ETH ETFs Bleed $1.42B – Can $3K Survive This Drama? 💸📉

On-chain data whispered “reversal,” but macro news on Nov 20 might finally say “I do.” Or not. 😬

On-chain data whispered “reversal,” but macro news on Nov 20 might finally say “I do.” Or not. 😬

Brazil is reportedly considering a tax on international crypto payments. The government plans to expand the Imposto sobre Operações Financeiras (IOF) to include digital asset transfers abroad. 🦄

And no, this isn’t a plot twist from the latest science fiction movie. Société Générale’s crypto arm, SG-FORGE, has completed a “monumental” (their words, not ours) transaction in the United States, issuing a blockchain-based digital bond for the very first time. Looks like SG-FORGE is putting its digital stamp on the rapidly evolving world of on-chain capital markets. Get ready to say goodbye to boring old paper bonds, folks.

And just when you thought it couldn’t get any spicier, Mt. Gox-yes, that Mt. Gox-decides to wake up from its 8-month nap and move 10,423 BTC (aka $936 million, aka a lot of avocado toasts). 🥑💰 Is this the prelude to a creditor payout party, or just the universe’s way of saying, “Hold my beer”? 🍻 Historically, Mt. Gox transfers have been the crypto equivalent of a surprise clown at a funeral-nobody asked for it, but here we are. 🤡

So, Circle, the big USDC boss, decided, “Hey, let’s make it easier for all these blockchains to give each other monopolies on stablecoins.” They launched xReserve, a fancy smart-contract system. Basically, it’s like having a shared piggy bank, but on steroids. You deposit some USDC, and then it gives some other blockchain their own-because why not? It’s like a federation of stablecoins all playing nice, at least until they crash. 🤷♂️

Rising Open Interest and heavy short liquidations confirm strong conviction behind Aster’s rally. Buyers, it seems, are not just traders-they’re revolutionaries with stop-loss orders. 💥

In a missive penned with the flourish of a quill (or perhaps the click of a keyboard), the OCC proclaimed that banks may pay these network fees, provided they can foresee a “legitimate need” for such digital trinkets. Ah, legitimacy! That elusive concept, as slippery as a stablecoin’s peg during a market crash. The letter, signed by the Senior Deputy Comptroller and the Chief Counsel-two figures no doubt steeped in the wisdom of ledgers and spreadsheets-assures us that this is all perfectly acceptable under current regulations. How reassuring! 📜

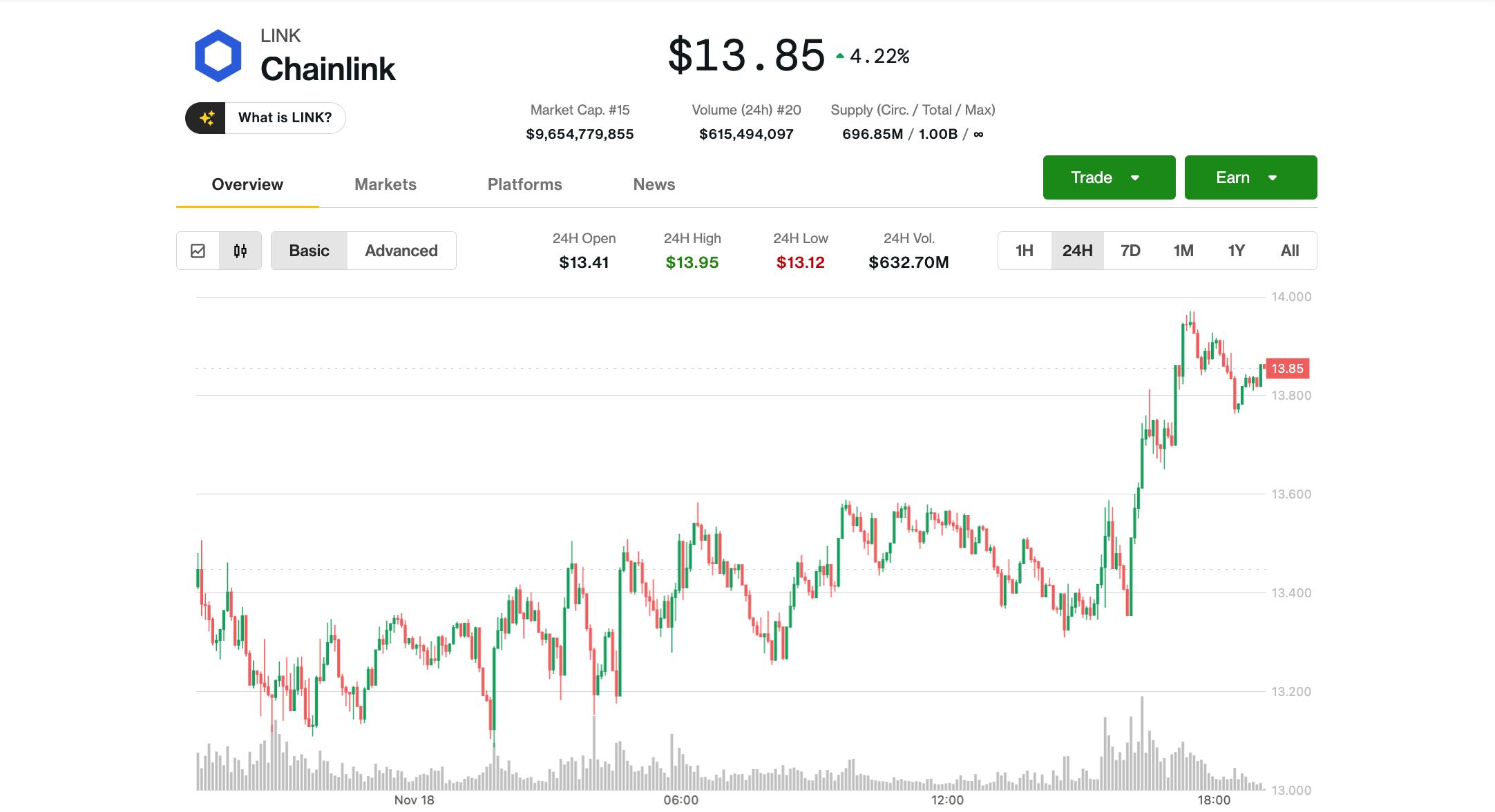

This move was brief but glorious, especially after recent slapdowns where LINK looked about as confident as a cat in a bathtub. Meanwhile, Bitcoin and the broad market index simply watched in mild confusion.

Their “System Update” arrives as Coinbase tiptoes deeper into the labyrinth of tokenization, a realm where real-world assets are sliced, diced, and served as digital confetti. With a new token-sale platform, they’ve resurrected the age-old dream of democratizing finance-assuming “democratizing” means letting retail investors bid on pre-listing tokens while whales sip champagne and laugh. The first sale, for Monad (MON), began on November 17, a date that will either be remembered as the dawn of a new epoch or the day someone forgot to back up their wallet.

On Monday, Mt. Gox-the Tokyo-based exchange that’s more famous for its vanishing act than its trading skills-woke up from its eight-month slumber to move a cool $936 million in Bitcoin. 🕺 The crypto world, always ready for a good drama, sat up and took notice faster than a witch spotting a shiny new broomstick. This is the first time since March that the exchange’s wallets have shown any life, and naturally, everyone’s wondering if this is the prelude to a creditor payout or just another chapter in the never-ending saga of “What Fresh Hell Is This?”