Bitcoin’s Glorious Peak? Experts Humbly Suggest September’s the Time to Watch

So, what does this new M2 signal portend? Let’s indulge in some expert musings, shall we?

So, what does this new M2 signal portend? Let’s indulge in some expert musings, shall we?

In an interview with ConsenSys Founder Joseph Lubin (you know, just a casual chat between two blockchain bigwigs), Vitalik didn’t just talk about Ethereum’s whitepaper dreams, he casually dropped the fact that this blockchain has brought us surprises like NFTs. *Surprise!* The blockchain also gave us endless pictures of bored apes that cost millions—ah, the joys of the modern internet.

I’ll produce final answer accordingly.

It’s a fact, folks. The crypto treasury saga has been the Oprah of investment stories this year—“You get crypto! And you get crypto! Everybody gets crypto!” The market cap doubled in less than three months, because apparently, everyone loves a good gamble. Who started this madness? Oh, Michael Saylor and his MicroStrategy crew, of course. Now, everyone wants to be the next Saylor, digging for gold in the blockchain mountains like digital prospectors. Meanwhile, Saylor’s virtual vault shows a $28 billion paper profit—so much cash that even the Monopoly man blushed. 🤑

Now, this fund is just passively lounging around holding SOL, keeping an eye on the CoinDesk SLX Index. Future plans? Possibly staking, if the regulators ever get their act together—and no derivatives or leverage to spoil the party, naturally. Because who needs excitement when you can have boring stability, right?

On a most unremarkable Thursday, the air of Bengaluru was abuzz with whispers of a scandal. Reports emerged that the esteemed Bengaluru City police had taken into custody one Mr. Rahul Agarwal, a software engineer of considerable talent and a member of the CoinDCX household, for his alleged participation in a nefarious act involving the theft of a sum so vast, it would make even the most generous dowry pale in comparison—$44 million in USDT, to be precise.

On August 1st, Hong Kong unleashed the “Stablecoin Ordinance” – the region’s FIRST ever stablecoin bill. Apparently, they needed a rulebook for this. Who knew? It’s basically a permission slip for companies wanting to issue those digital dollar things. It’s a formalized framework, which is basically government-speak for “we’re finally paying attention.”

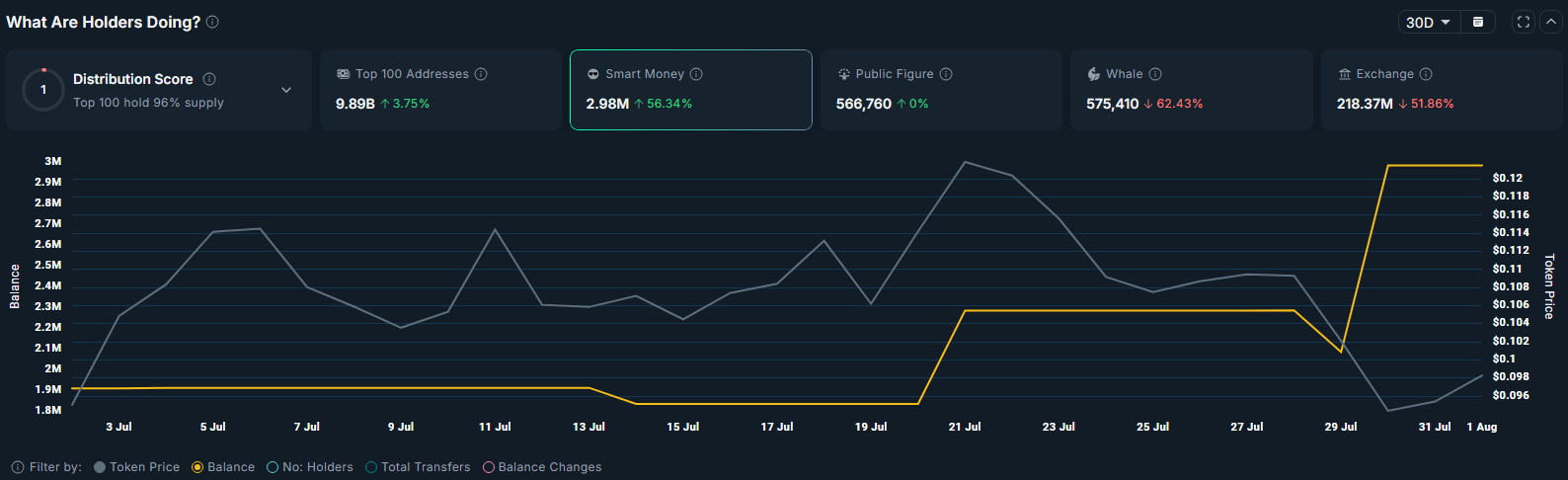

According to Nansen’s cryptic scrolls of on-chain data, these “smart money” entities — hedge funds, early adopters, and blockchain busybodies — have been piling into PLUME like it’s the last lifeboat on the Titanic. Their collective stash now stands at 2.8 million tokens, a 56% surge over the past month. Are they geniuses or gamblers? Only time will tell.

In the annals of its storied ledger, for the period culminating on the 30th of June, Coinbase proclaimed a net income of $1.43 billion—or $5.14 per share—a sum that loomed as grand as the Russian steppes compared to the meager $36.13 million (or merely 14 cents per share) of the preceding year. This remarkable ascent, however, owed much to a serendipitous windfall: a $1.5 billion gain from its investment in Circle (CRCL) and an additional $362 million from its crypto investment portfolio. On an adjusted basis, the company’s earnings per share reached $1.96, surpassing the modest forecast of $1.26 posited by LSEG.

Ah, dear audience, let us recount the tale of PENGU, trading near $0.034 after losing 12% in a day and 9% in a week. With trading volume at $1.13 billion, our hero has formed a bullish pennant—a flagpole followed by consolidation, much like a nobleman pausing to adjust his wig. Analyst Ali Martinez declares it “textbook,” as though PENGU were studying for an exam on market behavior.