Bitcoin Hits $116K! Stocks Party, Larry Ellison Richer Than Elon? 😱💰

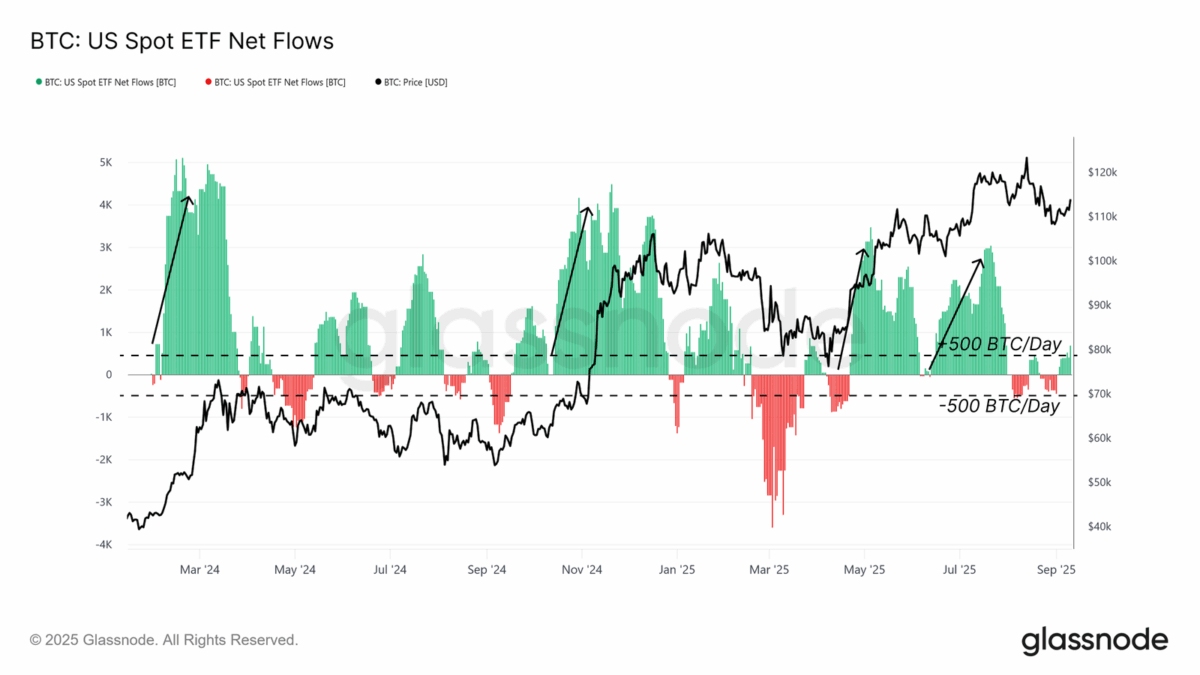

So, here’s the tea: Inflation was a tiny bit spicier than expected (thanks, Bureau of Labor Statistics, for the heart palpitations), but the real drama? Jobless claims surged like a bad Tinder date gone wrong. Economists are now convinced the Fed will cut rates next week, and suddenly, stocks were like, “Let’s break records!” All three major indices closed at all-time highs, and Bitcoin was like, “Hold my crypto,” and joined the rally. 🌟💸