Legendary XRP Whales Play Hide and Seek: Filing Bags or Fooling the Market? 🐋💼

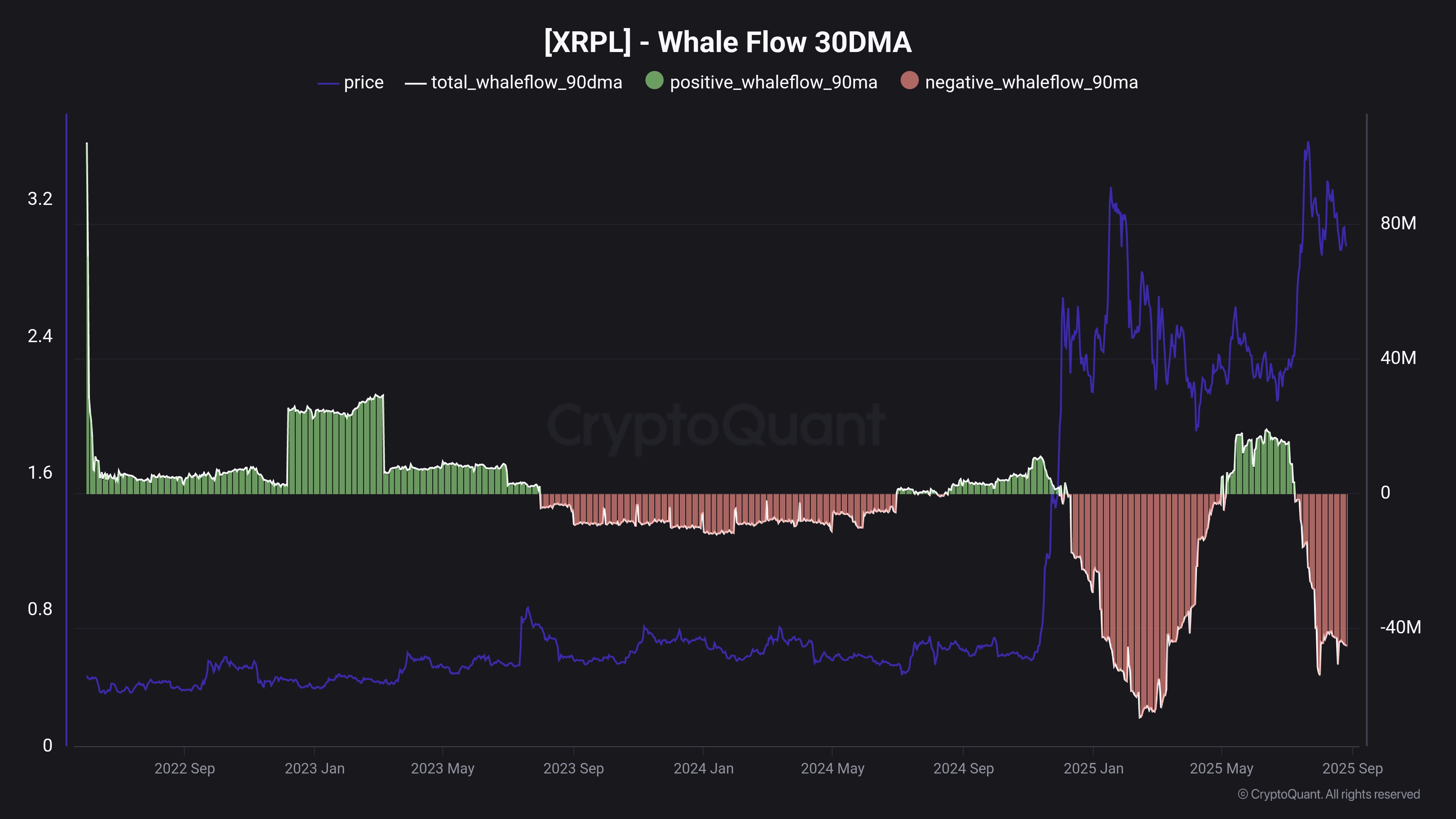

Le dernier rapport de la fine observatrice CryptoQuant, qui consiste à compter et recomposer le flux de ces grands investisseurs lors d’un mois en or, montre que nos géants de l’eau salée distribuent leur fortune, à l’aide de graphiques qui ressemblent à la mauvaise humeur d’un marabout en pleine lune. Louons leur défi : ils expulsent leur XRP avec la régularité d’un vieux moulin à vent, et le signal est aussi clair qu’une bouteille à la mer : « Nous vendons, mes amis, nous vidons nos cales ! »