Bitcoin Hyper: The Crypto Circus is in Town! 🎪💰

1⃣ Bitcoin Hyper is the latest clown car in the crypto circus, with its presale hitting $25M while the market does the cha-cha slide into volatility. 🎢

1⃣ Bitcoin Hyper is the latest clown car in the crypto circus, with its presale hitting $25M while the market does the cha-cha slide into volatility. 🎢

Check out the chart above (yes, the one that looks like a modern art piece). The $BTC price is getting smacked down by not one, not two, but THREE trendlines. The major one (that bold black line), the top of the descending channel (blue, because why not?), and the faint dotted line from the all-time high. It’s like a fortress, and the bulls are standing outside with a sad trombone. 🎺

Since October rolled in, the peso took another nosedive, because of course it did. October’s theme song: “It’s Raining Pesos (And I’m Not Keeping Score)” 🌧️💸. According to Google Finance, it’s down 4% against the dollar. Meanwhile, Bloomberg reports locals are now treating stablecoins like a high-stakes game of hot potato-swap dollars for crypto, then resell for pesos at a discount. It’s called “rulo,” which sounds like a dance move but is actually how you turn economic despair into a 4% profit. Cha-ching! 💸💃

They’re still selling at a profit, showing confidence and increasing their long exposure. Basically, they’re sipping margaritas while the rest of us are Googling “how to eat instant noodles for a month.”

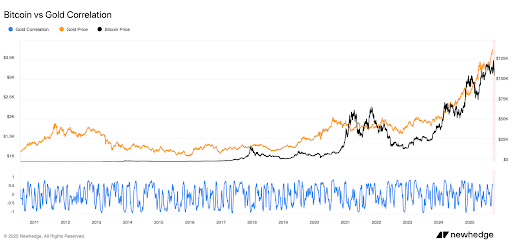

Apparently, Schiff, bless his perpetually skeptical heart, threw down the gauntlet. And CZ, being the magnanimous sort, accepted. He complimented Schiff on being “professional and nonpersonal” which, let’s face it, is basically saying “you’re a grumpy old man, but a polite grumpy old man.”

Liquidity, momentum, and institutional focus have done a disappearing act, leaving altcoins high and dry. It’s like the party’s over, and everyone’s gone home! 🕺 The golden era of altcoin speculation appears to be on pause-if not over entirely.

Forsooth, on this twenty-third day of October, the so-called ‘Ethereum spot ETFs’ did find themselves in a most unseemly predicament. A veritable exodus of coin, amounting to one hundred and twenty-eight million units, fled these funds! Not a single one, mind you, showed the smallest sign of refreshment – a desert of inflows, I tell thee! 🌵

And just like that, Custodia Bank and Vantage Bank, in a glorious moment of technological enlightenment, have unveiled a blockchain solution so seamless, it might as well be fairy dust. With this new platform, old-school banks can now issue tokenized deposits like they’re flipping pancakes at a Sunday brunch. The future has arrived, and it’s tokenized.

Dubbed MultiSYG (because Latin makes everything sound important), this grand spectacle shall debut in early 2026-because why rush perfection?-catering to noble institutions and high-net-worth individuals who crave bank-grade loans yet recoil at the thought of their collateral being gambled away like a drunken sailor’s wages. ⚓

“Oh, rest assured, there will be 50% drawdowns,” proclaimed Lee, as if predicting rain in London, during a chat with crypto enthusiast Anthony Pompliano. “Mark my words-when the winds of fortune shift, Bitcoin shall tumble like a sack of potatoes down a steep staircase.” 🥔📉