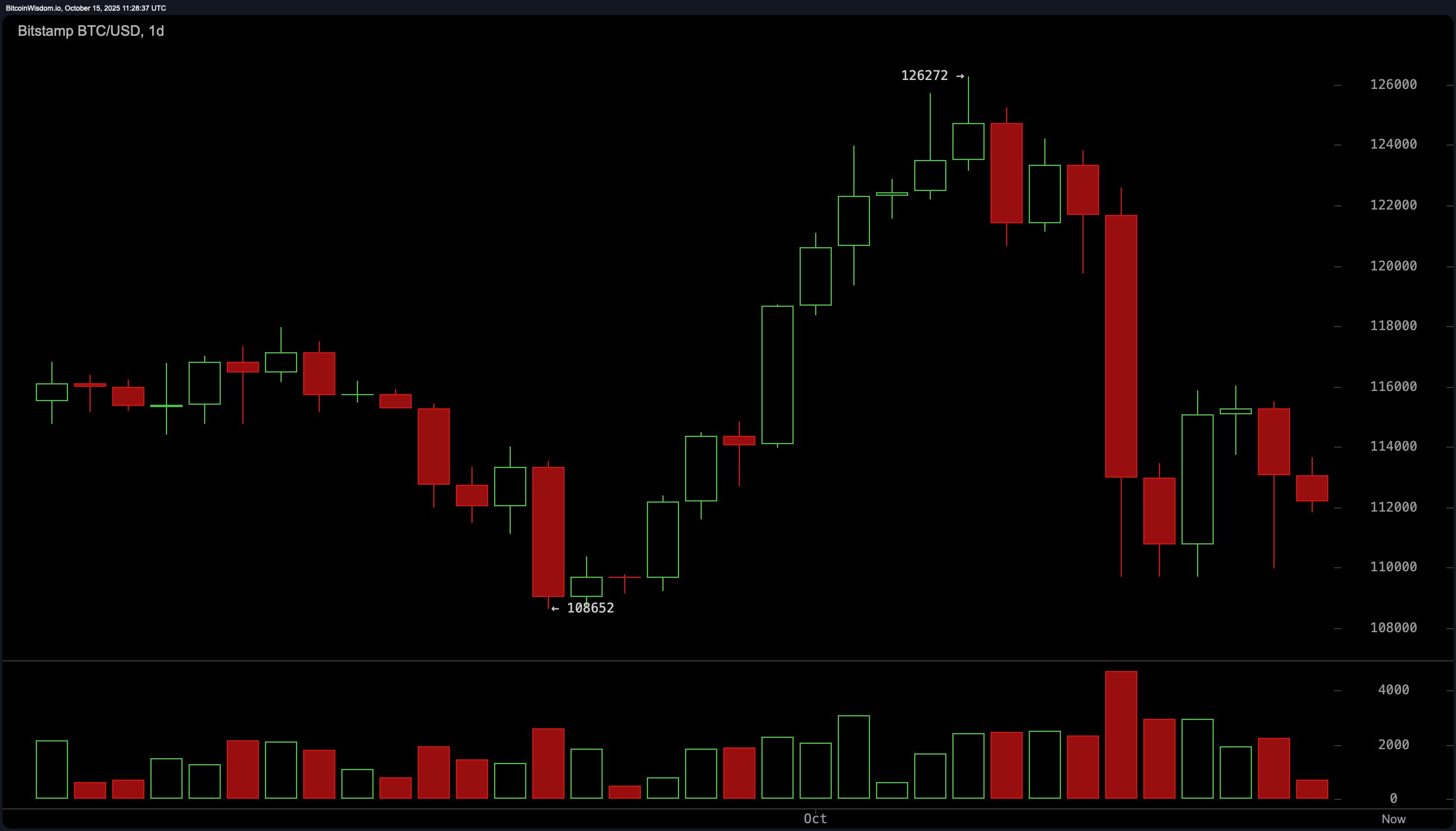

Crypto Charts Decoded: 2025’s Guide for the Perplexed (and Slightly Drunk)

OHLC helps traders track price movements, analyze volatility, and find trading opportunities. If you stare long enough, it might whisper secrets to you… probably about your life choices.