Memecoins Mania: How Traders Are Betting on Rate Cuts and Altcoin ETFs!

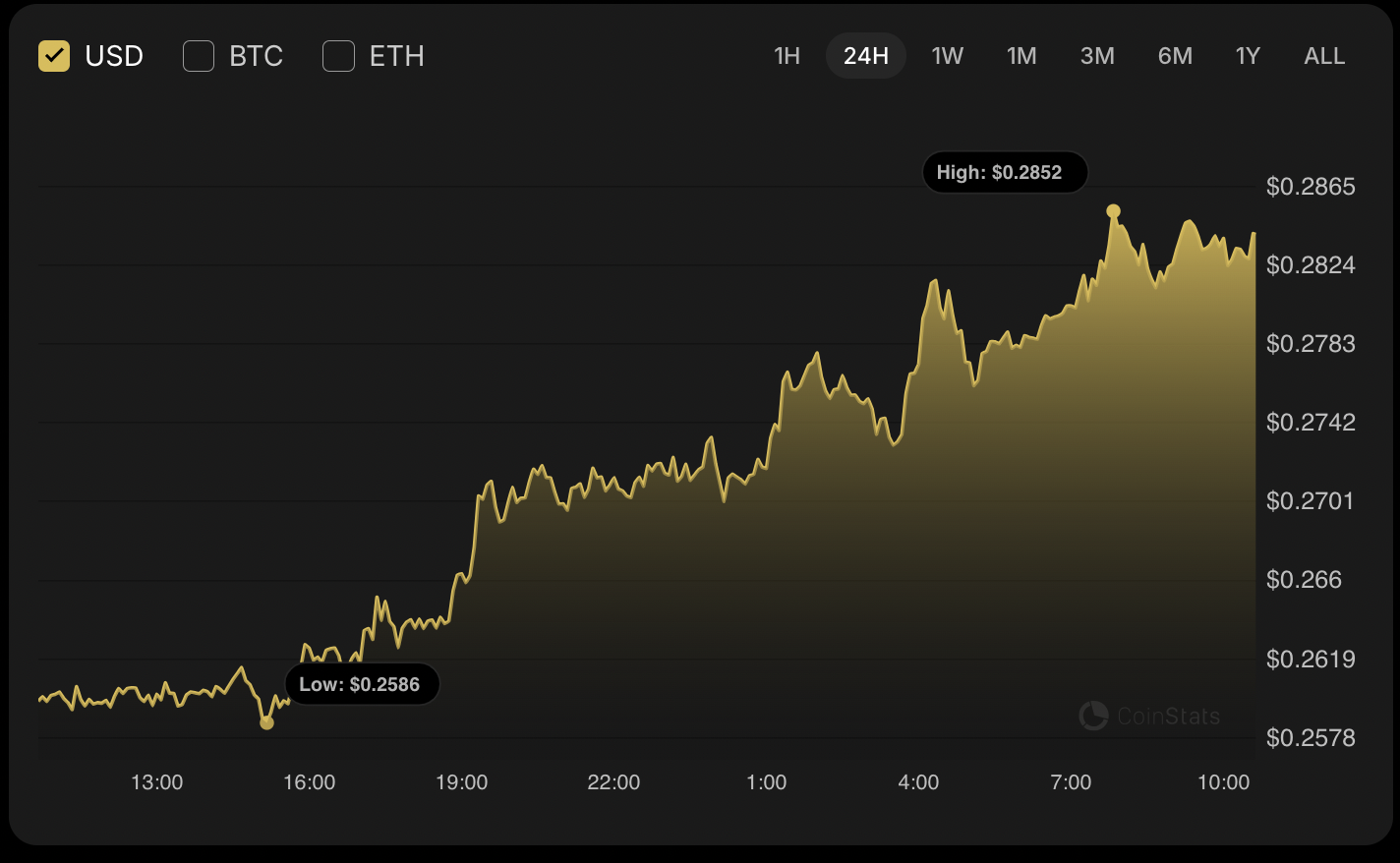

Ah, the memecoin market is heating up faster than a pot of water on a ravenous stove, with chatter about altcoin season growing louder on social media, no doubt fueled by the intoxicating prospects of Fed interest rate cuts, which, let’s admit it, could turn risk assets into the darlings of the investment world.