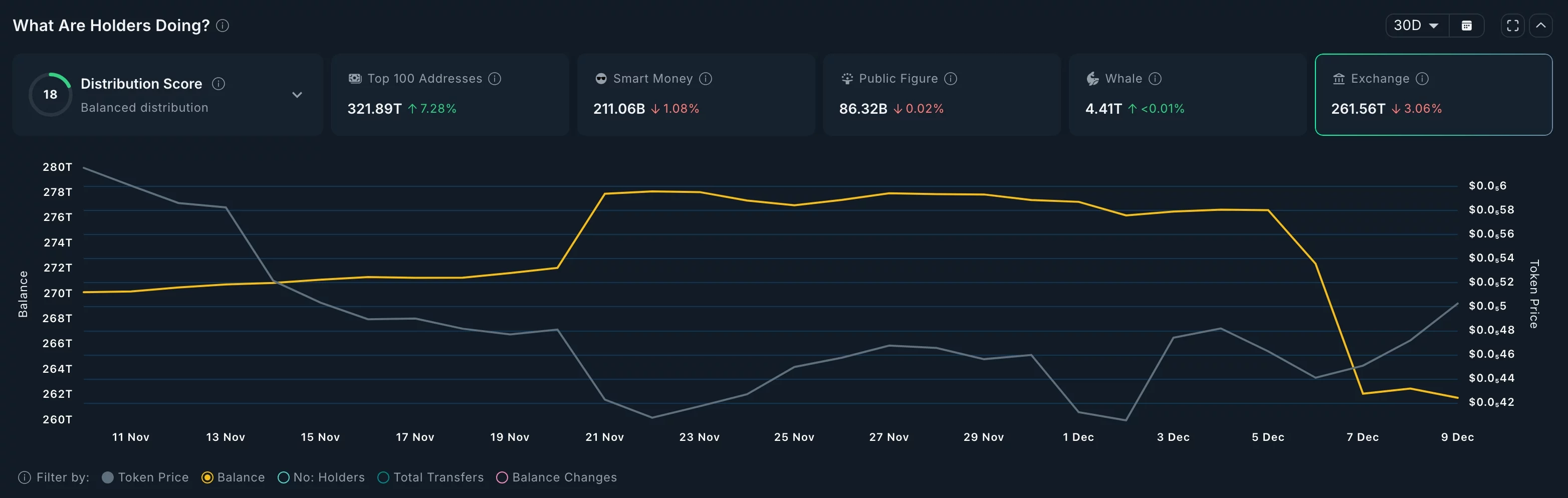

Pepe Coin’s Surprising Rebound: 15 Trillion Tokens Flee Exchanges! 🚀

Pepe (PEPE), that steadfast little meme, climbed to the psychological threshold of $0.0000050, a 28% ascent from its November lows. The market cap, now over $2.1 billion, is a number that would make even the most stoic investor raise an eyebrow. 🤯