Justin Sun Reveals HTX’s High-Yield Products and Huge Growth Strategy

Here’s insight into HTX’s strategy.

Here’s insight into HTX’s strategy.

On a day marked by the sun’s descent into the horizon, Mr. Jonny Litecoin took to the social platform known as X, a place where gentlemen of lesser means often seek to make their voices heard, and declared that the XRP, a currency dear to the hearts of many, lacked the intrinsic value of the noble Litecoin. He argued, with a flourish of rhetoric that would have made Cicero proud, that XRP was conjured from the very ether itself, a mere figment of code, unlike the sturdy Litecoin, which is forged through the sweat and toil of computational effort and energy, a process known to the learned as Proof-of-Work (PoW).

Rewind to 2021: Mantle Network strutted onto the stage as Ethereum’s layer-2 scaling solution, proudly waving the flag of BitDAO. Yes, the first L2 network born from a decentralized autonomous organization-fancy talk for a robot running a democracy… kinda.

Now everyone’s losing their minds asking: “Is Bitcoin about to get owned by quantum hackers overnight?” Spoiler-it’s more like “not today, maybe never.”

Le théâtre est prêt, les rideaux se lèvent pour un grand retour des altcoins. Sous les auspices bienveillants d’un taux qui s’assouplit, de banques centrales moins dures que Monsieur Jourdain en soirée, et d’une régulation enfin intelligible, voilà que l’envie de risquer nos écus s’enflamme. Les dindons de la farce, pardon, les capitaux, s’éloignent du duo classique (BTC/ETH) pour courir vers des terres plus agiles. Résultat : volumes en pleine ascension, flux divers et variés sur CEX/DEX, préventes fermées comme des coffres-forts, et des foules en délire.

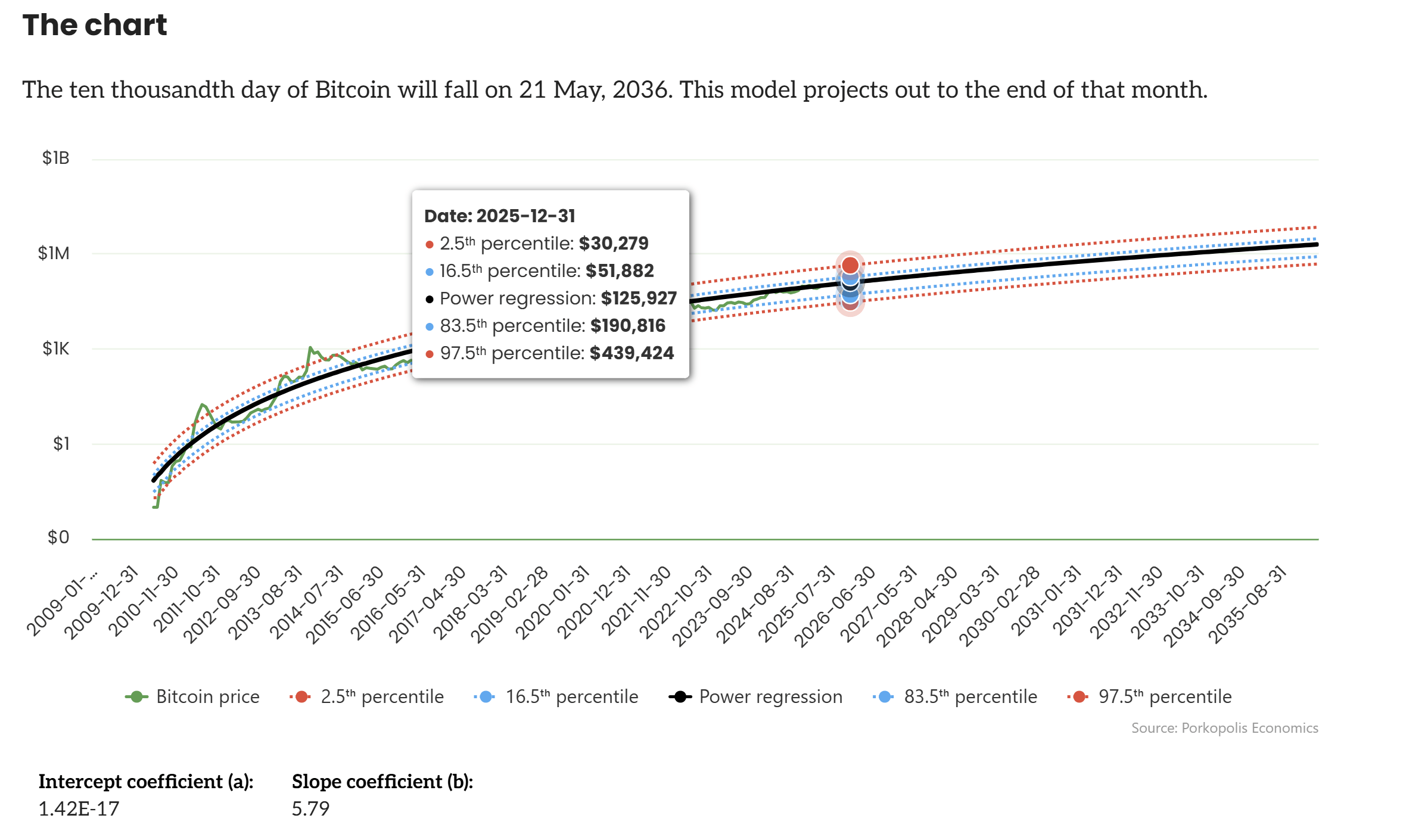

He’s not just winging it, no. Oh no. He’s got these “power trends” and “percentile bands” that sound suspiciously like financial fairy tales. According to him, Bitcoin’s price has a habit of dancing above the 80th percentile like it’s at a particularly chaotic party. If it doesn’t hit $170k by December, he’ll “rethink the four-year cycles.” Good luck with that, love. The market’s as predictable as my ex’s text schedule. 📱

In a world where economic crises and sanctions are basically Venezuela’s default settings, they’re turning to USDT-the big, stable, and slightly scandalous stablecoin-to keep their oil money flowing. It’s like switching from a rusty bike to a Tesla-kinda flashy, kinda risky, but hey, it gets the job done.

In a filing as fortuitous as finding a pot of gold, they declared: “We possess 2,443 BTC, worth barely less than $273 million.” Compared to their former claim of 152 BTC, it was almost as if the tale of magical numbers reinvented itself.

Judge Analisa Torres’ July 2023 ruling, where she declared that XRP itself is NOT a security, wasn’t just a win for Ripple. Oh no, it was a turning point for the entire crypto world. And according to Deaton, it wasn’t just the lawyers at Ripple who did the heavy lifting. Nope, it was those 2,000 exhibits filed and, get this, some key documents that the judge relied on – including affidavits from XRP holders and Deaton’s oh-so-influential amicus brief. Talk about a plot twist!

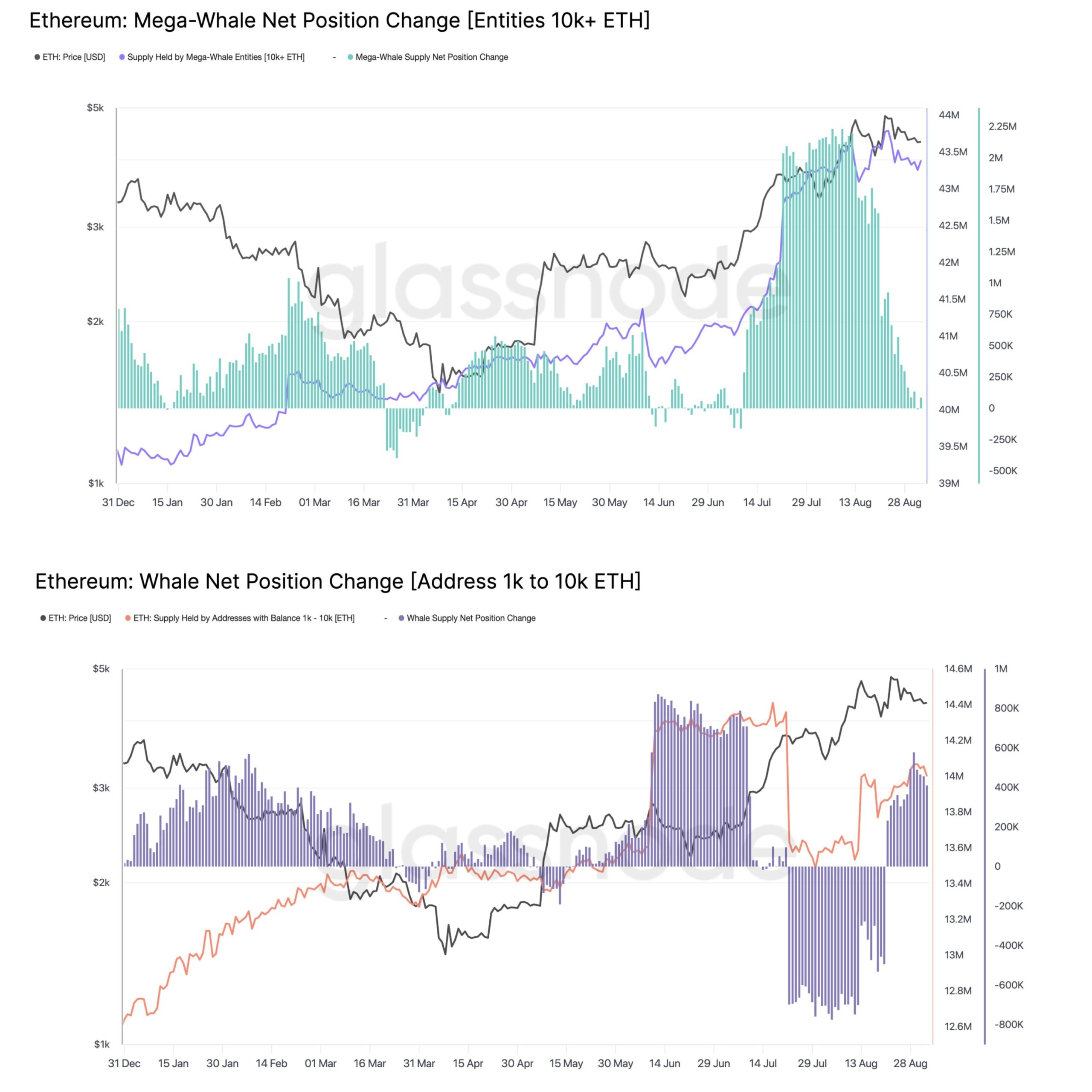

And by “swimming,” I mean one group is hoarding ETH like it’s toilet paper during an apocalypse, while another group seems to have misplaced their shopping list. This delightful chaos has left everyone scratching their heads and wondering if Ethereum is about to moon, sink, or just… float awkwardly like a rubber duck in a bathtub. 🛁