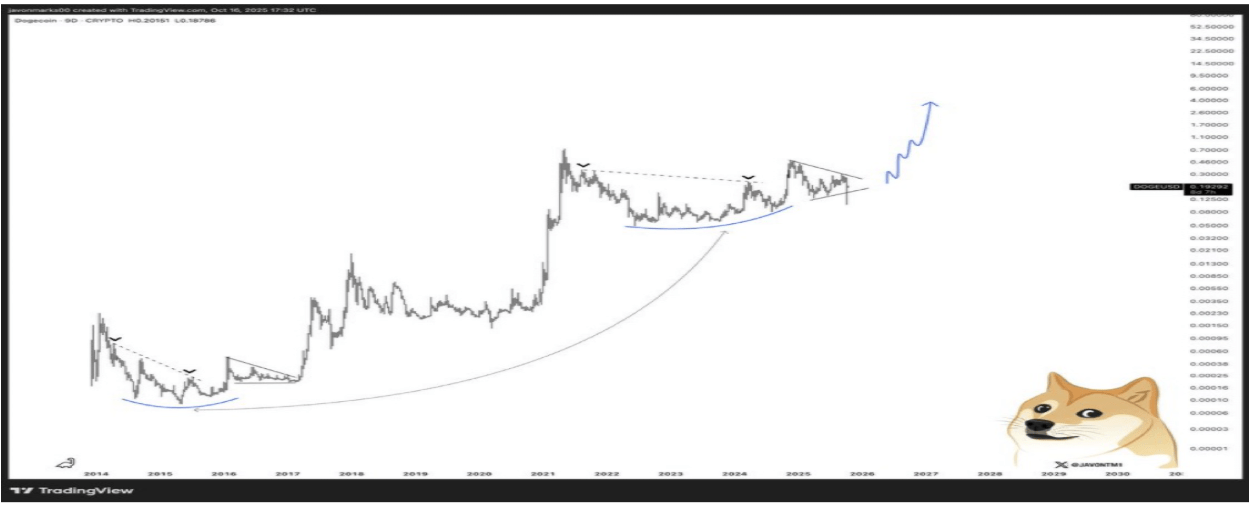

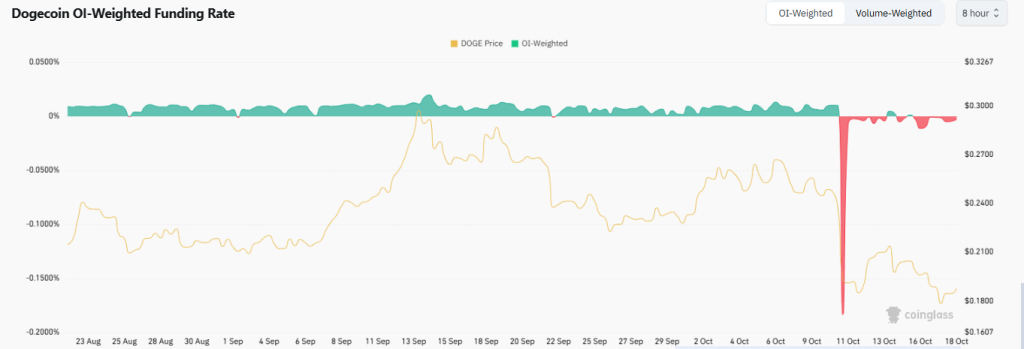

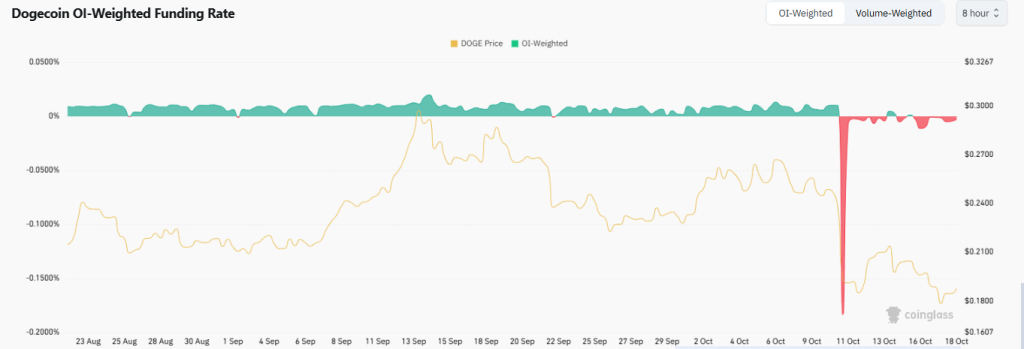

Following the Trump administration’s declaration of a complete tariff on Chinese imports-a move that surely upset the entire global bazaar-the crypto market, including our beloved canine currency, suffered a most distressing decline, much like an unwelcome house guest who oversteps boundaries. On October 10th, the tremors of sudden liquidations were felt sharply; yet, at the approximate lodestone of $0.18, the market found a surprising steadiness. Whales and market makers-those shadowy figures of finance-seemed quite content to absorb the downward blows, perhaps hinting at a quiet gathering akin to a ball before the grand dance. The prudent money is quietly staking its claim, neither fleeing nor overexcited, asserting that perhaps, just perhaps, a bullish turn might be in the making. As for the funding rates in the derivatives markets, those fickle indicators, they have resumed their normal course-calm after a brief storm-a signal that the mood is stabilizing and that the forthcoming stage might be set for a spirited rise.