A Dostoevskian Reflection on the Cosmic Dream of Bitcoin’s Future

“Where, in the bleak eternity of twenty-one years, might this strange, metallic creature called Bitcoin find itself?”

“Where, in the bleak eternity of twenty-one years, might this strange, metallic creature called Bitcoin find itself?”

Behold the chart, which reveals a pattern of rapid ascent immediately followed by a sharp, multi-day correction. Yet, despite this retreat, a glimmer of hope persists; for the recent recovery from around $3.10 indicates that the bullish structure, though less vigorous, still lingers. The market’s Relative Strength Index (RSI), now hovering around 62, serves as a gentle reminder that the fervor of yesteryear has abated, while the 200-day EMA—lying humbly beneath the present price—and the short-term EMAs, particularly the 21-day, continue to lend their support. Thus, an intact macro uptrend is confirmed, much to the chagrin of those who would sooner witness a reversal. (One might remark, with a twinge of sarcasm, that if the markets were as constant as our affections, such fluctuations would never give us pause!)

Just a week after raising a mere pittance of $60 million, which is to say, a sum that could barely buy a decent chateau in the south of France, Windtree announced a partnership with the ever-so-mysteriously named Build and Build Corporation. This partnership, as grand as a czar’s decree, unveiled a $200 million securities purchase agreement, all to establish a BNB treasury. Can you imagine? A treasury full of digital tokens, guarded not by knights in shining armor but by algorithms and firewalls!

In a delightfully panicked post on the social media platform X (because Twitter was just too stable), Kiyosaki let loose with some hot takes about Bitcoin ETF shares. He compared them to “paper,” as if we’re on an episode of “Are You Smarter Than a 5th Grader?” and the answer is still a resounding “NO!”

Market analyst CasiTrades recently posted about a “potentially explosive setup” forming as XRP tests the $3.00 support zone. Translation: fingers crossed, folks. Unfortunately, XRP couldn’t hack it at $3.21—classic case of “almost, but not quite” syndrome. Back to the drawing board at $3.00, which has historically been XRP’s emotional support dog, refusing to let the price spiral into chaos.

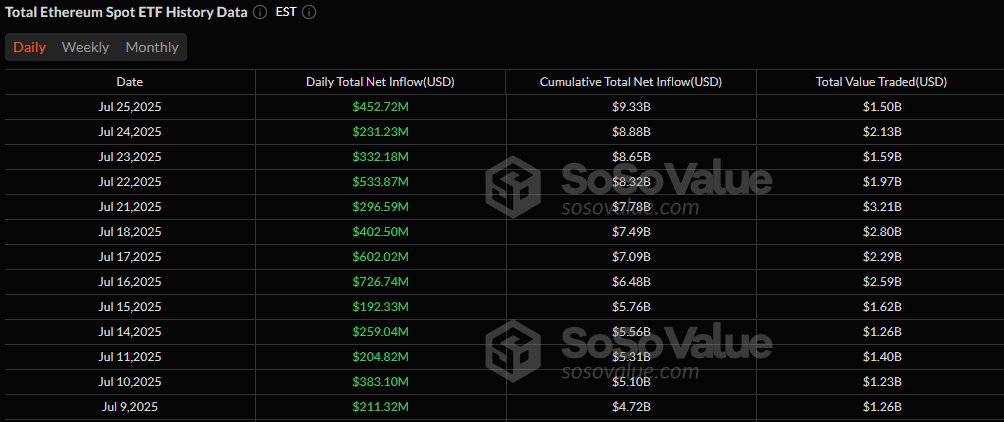

The week concluded with a most resplendent performance for ether exchange-traded funds (ETFs), while bitcoin ETFs maintained their composure. Ether ETFs extended their commendable green streak to 16 consecutive sessions, pulling in $452.72 million on Friday, while bitcoin ETFs added $130.69 million despite a hefty outflow from Grayscale’s GBTC. 📈

In an X post on July 19, Tyler Winklevoss unleashed a tirade against JPMorgan and its CEO, James Dimon, after Bloomberg reported the bank’s plan to charge companies for access to customer data. The Gemini boss claimed these fees would bankrupt fintechs, which are basically the crypto world’s version of a magical portal to your bank account. 🧙♂️💸

Ethereum, our ostensibly resplendent hero, finds itself mired in a rather sluggish performance—its boisterous 52% surge over the past month, an enigma wrapped in a riddle. What does it mean to gallop effortlessly whilst strapped to the weight of stagnation? 🤔

Could $132K Be Our Distant Star? Methinks It Needs Proof!

Enter Nayib B., the grand maestro conducting El Salvador’s breathtaking Bitcoin symphony, with its legal tender debut. “Fear not,” they sing, “for our 760 million reserve shall weave magic into health, education, and infrastructure!” But beneath this jubilation, marketers serenade us with tales of cryptocurrency shields against financial storms. Yet, as the curtain rises, the great reveal is far from the fairy tale imagined: rising costs, urgent pleas for Wi-Fi, and stagnant salaries drown the average citizen’s song of hope.