XRP’s Price Plummets: What’s Going On? 🚨

//media.crypto.news/2025/10/XRPUSDT_2025-10-17_10-54-06.webp”/>

//media.crypto.news/2025/10/XRPUSDT_2025-10-17_10-54-06.webp”/>

My dears, in the wild jungle of crypto, presales are the crème de la crème of opportunities. These early-stage darlings raise funds for everything from meme coins (oh, the absurdity!) to utility projects and even those delightful degen shitcoins. 🪙💨

Dozens of exchanges, from the titanic Binance to the modest Coinhouse, now tremble under the weight of France’s regulatory gaze. The ACPR, that austere arbiter of financial virtue, has descended upon them like a vengeful angel, demanding proof of their righteousness in compliance, risk controls, and the sacred art of anti-money laundering. One might imagine Binance’s CEO weeping into a spreadsheet, whispering, “Not again… the risk controls!” 🤡

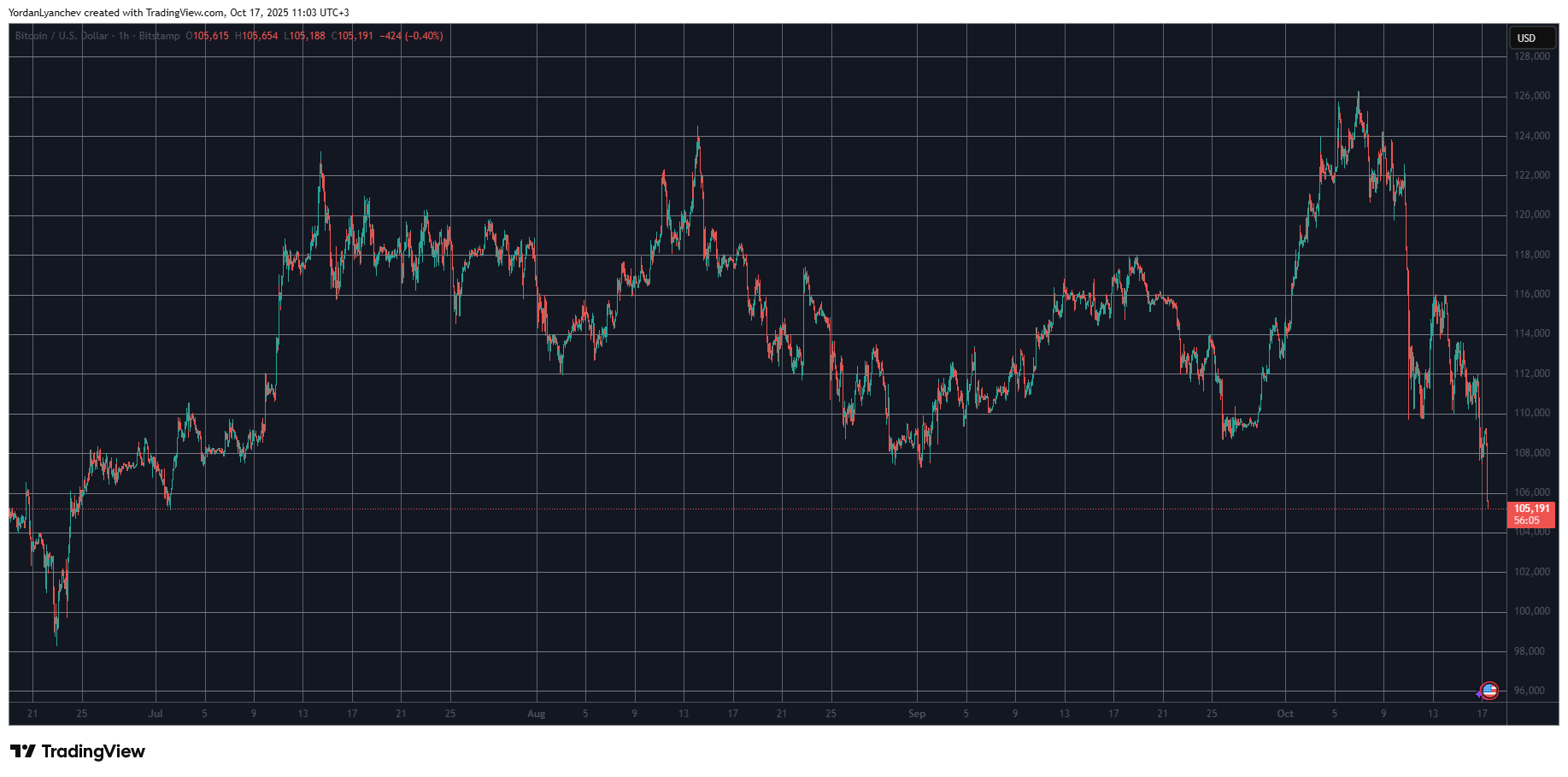

Ah, wretched Bitcoin, you pitiful creature of the digital abyss, lingering like a forsaken soul around a mere $105,000, what depths of despair have you sunk! Yet behold the grotesque spectacle of our nation’s fiscal soul, illuminated in a sepulchral September surplus, a twisted jest from the gods of coin and commerce. 💸

Changpeng Zhao-CZ to friends and enemies alike-rattled the cage. He called out, loud and clear, that these digital treasure chests-DAT companies-must get their act together. Use third-party guardians for their coins, and let the investors peek behind the curtain with audits. Because nothing says “trust” like a third-party with a magnifying glass, huh? It’s a bit like telling a snake oil salesman he should probably wear gloves.

“If you want to dance with YZi Labs BNB,” CZ said, “better have your ducks in a row.”

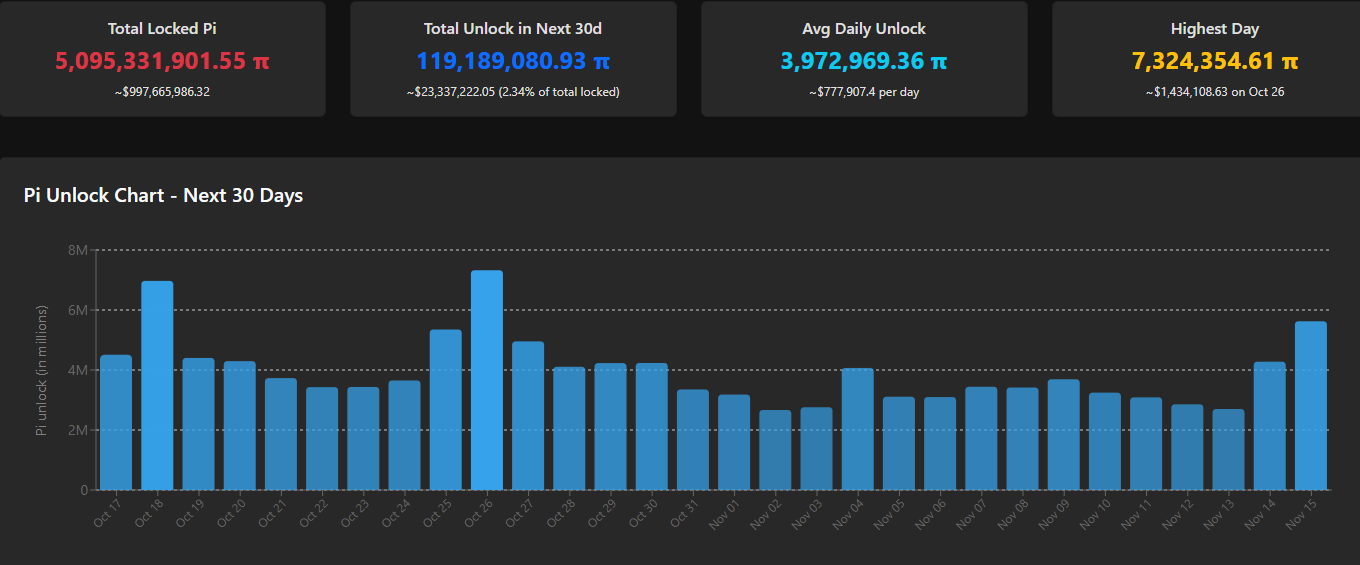

In the balmy summer of 2025, as the faithful celebrated Pi2Day (June 28, mark thy calendars!), this application emerged, a fusion of blockchain, AI, and other fanciful notions. Its purpose? To empower users to craft their own Pi-native applications, a task as daunting as convincing a miser to part with his gold. 🧙♂️

$BTC, that sly old fox, dances on the edge of a precipice-plummeting to ≈$103K, then rebounding to ≈$116K, only to slink back to ≈$109K within a week. A performance worthy of a circus, if the ringmaster were a deranged algorithm.

Bitcoin, once the belle of the speculative ball, is now nosediving toward $105,000 with the grace of a flamingo in a freefall. Altcoins, bless their overhyped little circuits, are plummeting even harder. One might call it a “correction,” but really, it’s more of a full-body liquidation masquerade.

Oh, the humanity! On October 16 (ET), the crypto ETF market decided it was time for a little emotional breakdown. Spot Bitcoin ETFs sobbed their way to a $536 million net outflow, with not a single one of the twelve funds managing to keep their cool. Meanwhile, Ethereum ETFs were like, “Hold my beer,” and logged a $56.88 million net outflow. The only one not crying into their latte? BlackRock’s ETHA, which somehow managed to stay chic. 🥂 But let’s be real, this synchronized meltdown screams “market cooldown” louder than a mic drop at a karaoke bar. Traders are cashing out faster than a bad first date, all thanks to volatility and the eternal question: “What’s next?” 🤷♀️

“For ten full years, we’ve been told of the wondrous on-chain possibilities, and lo! With real-world attempts, the cracks in the facade yawn wide.” Thus spake O’Leary, sounding much akin to a disenchanted yet eloquent farmer upon discovering worms in his once-stable apples. ‘