Japan’s Rate Hike: Will It Crash the Market? 🚨

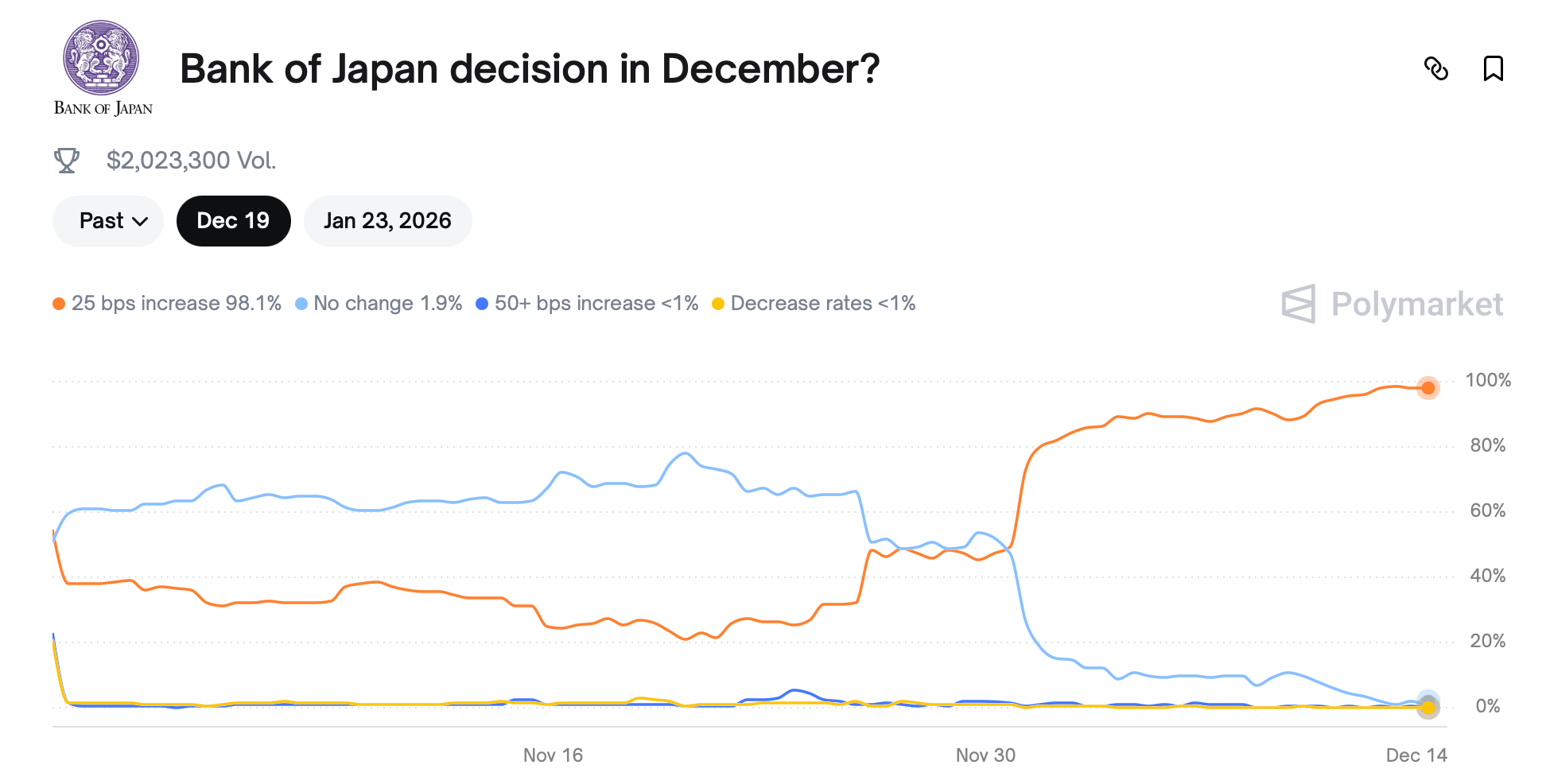

The Federal Reserve, ever the drama queen, has just trimmed its rates by a quarter point, and now markets are betting that the January FOMC meeting will deliver no adjustment. Attention has since shifted to the Bank of Japan, where expectations are building that the central bank will lift its short-term interbank rate next week. 🤝