Why Kraken’s New ‘Perps’ Product Is the Wildest Thing Since Sliced Bread 🍞

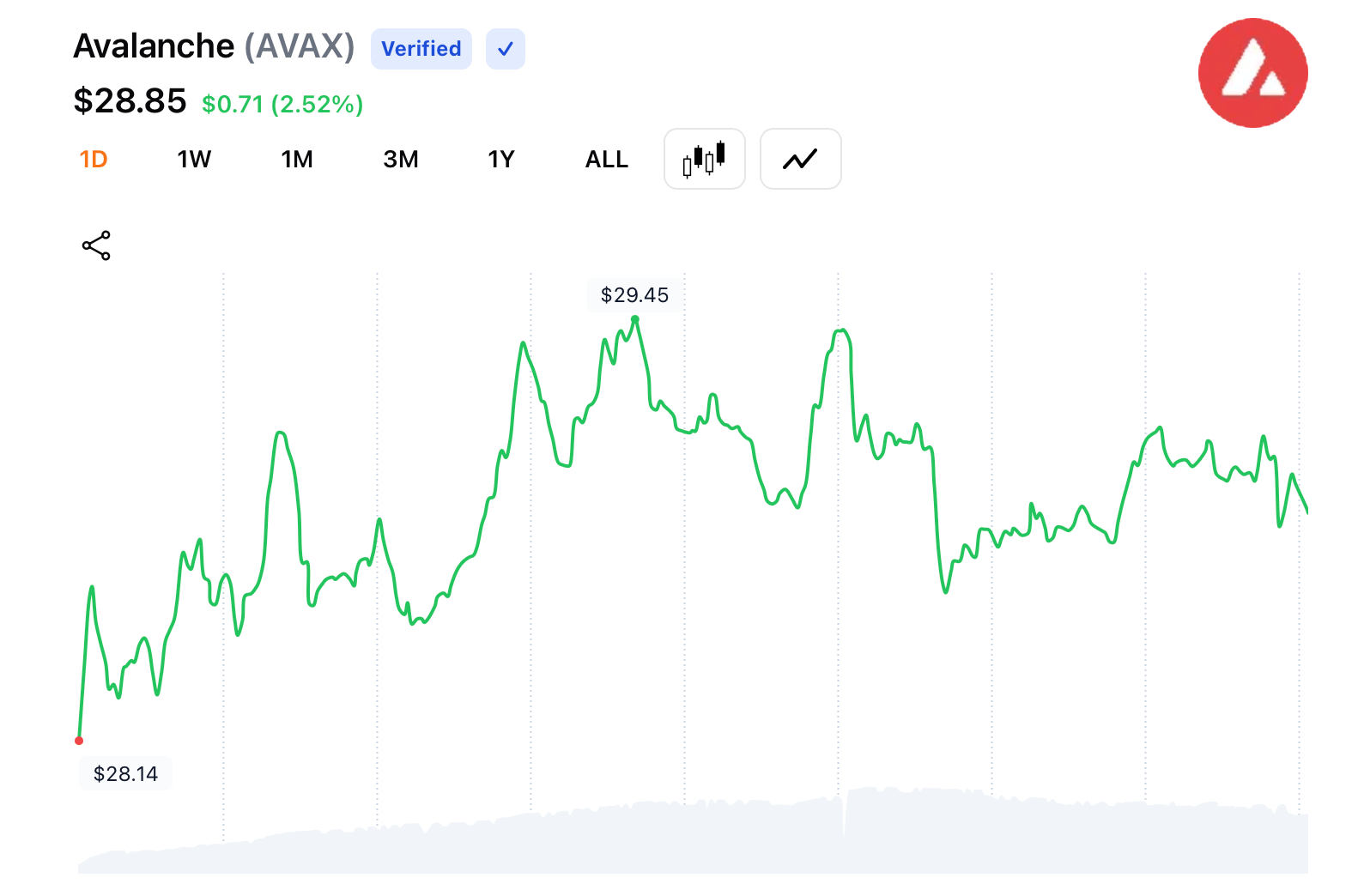

Now, according to the fine print on their website (which I’m sure everyone reads), Perps lets you wager on price movements without actually owning the coins. No expiry dates, no pesky deadlines-just pure, unadulterated speculation that can be abandoned faster than a cat fleeing a bathtub. 🐱🛁 And guess what? It’s available for over 300 assets, including Bitcoin: