SKY Crypto’s 10% Rally: Can It Survive the Buyback Storm? 🌪️💸

If the price clings to the broken trendline like a barnacle to a ship, SKY might waltz back to $0.0620-though the orchestra may cut out at any moment.

If the price clings to the broken trendline like a barnacle to a ship, SKY might waltz back to $0.0620-though the orchestra may cut out at any moment.

Gather ’round, ye chart-watchers and tea-leaf readers! The wise sage CryptoCrewU hath proclaimed from the mountaintop of X (formerly known as Twitter, because why not?) that BTC is experiencing the most dramatic bearish divergence since the last time someone said “HODL” unironically. Pair that with a rare two-week snooze below the 21-period Simple Moving Average, and you’ve got a recipe for either triumph or disaster. Or possibly a nap. 💤

So says Mike Novogratz, CEO of Galaxy Digital and professional watcher-of-things-going-very-wrong, in what can only be described as the most dramatic financial podcast since someone tried to explain NFTs to their grandmother. Speaking on the premiere episode of “All Things Markets” (not to be confused with “All Things Margaritas,” which would’ve been far more useful), Novogratz revealed that October 10th wasn’t just a market dip – it was a full-on digital extinction event.

Apparently, amidst a cocktail of regulatory jazz hands, institutional high-fives, and a tech glow-up, AVAX is primed for a comeback tour that’ll probably last until 2026 (or until it crashes again-who knows?).

On Nov. 25, the U.S. Securities and Exchange Commission (SEC), that venerable guardian of the financial realm, proclaimed its Investor Advisory Committee would convene virtually on Dec. 4. Their task? To scrutinize the sacred texts of corporate governance, to ponder the mystical role of tokenization in equity markets, and to grapple with the specter of artificial intelligence. The full ritual will be streamed on the SEC’s digital altar, for all to witness. 📡

The market has been experiencing growth faster than you can say “blockchain,” with institutional players jumping on the bandwagon since late 2023. On-chain private credit, tokenized Treasuries, and tokenized equities – it’s all the rage, apparently. In fact, private credit has been crowned the reigning champion of the tokenized asset world, expected to capture up to 50% of the market by 2026, according to RedStone’s calculations. A fascinating little tidbit, don’t you think?

Figment, ever the diligent middleman, facilitates the grand game of staking, helping institutions-probably including Bhutan-capitalize on proof-of-stake networks. This latest move is just the cherry on their blockchain sundae, adding yet another droplet to Bhutan’s increasingly prosperous crypto cup. The nation, which has about the population of a midsize town, has been steadily transforming from a serene Buddhist enclave into a Hub of Digital Ambition.

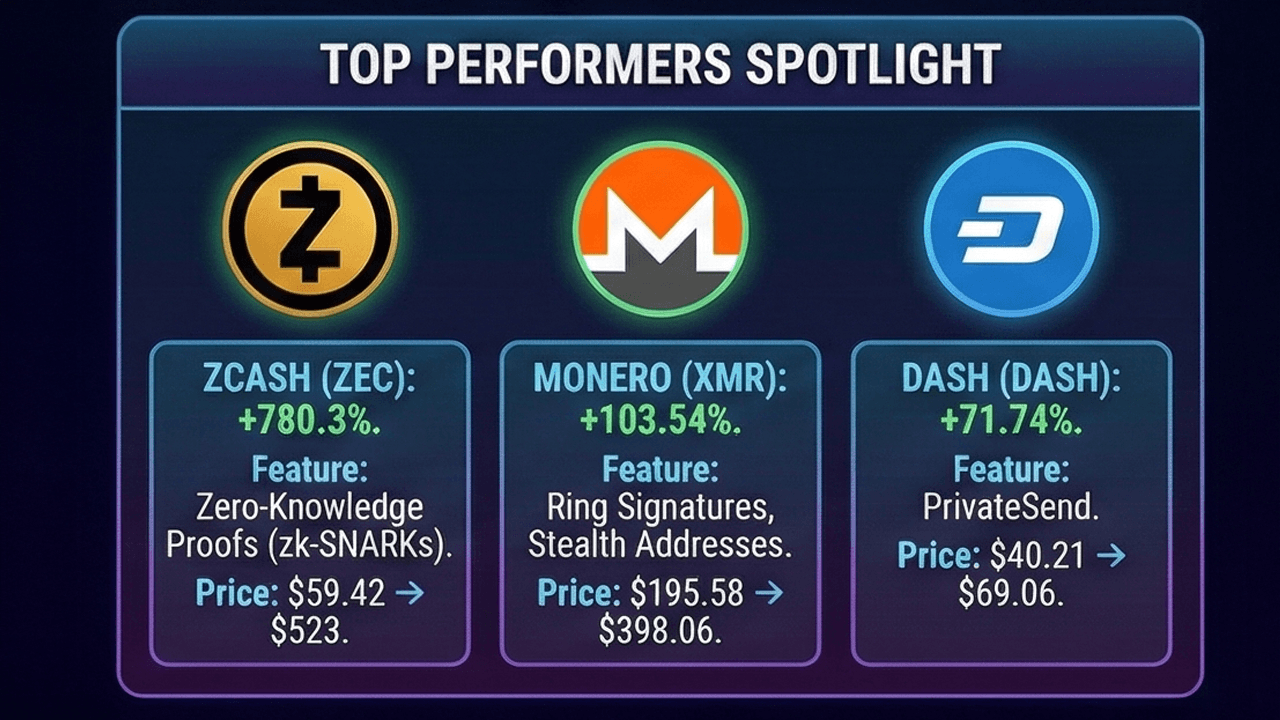

It’s November 26, 2025-less than a month before we start another year of chaos. Crypto’s been on a rollercoaster-remember memes? Those got hot again, didn’t they? And Dino coins? Oh, those fossilized relics crawled back out of the grave. But the real headline? Privacy coins, baby. Apparently, everyone’s suddenly paranoid. Go figure.

Behold, the plot thickens! 🕵️♂️ Our intrepid investigators reveal a troubling truth: 20% of the airdrop, a treasure trove of IRYS, lies in the grasp of a single entity. A monopoly, if you will, that threatens to unleash a torrent of tokens upon the market. Alas, this claim remains unchallenged, a shadow looming over our young protagonist. 🦹♂️