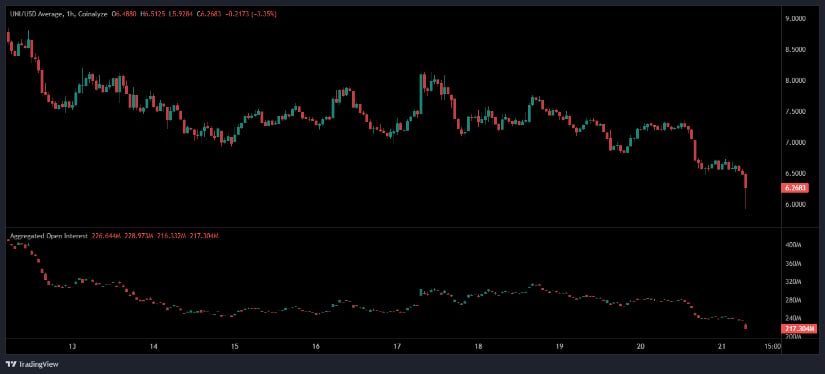

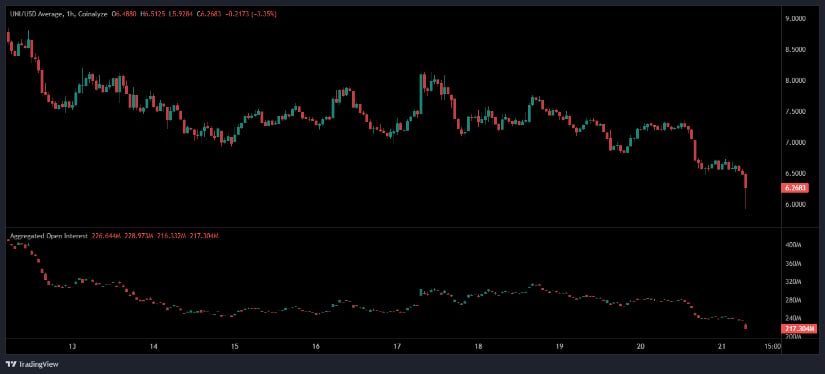

🚨 UNI Plunges: Bulls in Hiding, Bears on a Rampage! 🚨

Buyers are tryin’ to patch this leaky boat, but the indicators are hollerin’ louder than a banjo at a hoedown-further downside’s comin’ unless the market decides to wake up from its nap. 🛌

Buyers are tryin’ to patch this leaky boat, but the indicators are hollerin’ louder than a banjo at a hoedown-further downside’s comin’ unless the market decides to wake up from its nap. 🛌

Imagine, if you will, a wallet that transcends the mundane-a mobile maestro, a non-custodial nymph, offering not just the banal send-and-receive but a symphony of staking, swapping, and presale privileges. With Fireblocks’ MPC as its shield and Rubic’s DEX aggregator as its sword, it strides forth, aiming to conquer 40% of the global wallet market by 2026. Audacious? Perhaps. Absurd? Hardly. 🧐

What is this signal, and what does it mean in the current context? The following report provides a detailed explanation. (Spoiler: it’s probably not the end of the world. Or is it?) 🕵️♀️

Ethereum’s (ETH) recent charade-sorry, chart dance-has entered a stage of decisive despair. It has awkwardly slid out from under the protective embrace of major support zones, once cradling its bullish dreams. Now, trading shy of $3,500, the scene resembles a plot twist: previous fortresses have fallen, flipped into foes, and the broader trend is twisting into a bearish ballet, perhaps even a tragedy.

A surge in altcoin flows might yet awaken these dormant giants from their slumber. 🧙♂️ But will the masses follow, or shall we remain trapped in this curious limbo of potential? 💸

Oh, poor Bitcoin-again, it’s the same old story, but this time with more drama than a Shakespearean tragedy! 🎭💸 Currently circling the $82K mark, the $BTC price has declined by 10% in the past 24 hours alone. That’s enough to make even the most stoic whale weep into their ledger. 🧼😢

Sip your coffee, for the crypto carnival is in full swing! Influential jesters-er, investors-wave their hands, crying, “Beware the fragile market, propped up by short-term tricks and ‘dumb money’ pouring into Bitcoin ETFs like lemmings to the sea!” 🌊🤡

Here’s the kicker: Bitcoin, that lumbering giant, moves slower than a sloth in molasses and costs more than a Manhattan penthouse. Enter Hyper, promising to fix what’s broken. This ain’t just another meme coin, no sir. It’s got “technical chops” sharper than a Ginsu knife and the meme community’s seal of approval. Partnering with DeFi like it’s a Hollywood romance, HYPER might just become the Jedi knight of Bitcoin’s sandbox. May the force be with us. 🌪️

Kalshi, a digital bazaar where humans trade in guesses and hope, has pulled off a financial juggling act, securing $1 billion in a round that makes its worth $11 billion, according to whispers from Techcrunch on Nov. 20, 2025. The round was masterminded by Sequoia and CapitalG (old friends of Kalshi) and joined by other venture-capital wizards like Andreessen Horowitz and Paradigm. This follows a previous round in October that valued the company at a modest $5 billion-a price tag that now seems quaint as a teacup elephant. 🐘

So, according to the on-chain analytics geniuses at Glassnode, this metric tracks the total of BTC futures bets floating around on all those fancy centralized exchanges. When it climbs, investors are opening more positions-probably with too much leverage and a dash of gambling spirit. But when it dips? Well, that’s a fancy way of saying “everyone’s bracing for impact,” or maybe just hiding under the duvet because the market’s playing hard to get.