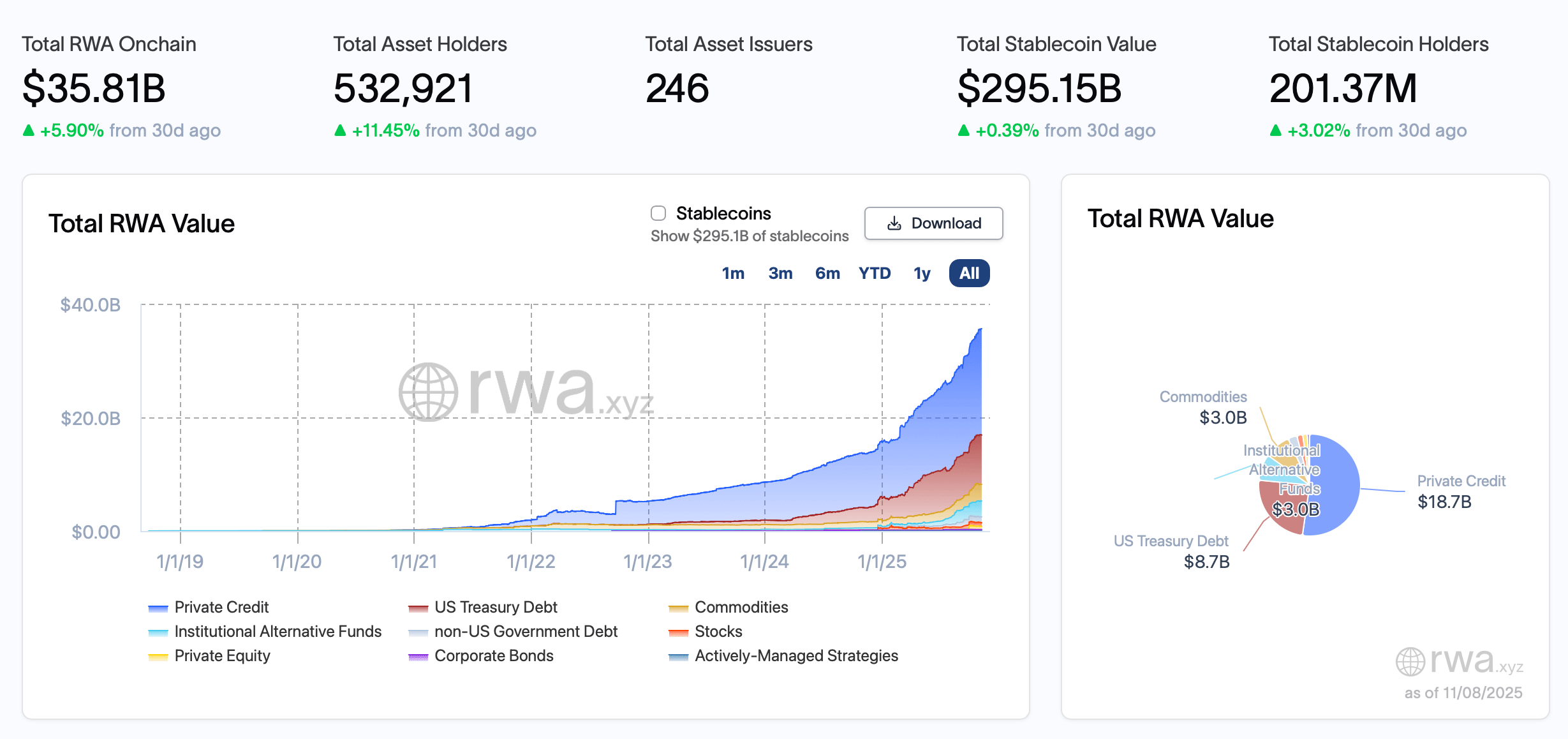

Tokenized real-world assets (RWAs) have soared to a magnificent $35.81 billion onchain, a jump of 5.90% in the last 30 days, according to the ever-so-reliable metrics from rwa.xyz.

BUIDL, USYC, and XAUT Reign Supreme as Tokenized Asset Giants, with RWA Holders Exceeding 532K

Oh, how the RWA stack thickens! It’s like a scrumptious buffet of private credit, tokenized Treasuries, commodities, and alternative funds – all served up piping hot onchain. Meanwhile, stablecoins are stumbling, their pegs slipping like a bad pair of socks in a wet shower. Can’t win ‘em all, eh? Stablecoin drama!

Rwa.xyz reports that over the past month, the number of RWA holders has jumped 11.45%, topping 532,921 – and they’re not just lurking; 246 issuers are in the game, proving that this tokenized asset party is still very much alive and kicking. While the broader crypto economy has been stumbling like a toddler in a toy store, tokenized RWAs are thriving. Go figure.

Private credit continues to flex its muscles, commanding a glorious $18.7 billion, while U.S. Treasuries are quietly trailing with $8.7 billion. Commodities and institutional alt funds are each hovering near or above the $3 billion mark. And the smaller-cap RWAs are just filling up the rest of the blockchain charcuterie board – someone has to eat the leftovers.

Within tokenized private credit, the numbers are more seductive than a velvet curtain: $18.72 billion in active loans out of $33.31 billion total, with a mouth-watering 9.78% average base APR spread across 2,712 loans. Figure still dominates the lending landscape, with about $13.5 billion of those loans parked on Provenance. And don’t even get me started on the juicy APR rates: Tradable on Zksync Era is posting a spicy 11.08%, while PACT on Aptos is making waves with an audacious 22.22% – though, not all is rosy. Defaults are hovering at $138.48 million. Oops.

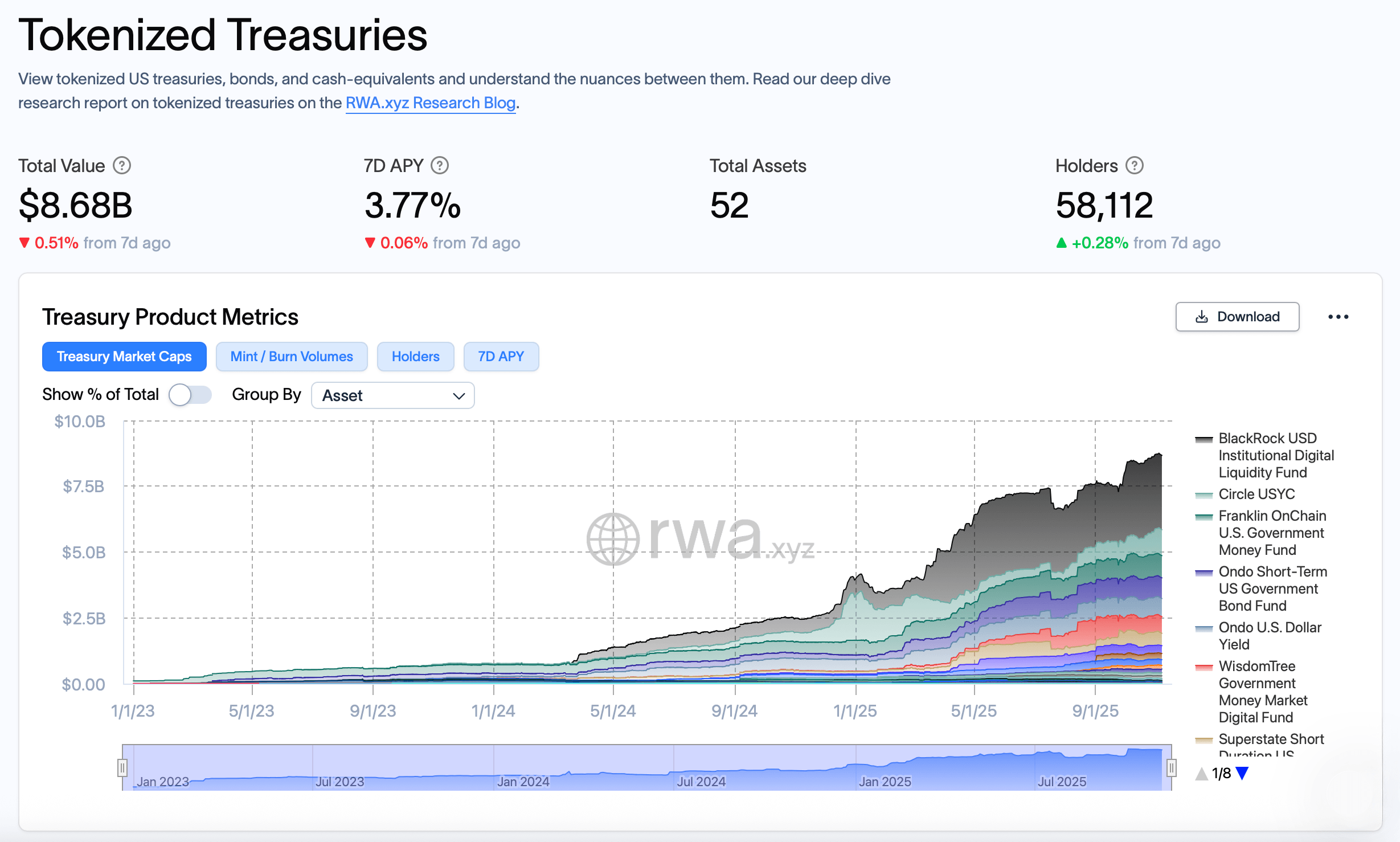

On the U.S. government-debt side, tokenized Treasuries are as steady as an old librarian’s hand, holding firm at $8.68 billion across 52 products, pulling a respectable seven-day APY near 3.77%. The leaderboard looks like a who’s-who of the corporate giants: Blackrock’s BUIDL with $2.82 billion, Circle’s USYC nipping at its heels with $986 million, and Franklin Templeton’s BENJI hanging around with $845 million. Talk about a power trio!

In the last 30 days, USYC has made waves with inflows of $295 million, while BENJI, Openeden’s TBILL, and Superstate’s USTB have been busy leaking capital like a sieve. Janus Henderson’s JTRSY is adding a modest $51 million to the pot, and Wisdomtree’s WTGXX is not far behind with $45 million. It’s not all sunshine, though – Superstate’s USTB saw outflows of -$82 million, proving that not all Treasury tokens are created equal.

As for which chain is winning the race, Ethereum is still the undisputed champion, holding a dominant $4.2 billion in tokenized Treasuries. BNB Chain, Avalanche, Stellar, Aptos, and Solana all come in trailing behind like underdog contenders – none of them exactly tiny, but none stealing the show either. XRP Ledger and Arbitrum are hanging out in the middle tier, neither top-tier nor bottom-of-the-barrel. We see you, guys.

Among the standouts, the metal-backed crowd is gleaming with pride. Tether Gold (XAUT) is shining brightly with $1.557 billion, up 32.57% over the past 30 days. Paxos Gold (PAXG) is chilling at $1.328 billion, a steady 9.32% rise. Circle’s USYC is flexing a 43.35% increase this month. Meanwhile, Syrup USDC and Syrup USDT are experiencing mood swings, both down for the week but up for the month – a bit of crypto drama there. 😏

Tokenized corporate bonds remain the quiet kid at the party, sitting pretty with $258.99 million across 10 assets. Held by 13,848 investors (a slight dip of 0.86% week-over-week), this is still a growing niche that whispers sweet nothings about the future of digital debt.

In summary, the RWA market is a lively one. Private-credit venues are scaling up, even as some take a hit from defaults ($185.5 million in total), while tokenized Treasuries keep raking in steady inflows – especially USYC – likely from those looking for safe, short-duration yield. The onchain financial system is maturing, and it’s not doing so quietly. One public ledger entry at a time.

FAQ ❓

- What is the total onchain RWA value now? Tokenized real-world assets total $35.81 billion, up 5.90% in 30 days, per rwa.xyz.

- Which RWA category is largest today? Private credit leads at about $18.7 billion, followed by U.S. Treasuries near $8.7 billion.

- Which tokenized Treasury product saw the biggest net inflow? Circle’s USYC led 30-day net flows with roughly $295 million.

- Which networks host the most RWAs? Ethereum tops with about $4.2 billion, then BNB Chain, Avalanche, Stellar, Aptos, and Solana.

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

- XRP’s Little Dip: Oh, the Drama! 🎭

- THORChain Founder Loses $1.35M After Deepfake Zoom And Telegram Scam

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- TRON’s Fee Slashing: A Comedy of Stablecoin Errors? 🎭💸

- Will SUI Soar to $7 Despite 6% Plunge? 📈🚀

- Shiba Inu’s Trillion Token Tumble: A Comedy of Errors 🐶💰

- ETH Crash Incoming? 😱

- Flipster’s Bold Leap: Zero-Spread Crypto Trading Unveiled! 🚀

2025-11-09 18:06