Crypto’s Great Tumble: $280B Vanishes Like a Cowardly Magician! 🎩💨

The crypto economy, my loves, has ended the week in the red-a shade I reserve only for my most dramatic evening gowns. Losing $280 billion, it brought the total market capitalization to just under $3.3 trillion. The downturn, a continuation of last week’s farce, saw Bitcoin ( BTC) fall below the $100,000 mark for the first time in months. How quaint! 🥂💔

The Eternal Struggle: Bitcoin’s Soul Caught Between $96K and the Abyss of $92K! 🕯️💸

Ah, the CME gap! That accursed chasm which draws traders like moths to a flame-or perhaps to a guillotine. “Bitcoin shall fill this gap before any salvation,” intones Ted, the prophet of pillows and charts, as if uttering a prophecy from the depths of a Dostoevskian fever dream. 📉 But what is a gap, if not a mirage conjured by the market’s own madness? 🕳️

Bitcoin’s Desperate Dive: Will It Crash Into Oblivion? 🚀💣

The BTC options market, that grand theater of speculation, allows traders to gamble on Bitcoin’s future like soothsayers with calculators. Here, one may buy the right to sell Bitcoin at a chosen price-or perish trying. A noble endeavor, if ever there was one, to hedge against risk and bet on volatility. Alas, it is a mirror held up to the soul of the market: fractured, frenzied, and forever hungry. 🎲📉

Stablecoins in a Pickle: $1.2B Vanishes, Folks are Tiptoein’ Out!

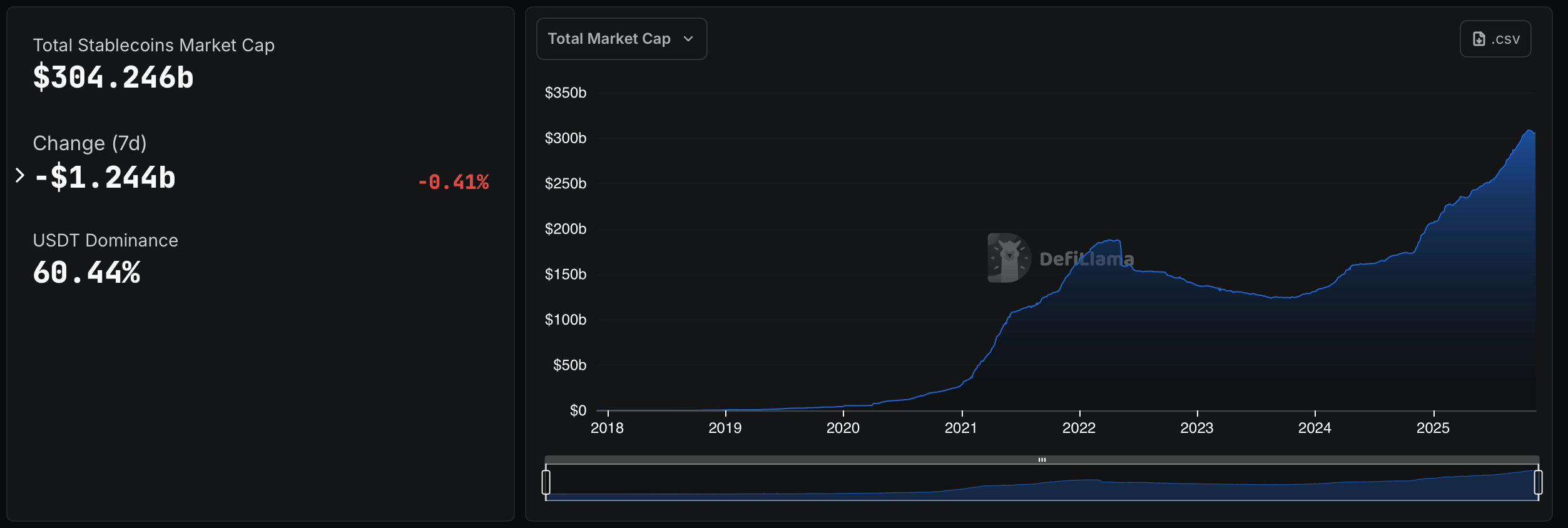

This weekend, stablecoin data from defillama.com pegs the fiat-pegged economy at $304.246 billion following the week’s 0.41% reduction. Over the past seven days, the stablecoin sector delivered a full spectrum of mood swings. Tether’s USDT, still standing tall as the heavyweight at $183.896 billion, squeezed out a modest 0.16% lift – the kind of move that barely gets a nod, like a yawn so loud it could be heard in the next county. 🐴

Crypto Crashes and Stars: Solana & XRP Shine While Bitcoin Bleeds Red

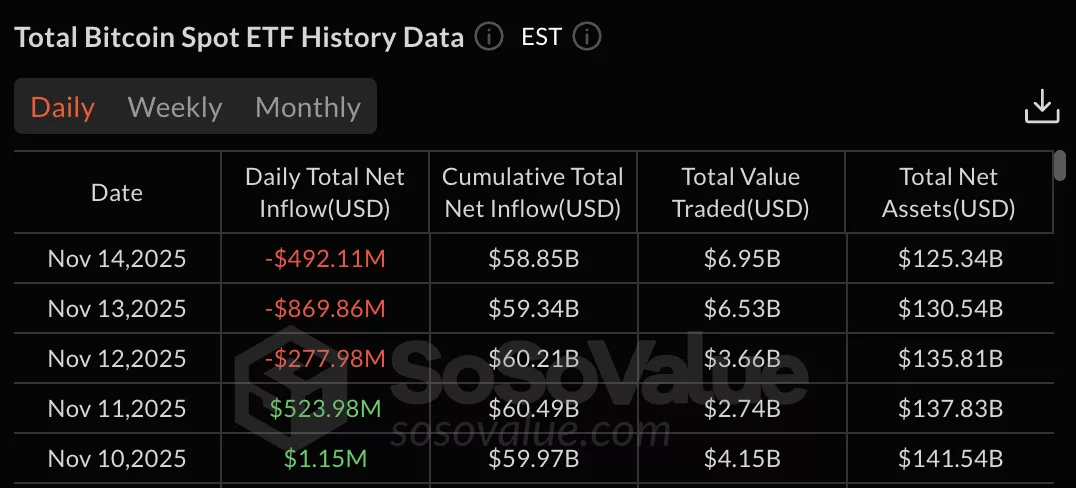

Bitcoin (BTC) ETFs gouged out $492.11 million-no use crying over spilled blockchain. Ethereum (ETH) was not far behind, with $177.90 million in redemptions-because nothing says ‘trust me’ like a collective exit stage left. Solana (SOL), that resilient sprout, posted a modest $12.04 million in inflows, entertaining hopes of staying afloat amid the chaos. And XRP? Its second day of trading brought in a hearty $243 million for its debut-showing that not all that glitters is liquidated.

Aster’s Tokenomics: A Tale of Miscommunication and Midnight Locks 🌌

The confusion? A calendar shift so dramatic it could make Stalin reconsider his Five-Year Plan. Dates once etched in 2025 now sprawled into 2026, 2035-epochs in the blink of a blockchain. Users, armed with spreadsheets and existential dread, questioned whether their tokens were now buried under layers of bureaucratic ice. 🧊

Harvard’s Bitcoin Blunder: $442M on IBIT? 🤑🤡

As the ever-watchful Eric Balchunas, Bloomberg’s senior ETF analyst, has noted with a mix of awe and bemusement, Harvard has anointed BlackRock’s iShares Bitcoin Trust ETF (IBIT) as the crown jewel of its portfolio. A $326 million increase, you say? How delightfully reckless! Microsoft and Amazon, those staid giants of industry, now find themselves relegated to second and third place, respectively. Oh, the irony of academia out-gambling the tech titans! 🤓📈