Crypto’s Wild Ride: A Tale of Volatility, ETFs, and Stablecoins 🌪️💰

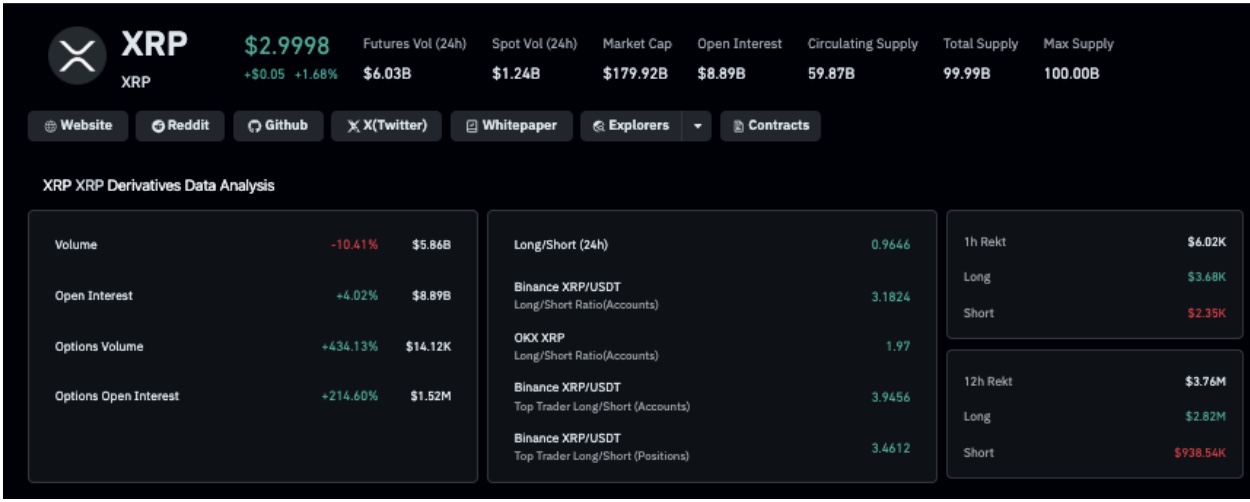

Ethereum (ETH), the consummate courtier, flirted with $4,600 before retreating to $4,567, a marginal dip that whispers of unspoken desires and unmet expectations. 💔 Ripple (XRP) and Dogecoin (DOGE), those mischievous scoundrels, danced above $3 and $0.257 respectively, only to stumble, leaving us to ponder their fleeting glory. 🕺 Solana (SOL), Cardano (ADA), and Chainlink (LINK) – a trio of tragic figures – each suffered declines, their stories as intertwined as the plots of a Wildean novel. 🌀