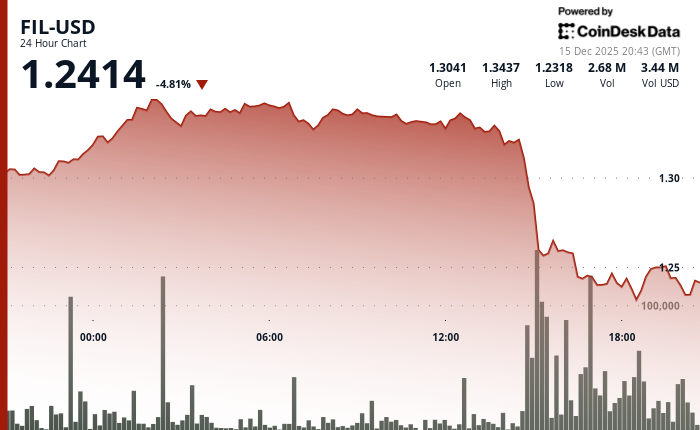

Crypto Market Meltdown: Filecoin’s 5% Slide and the Great Sell-Off! 🚨

Filecoin, that paragon of digital virtue, crumbled through its support levels like a poorly constructed farce, shedding 5.1% to $1.24. A volume surge rivaling a mob at a bakery signaled institutions bidding adieu, according to CoinDesk’s crystal ball 🔮.