Bitcoin’s Secret Society: Traders, Cruisers, and Hodlers in a World of Greed 🤑

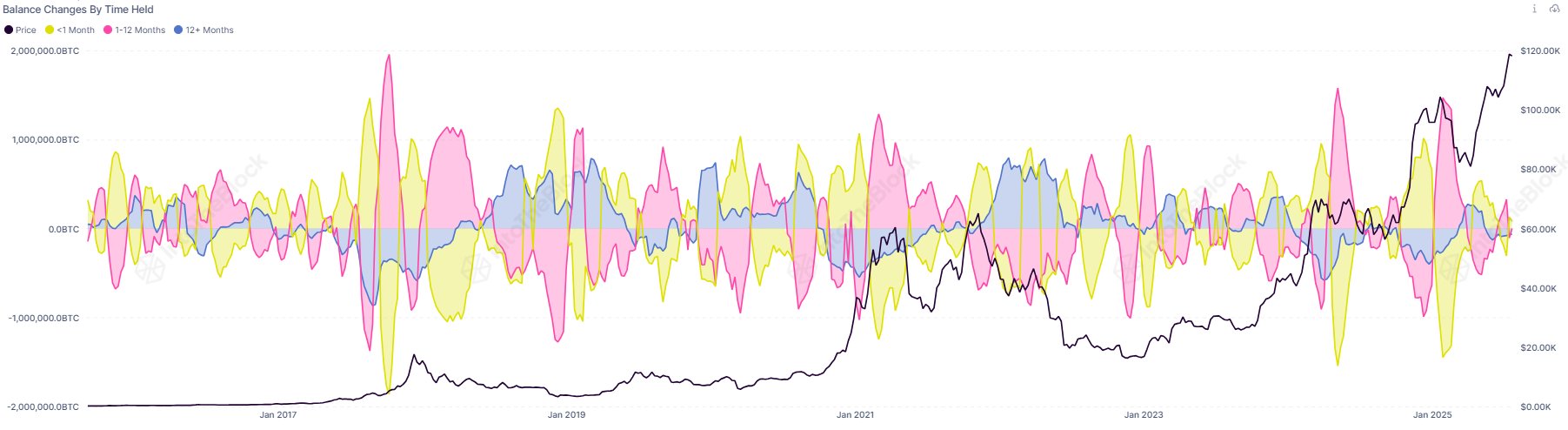

In a recent missive on X, Sentora (formerly IntoTheBlock) has graced us with a chart that divides Bitcoin’s adherents into three distinct classes: traders, cruisers, and hodlers. A most scientific endeavor, one might say, though it’s hard to imagine these categories surviving a Wildean satire. Traders, those ephemeral beings who hold their coins with the same permanence as a summer romance, are the first to dance to the tune of market whims.