling a dangerous zone, which sounds less like a thriller movie and more like a warning label on a bottle of bleach. The $90K support level? Gone. Vanished. Poof. Bulls are now looking like they’ve lost their keys to the Lamborghini, and volatility’s having a full-blown disco party. 🕺💫

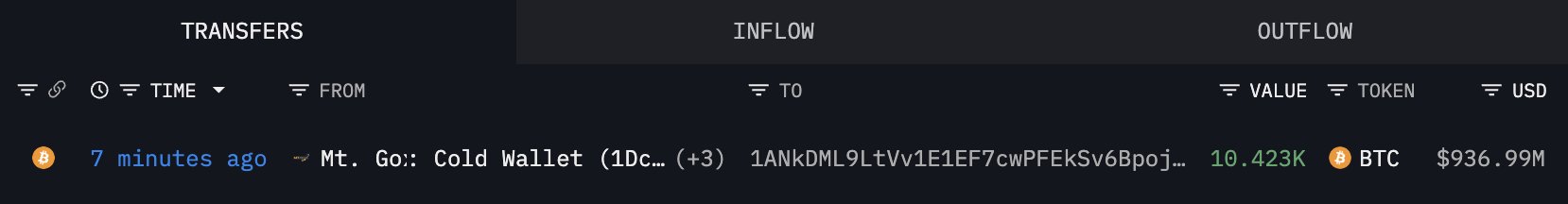

And just when you thought it couldn’t get any spicier, Mt. Gox-yes, that Mt. Gox-decides to wake up from its 8-month nap and move 10,423 BTC (aka $936 million, aka a lot of avocado toasts). 🥑💰 Is this the prelude to a creditor payout party, or just the universe’s way of saying, “Hold my beer”? 🍻 Historically, Mt. Gox transfers have been the crypto equivalent of a surprise clown at a funeral-nobody asked for it, but here we are. 🤡

Timing? Immaculate. Sentiment’s already as fragile as a vintage wine glass, and now we’ve got nearly a billion dollars’ worth of BTC on the move. Will this be the shakeout before the comeback, or the final nail in the coffin? 🪦 The market’s narrative today is basically a soap opera, but with more charts and fewer love triangles. (Though, let’s be honest, crypto’s got drama for days.) 💔📉

Mt. Gox: The Crypto Boogeyman Returns 👻

Every time Mt. Gox sneezes, the market catches a cold. Or pneumonia. Or whatever the financial equivalent of a full-body cast is. 🩺 This latest transfer has everyone clutching their ledger wallets like they’re the last slice of pizza at a party. 🍕 The mere possibility of that BTC hitting the market has traders sweating more than a vegan at a steakhouse. 🥓💦

And let’s not forget Japan’s economy, which is currently doing its best impression of a Jenga tower after someone pulled out the wrong block. 🇯🇵🪨 The Yen carry trade is unwinding faster than a cheap sweater, and crypto’s caught in the crossfire. Leveraged positions are deleveraging, liquidity’s drying up, and Bitcoin’s like, “Why me?” 😭

Combine Mt. Gox’s supply risk, lost support levels, and macro chaos, and you’ve got a recipe for volatility soup. 🍲 Will it be a breakdown or a bounce? Only the next few days will tell. Spoiler alert: nobody knows. 🤷♀️

Weekly Chart: Stress Levels Off the Charts 📈😱

Bitcoin’s weekly chart looks like it’s been through a breakup, a bad haircut, and a tax audit all at once. 💔✂️💼 Trading around $90,877, it’s seen sharper declines than a Black Friday sale. The breakdown from the $100K-$105K range has it hugging the 50-week moving average like it’s a security blanket. 🧸

If that level breaks, we’re looking at a potential nosedive to the $85K-$88K liquidity zone, where the 100-week MA is waiting like a safety net-or a trampoline, depending on your optimism. 🤸♂️ Volume’s screaming “sell,” but those wick rejections near $89K suggest buyers aren’t ready to throw in the towel just yet. 🧼

Long-term, BTC’s still above the 200-week MA, but it’s getting cozy with the danger zone. Historically, this phase is like a choose-your-own-adventure book, but with more charts and fewer happy endings. 📖 If bulls can rally and reclaim $95K-$98K, we might stabilize. If not? Well, let’s just say the demand zones below are looking mighty interesting. 🕳️

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- Will SUI Soar to $7 Despite 6% Plunge? 📈🚀

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- Pasternak’s Hot-ETH Ticket: Half a Billion Bucks & the Moon’s Already Jealous!

- Get Ready for Ether’s Dramatic Ascent-More Than Just a Craving for Fame! 🚀💥

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

- Silver Rate Forecast

- XRP’s Little Dip: Oh, the Drama! 🎭

2025-11-18 23:44