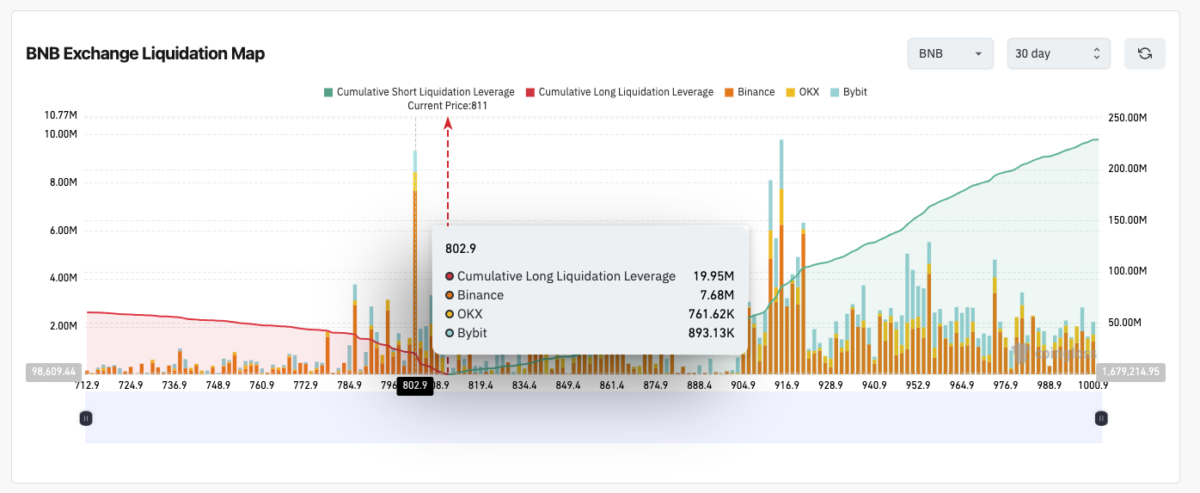

Binance Coin on the Brink: $20M at Stake Below $805 🤯

Coinglass’ 30-day liquidation map reveals bears are the undisputed kings of this jungle, hoarding $228 million in short positions that’ll make bulls question existence itself. Meanwhile, the puny $60 million in longs has enough oomph to power a tea kettle-not a crypto comeback. BNB’s 20% monthly loss? A 📉 gift to everyone’s patience.