ETH’s $18B Treasury: A Desperate Dance with Leverage 🎭💸

Aye, the Leverage Ratio dances higher, a masquerade of confidence masking the specter of ruin. One misstep, and the curtain falls on $4,000. 🎭

Aye, the Leverage Ratio dances higher, a masquerade of confidence masking the specter of ruin. One misstep, and the curtain falls on $4,000. 🎭

A bold new chapter is unfolding in the corporate bitcoin world. Strive, co-founded by Vivek Ramaswamy, has agreed to merge with Semler Scientific. Full stock purchase combines two of the most aggressive corporate buyers of bitcoin. Both Boards voted to approve the move, pending closing conditions. The transaction aims to entrust Strive’s position as a bitcoin treasury management leader and provide Semler stockholders with a solid premium. 🚀

On-chain metrics? More like on-chain *magic tricks*. Daily active addresses (DAA) are climbing faster than a social climber at a champagne reception 🥂, currently lounging at 63.97%. Who needs a market upswing when you’ve got *organic demand*? How très chic.

The State of Delaware, that most accommodating of bureaucratic playgrounds, has been chosen by WisdomTree not merely as a legal address but as a theatrical stage for its grandiose ambitions. After all, who wouldn’t want to conduct business in a state where the law is as flexible as a yoga instructor’s schedule? It’s the kind of environment where even the most absurd financial schemes can masquerade as prudent investments.

Buterin, that clever clogs, declared Base an “Ethereum Layer-2 doing things the right way.” Sure, it’s got a few centralized bits to make life easier for users, but it’s still anchored to Ethereum’s Layer 1 like a barnacle to a battleship. Because nothing says “trust” like a network that can’t steal your funds or block withdrawals-unless it’s a Tuesday and the coffee’s weak. ☕

On a day when the sun refused to shine (or perhaps blinked in disapproval 🌞👁️), House Committee Chairman French Hill led a troupe of financial illusionists-including Subcommittee Chair Ann Wagner and Reps. Lucas, Davidson, and the ever-mysterious Stutzman-to pen a letter to SEC Chairman Paul Atkins. Their mission? To hasten the implementation of Trump’s masterpiece, Executive Order 14330, a document so revolutionary it might as well be a wizard’s spellbook. 📜✨

Oh, what a time to be alive! Korean Air has gone ahead and signed a research agreement with Wingbits (no, it’s not a cryptocurrency scam, just a future-tech wonder), a Stockholm-based company that will supply real-time ADS-B data for the airline’s ACROSS air traffic coordination system. Sounds like a lot of jargon, but stick with me. It’s all about tracking planes and drones in the sky like they’re a part of some sci-fi thriller.

In a flurry of activity on Monday, nine lawmakers-yes, not twelve like the room in the dorm but still a noteworthy squad comprising notable characters such as House Financial Services Committee Chairman French Hill and Subcommittee on Capital Markets Chairman Ann Wagner-voiced their demands. They kindly asked Atkins to sprinkle some of that SEC magic to help the Secretary of Labor and jazz up current regulations as needed. They cited the August memo straight from the desk of President Donald Trump: “Democratizing Access to Alternative Assets for 401(k) Investors.” Envision it: crypto dancing its way into your retirement stash, given your potential triple-A sophistication.

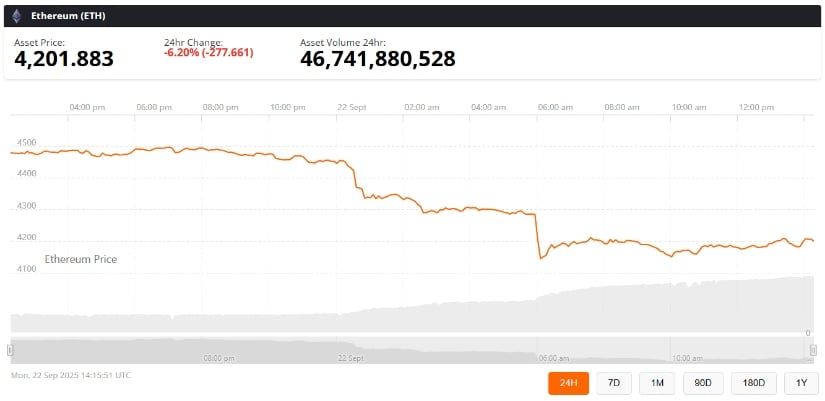

Ethereum is currently lounging around at $4,201, down a casual 6.2% in the last 24 hours. Ouch. According to Brave New Coin, ETH’s taking a bit of a tumble after some seriously heavy liquidation action. And guess who’s behind the wheel? That’s right, the whales, the big fish of the crypto ocean. 🐋

Market cap? Oh, just a casual $13.54 billion – probably enough to buy a small country or at least a really nice yacht. And the daily trade volume? A tidy $1.55 billion – because apparently, everyone’s eager to throw money into the blockchain abyss.