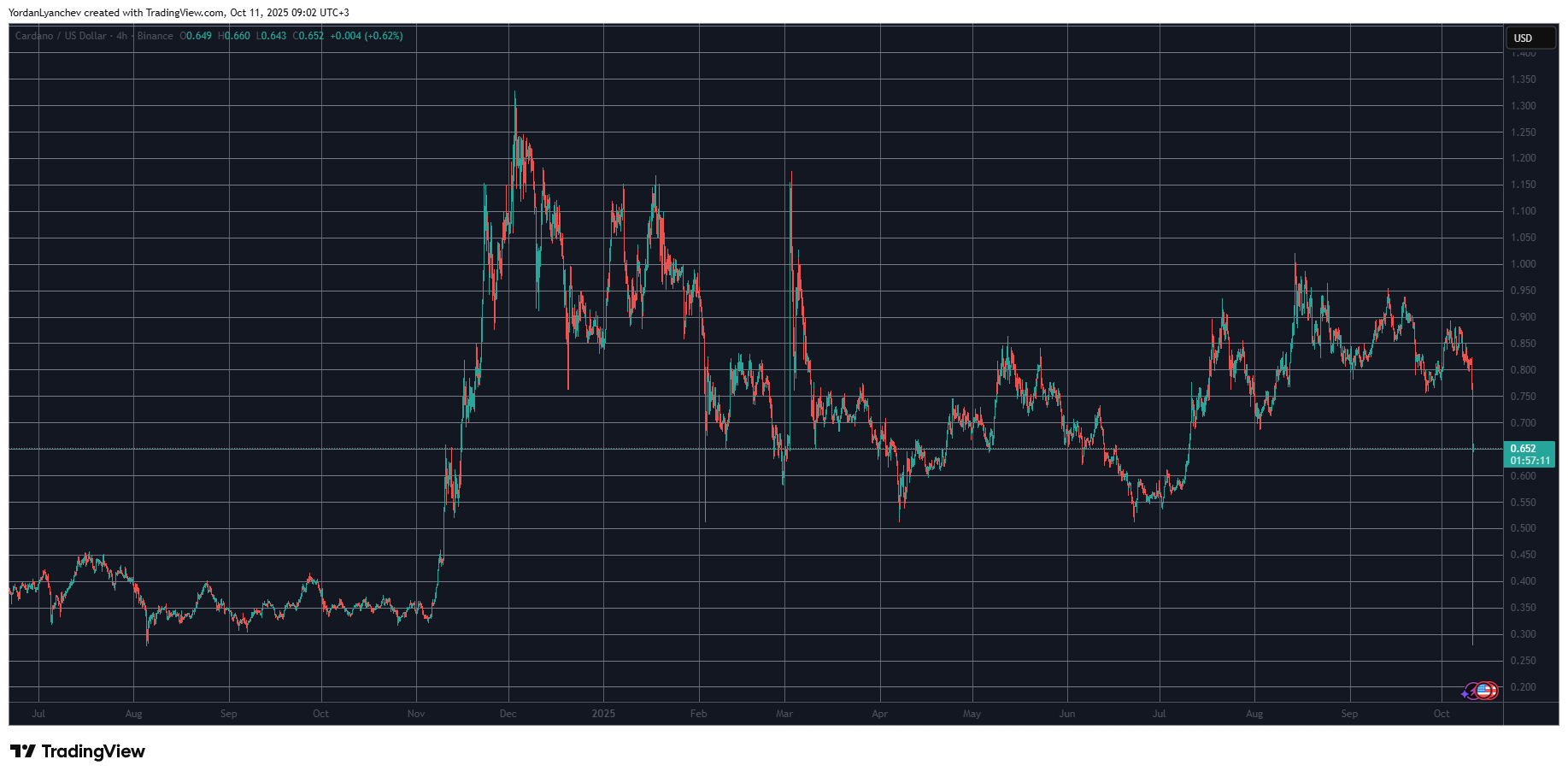

😱 Cardano’s Whales Abandon Ship in Financial Tsunami! 🚢💸

The same dread struck other trading arenas. A similar plunge was witnessed on Bitfinex to $0.30 and on Kraken to $0.42, though not quite as violently. Bears lethargically dragged it to $0.56 on Bitstamp, while Coinbase saw it dip to $0.6, now hovering near $0.65. 😏