Arthur Hayes’ ENA Gambit: 42% Surge or Just a Crypto Circus? 🎪

JUST IN: ARTHUR HAYES ADDS 2.16M $ENA TO WALLET, NOW HOLDS $3.73M IN TOKENS

JUST IN: ARTHUR HAYES ADDS 2.16M $ENA TO WALLET, NOW HOLDS $3.73M IN TOKENS

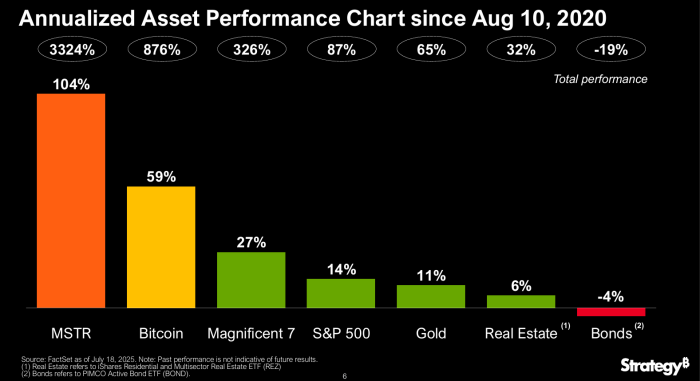

Microstrategy, that once humble software intelligence firm, now rebranded as the mighty Strategy, embarks upon yet another enormous bitcoin acquisition. Aided by the funding from its recent stock offering—oh, just a cool $2.47 billion—Strategy is preparing for its next big move in the cryptocurrency game. You see, this latest endeavor was announced with fanfare on July 25, as the company priced its grand new venture: a mind-boggling 28,011,111 shares of Variable Rate Series A Perpetual Stretch Preferred Stock (yes, that’s a mouthful, and no, it’s not a misprint), set at $90 per share. The public offering, completed on July 24, is expected to close by July 29, assuming nothing goes terribly wrong. But who would dare bet against them? 🤷♂️

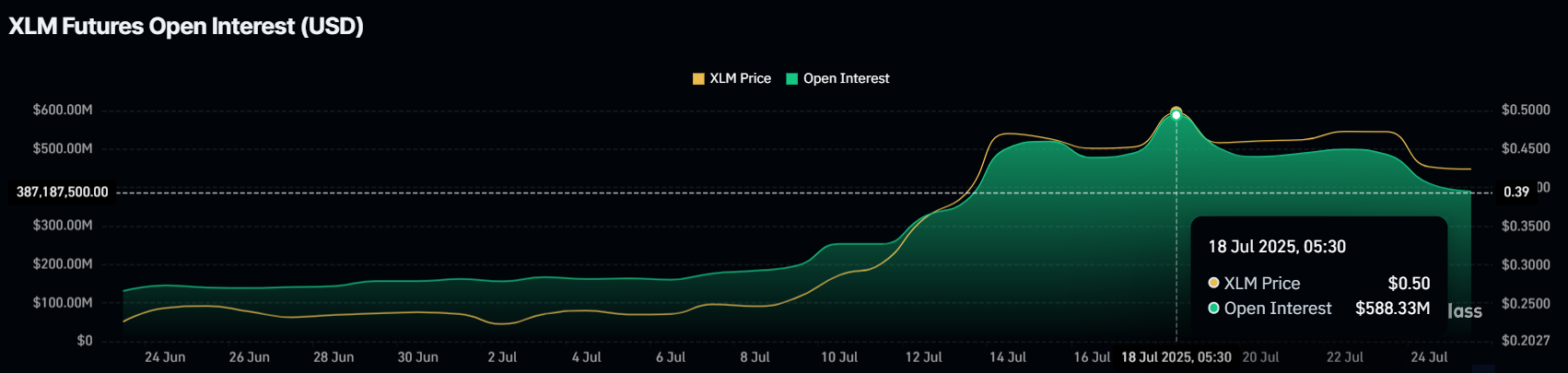

As Bitcoin’s price retreats, traders, those modern-day gamblers, open new positions with the fervor of a religious zealot. According to CryptoQuant’s Arab Chain, the sharp rise in open interest alongside a falling price is a dance of speculators, many wielding leverage like a sword. This dynamic makes Bitcoin more volatile than a drunk sailor on a shipwreck. 🚢💥

According to some very intelligent folks at GemXBT (who clearly know what they’re talking about), Solana (SOL, or as I like to call it, the rollercoaster with no brakes) is making a beeline downward. It’s slipping below its short-term friends—the 20 MA, 10 MA, and 5 MA—and looking more like a deflating balloon than a thriving blockchain. When the technicals betray you this way, it’s usually a sign that the market’s mood has turned gloomier than a Monday morning. And that’s before mentioning the MACD, which is still sulking below its line, like a sulky teenager refusing to speak.

In case you’re wondering, Ethena (ENA) has surged by a whopping 22% in the last 24 hours, pushing the token to around $0.5847. If this was a stock, we’d call it an overachiever, but since it’s crypto, we’ll just call it “ethereal.” 🚀

Chalom, who will now be joined at the helm by none other than co-founder and co-CEO Rob Phythian, is already declaring that Ethereum (ETH) is set to become the “foundation” of global finance. Let’s all pretend we didn’t see that one coming, shall we? 🙄

So, someone decided to capitalize on the passing of two icons, Ozzy Osbourne and Hulk Hogan, by launching meme coins. Spoiler: it didn’t end well. 🚀📉

The latest installment comes courtesy of the ever-reliable, occasionally scandalized Nile-side tabloid known as The Cable, which conveyed Agama’s words—“Nigeria is open for stablecoin business, but on terms that protect our markets and empower Nigerians.” Translation: “Come on in, but don’t get too clever, or we’ll send the regulatory coppers after you.”

Indeed, the altcoin, that fickle mistress, has suffered a grievous decline, with traders dramatically withdrawing a staggering $196 million from the eccentric embrace of the market. One cannot help but wonder: are these traders fleeing the sinking ship, or simply taking a leisurely stroll while the world crumbles? 🤷♂️

Now, hold onto your hats, because this ain’t your grandma’s investment strategy. Saylor’s cooked up a scheme called Series A Perpetual Stretch (STRC), or ‘Stretch’ for short—because why not add a little yoga to finance? 🧘♂️ It’s 5M shares at $90 a pop, with a dividend yield that’ll make your eyes water: 9% initial, stretching to 9.5–10% if you squint just right. And get this—the dividend’s tied to SOFR, so it’s as stable as a three-legged stool on a rocky boat. 🚀