🐕 SHIB’s Bizarre Plunge: Shorts Vanish, Longs Weep! 😂

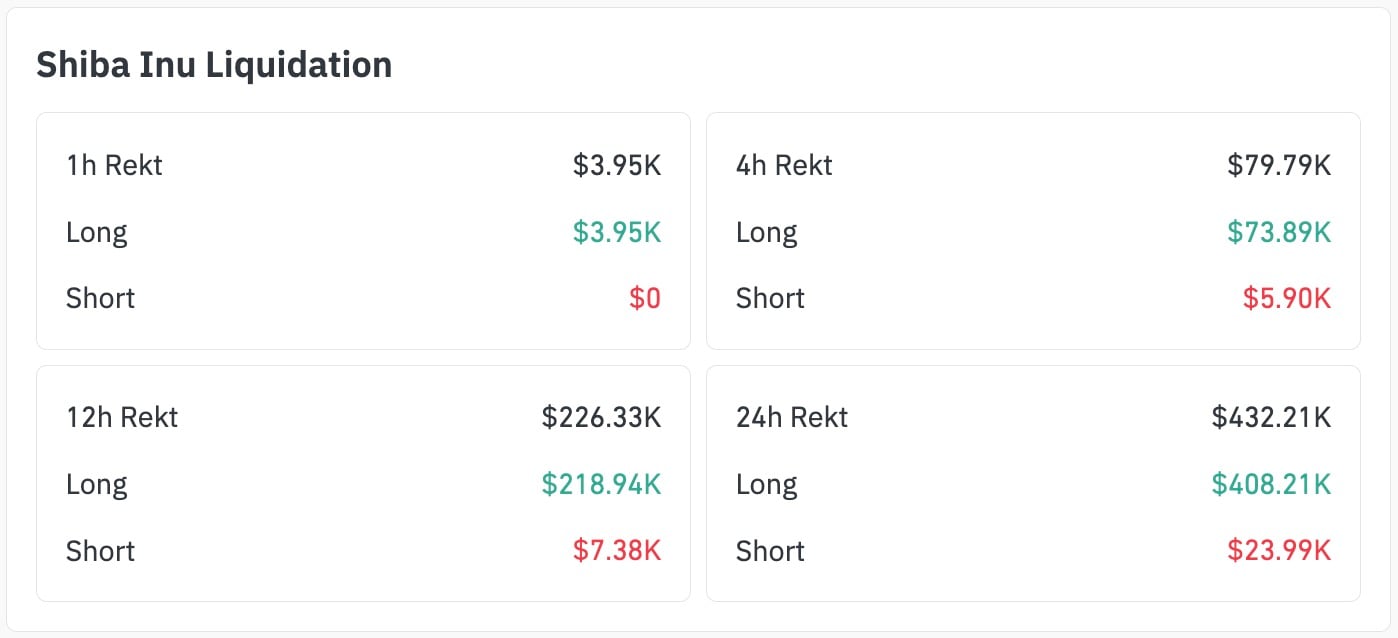

This comedy of errors continued throughout the session, for on the final day, SHIB’s long positions were fleeced to the tune of $408,210, while shorts merely shrugged off a trifling $23,990. And in the 12-hour window, the imbalance grew more grotesque: $218,940 from the longs, and a mere $7,380 from the shorts! 😱