Unbelievable! CEA Industries Takes on BNB with a $500 Million Power Play! 💰🚀

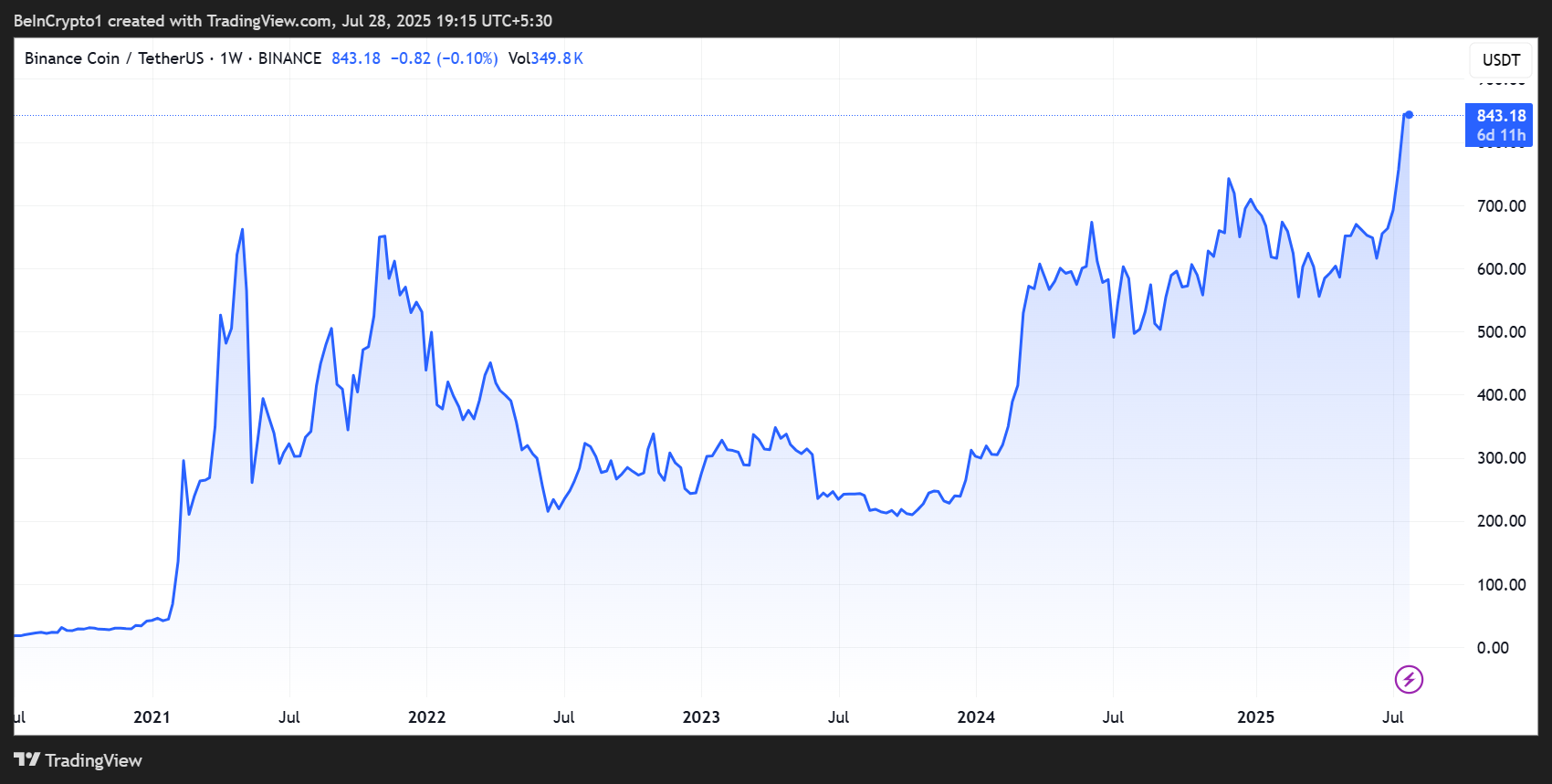

In a press release dated July 28, CEA Industries Inc. (Nasdaq: VAPE, yes, we’re serious!) announced this thrill-a-minute $500 million private placement—because why not? It was upsized due to heavy demand; apparently, everyone wants a piece of the Binance pie! 🍰 According to crypto.news data, they’re going for a Nasdaq-listed treasury vehicle exclusively for—wait for it—Binance Coin (BNB), the fourth-largest cryptocurrency. Talk about a plot twist!