Paxos’ $300T Fiasco: Crypto’s New Headache 🤯

Aave temporarily froze PYUSD lending markets as a precaution. Because when in doubt, freeze it out. 🧊

Aave temporarily froze PYUSD lending markets as a precaution. Because when in doubt, freeze it out. 🧊

Despite this short-term bump, the company’s stock remains down nearly 40% year-to-date, a sharp contrast to Binance’s BNB, which recently hit an all-time high of $1,370. 📈📉

Meanwhile, in Sydney, folks were queuing up outside ABC Bullion like it’s a Black Friday sale for existential dread. 🛍️🤡 One bloke in line muttered something about “macroeconomic uncertainty” and “distrust of banks,” but let’s be real-he just wants to feel like a pirate with a chest of gold. 🏴☠️

All this comes right before the Fed’s October meeting, where some expect fireworks-or at least another reduction in the interest rate. Not the fun kind of fireworks, mind you-more like the kind that shakes the economy awake. And let’s not forget the little detail of the U.S. government shutdown making markets sweat.

Avec son entrée dans l’écosystème de jalonnement Ethereum, SharpLink Gaming, cette company qui brillait dans le marketing de la performance en ligne, s’affirme comme un chef de file dans l’acceptation d’ETH. On peut dire qu’ils réalisent un grand coup, marquant une montée de confiance parmi les investisseurs institutionnels, tous applaudissant les fondations à long terme du réseau ! 👏

The airdrops were in BNB, and this measure directly benefits Binance in a lot of ways. Moreover, a goodwill gesture may lead traders to forget their legitimate grievances regarding platform outages. 🤡💸

This revelation emerged in response to a poll so viral it could only be described as a digital epidemic, inquiring whether the XRP faithful had ever parted with their precious tokens for goods or services. The options, one presumes, were not limited to trinkets and baubles, but extended to the more prosaic via POS systems or the debatable merits of Uphold and Gemini. Morgan’s reply? A succinct “Yes,” delivered with the gravity of a man signing his own arrest warrant. 📜✍️

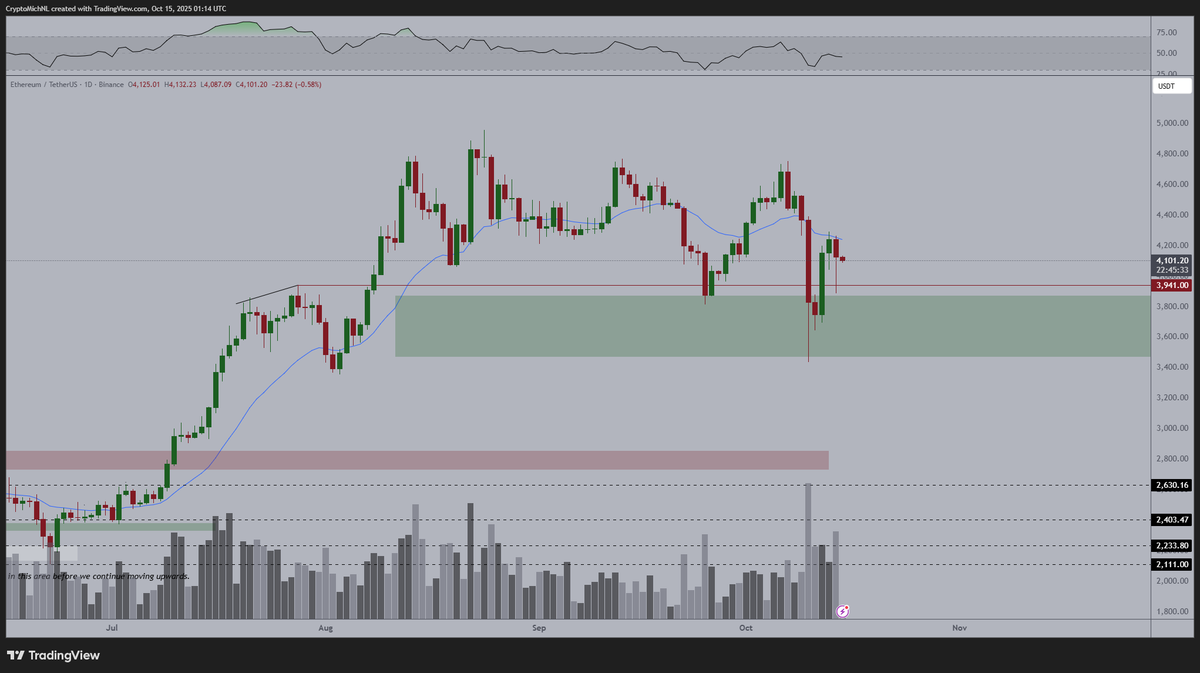

Meanwhile, the asset dances on a tightrope, balancing on key levels like a drunk acrobat. Trading activity? A masquerade ball of consolidation, where everyone’s pretending they know the plot.

Publicly traded companies, led by the ever-so-chic SBI Holdings, have stashed away over $11.5 billion in XRP. Yes, you heard that right-billions! It’s not just a fling; it’s a full-blown romance, suggesting XRP’s long-term role as the digital darling of settlement and reserve assets. How utterly divine! 🌟

In a recent missive to the ever-watchful eyes of crypto.news, the alliance was revealed-audaciously proclaiming that Stablecoin’s expansive blockchain has now welcomed Morpho into its embrace. Together, they promise salvation for holders of stable assets, tirelessly working to transmute idle balances into a fountain of interest. Indeed, the collaboration extends its tendrils into Stable Pay, an alluring app that seeks to guide users toward the sanctuary of yield generation.