BlackRock & XRP ETF: What’s the Hold-Up? 🕵️♂️💰

As reported by U.Today (yes, that’s a thing), Geraci’s been banging the drum for BlackRock to jump on this bandwagon, but so far, the financial titan’s sitting this dance out. 🕺💤

As reported by U.Today (yes, that’s a thing), Geraci’s been banging the drum for BlackRock to jump on this bandwagon, but so far, the financial titan’s sitting this dance out. 🕺💤

This isn’t just a “look how shiny our new tech is” stunt; it’s part of the Trump Administration’s *real* attempt to turn work from a circus of red tape into a well-oiled machine. Because what better way to boost efficiency than giving government workers a digital sidekick? 🎩✨

Hold onto your monocles, folks! Peek behind the velvet curtains of the City of London-yes, that fancy place with more history than your grandmother’s quilt. Two sly little firms are sneaking in, throwing curveballs like it’s a cricket match, and rewriting thoughts about how money *moves* – with code, not ink on parchment. Who needs laws when you’ve got blockchain, am I right? 😜

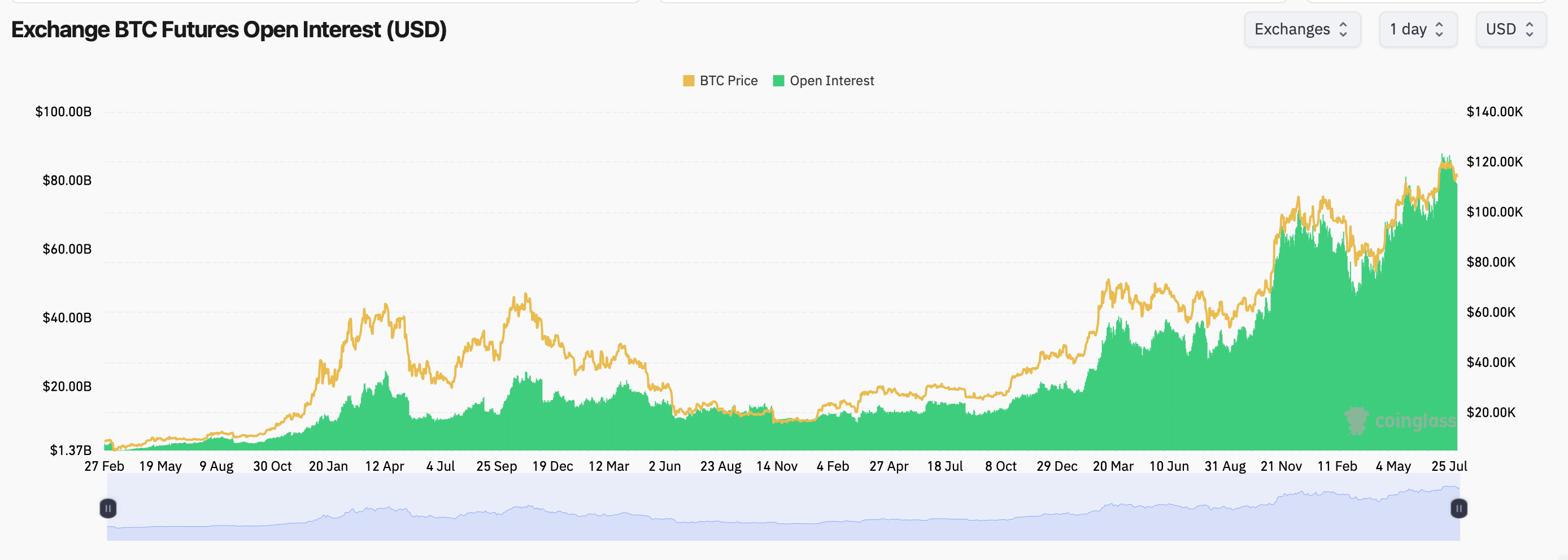

According to Coinglass data, the total BTC futures open interest (OI) is puking at 692,490 BTC, which cynical analysts translate into around $79 billion. CME, always the institution’s pet, leads with 139,350 BTC ($15.88 billion), grabbing just over a fifth of the entire market-a real showstopper! The rest are clinging on: Binance, Bybit, OKX, Gate-all playing their parts in this financial soap opera. 🎭

As it stands, a staggering 36 billion XRP tokens remain locked away in Ripple’s vault, like a treasure chest guarded by a particularly grumpy dragon. 🐉

In a dramatic reveal on August 5, 2025, OpenAI made it clear that these models are live on platforms like Hugging Face. They’re basically trying to compete with their own paid models. How rebellious! But wait, they also promise that they’ve got your back when it comes to user safety. Well, isn’t that reassuring?

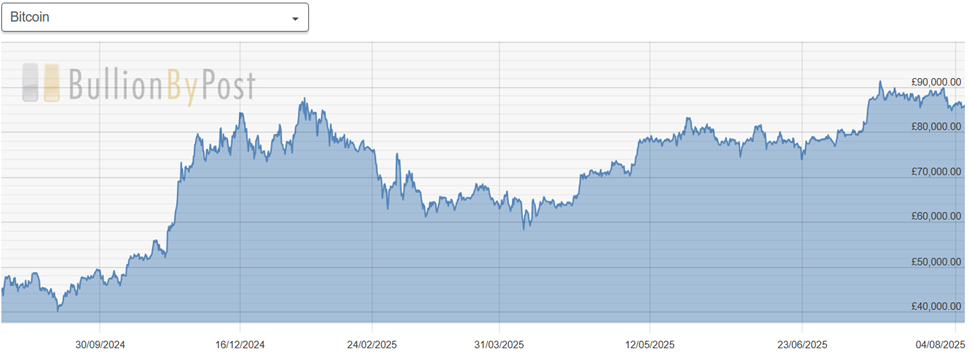

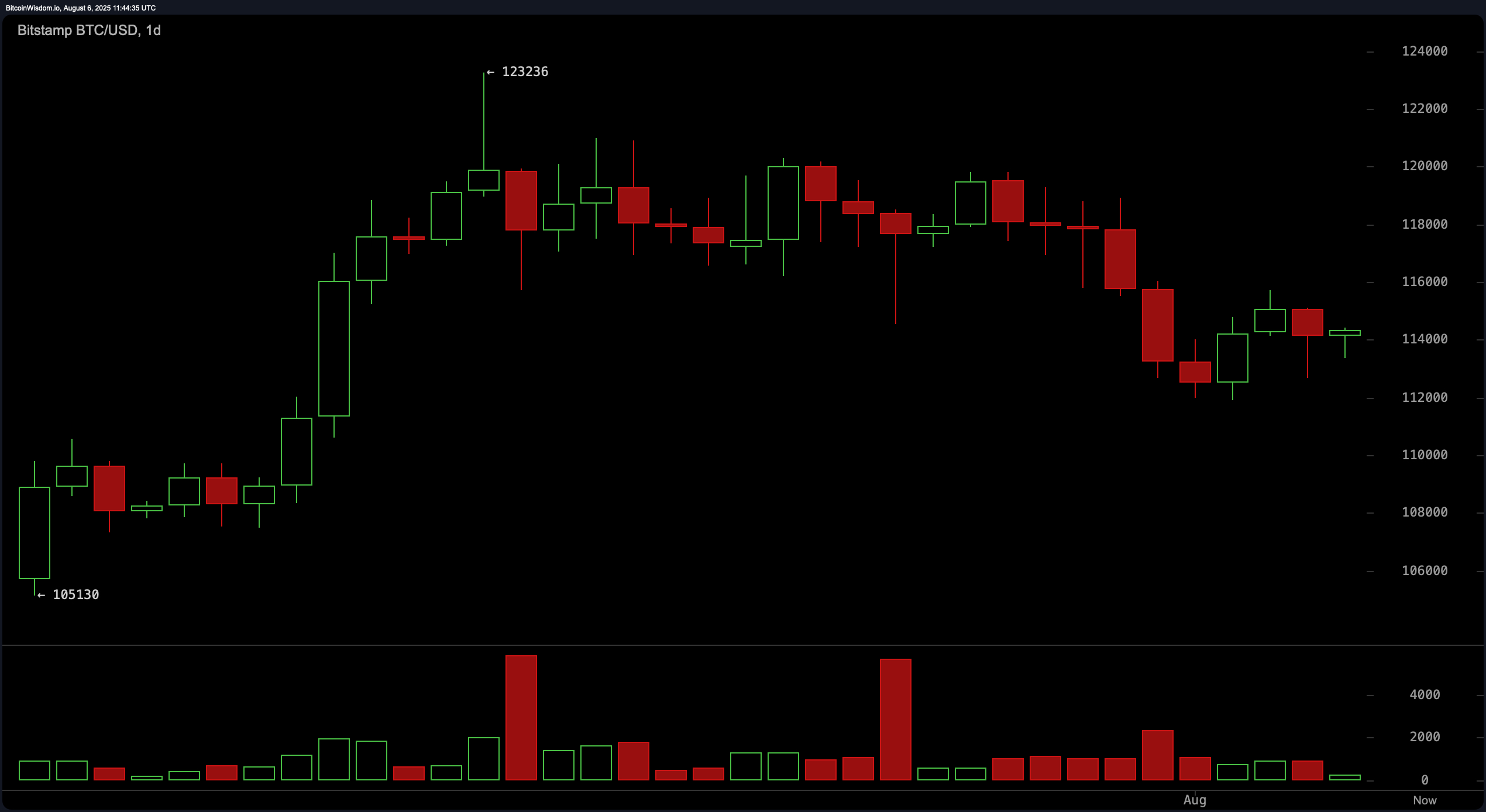

Kurnia Bijaksana, that sage of the crypto canyons, chimed in with a tale as old as time itself. Bitcoin, along with its rowdy cousins, the altcoins, took a spill last night-a sharp decline that sent traders scrambling like chickens in a thunderstorm. The culprit? A stubborn resistance zone near $115,000, as unyielding as a mule with a mind of its own. The rejection sparked a sell-off, a stampede across the crypto plains, leaving analysts to sift through the dust for clues.

The daily chart shows our elusive star rallied from a modest $105,130 to flirt near $123,236 before quietly slipping back into its corner at around $114,000. Volume surged at the high notes, hinting at a bit of a redistribution – like passing the baton at a fancy dance – and now, it’s doing its double-top impression, with lower highs that suggest it’s playing hard to get. Resistance squads are lurking at $118,000-$120,000, while the ever-important support zone is at $112,000; a decisive tumble below might just cause a quick tumble – a real panic at the crypto disco. The near-term looks bearish, but unless the buyers step up and reclaim $118,000, it’s a game of wait and see. 🍸

Comrade SOL dreams of the Siberian sky of $350 while its own shadow barely stops trembling at $164.4. Another two-percent frostbite overnight; revolutionary cap now officially “hovering,” that favorite verb the Ministry of Euphemisms uses while interrogators pace outside with rulers.

538 . 53 million tokens circulate-each one a restless prisoner, eyeing the gates of the $200-billion camp, presently guarded by market bears with frozen cigars.