TRON [TRX] Price Surge: Is a Rally on the Horizon?

Whale accumulation and social media engagement also contributed to the bullishness behind the token.

Whale accumulation and social media engagement also contributed to the bullishness behind the token.

Enter Raelene Vandenbosch, an unsuspecting citizen who suddenly found herself in a real-life episode of CSI: Mobile Kiosk Edition. Raelene claims (with paperwork to prove it) that an employee at her local mobile store gave her private info to someone as trustworthy as a raccoon at a campsite. The scammer promptly took over her phone number in what experts technically call “Good Old-Fashioned Nefarious Shenanigans.” Using Raelene’s phone like an express lane to crypto millions, the attacker transferred her SIM details and emptied her digital wallets faster than you can say, “Wait, what’s my password again?”

Tokenizing reality — yes, darling, those dull things like bonds and equities — is being hailed as the next trillion-dollar soirée. Of course, Ethereum still lords over this ballroom, clutching its fan and muttering about “legacy.” Yet Solana, fresh-faced and scandalously fast, sashays across the floor with block times so short one barely has the time to sigh, and fees so low the word “gas” might as well be reduced to a footnote or a slightly embarrassing bodily function. Ethereum, meanwhile, continues to drop coins everywhere like a careless Victorian with holes in her purse, despite the tailor’s many attempts at upgrades.

The speaker of the New York City Council, Adrienne Adams, has announced that the most populous US city is allocating $3 million to a guaranteed income program. 💸

According to Ripple Pundit, the XRP price will skyrocket the moment Ripple makes their banking license public. And, as if that weren’t enough, the SEC’s announcement of droppin’ its appeal will be the icing on the cake. Now, I ain’t no expert, but it seems to me that gettin’ a banking license is a mighty fine way to expand one’s services. And, with XRP bein’ the altcoin of choice for Ripple’s payment solutions, it’s likely to see a whole lot more adoption, especially from them institutional investors.

Our dear Bitcoin (BTC) was trading at a modest $108,000, a slight dip from this week’s high of $110,000, but still a respectable 10% above the lowest point this month. One mustn’t forget, after all, that even the most glamorous of assets need a moment to catch their breath.

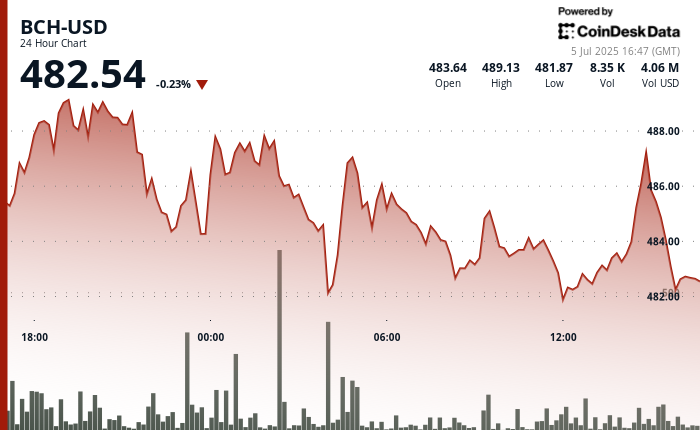

On July 1, BCH reached $526.5 — its highest price in eight months — as market enthusiasm, whale accumulation, and speculative inflows helped propel the token more than 75% higher over the past three months.

In some gloomy note to their fixed income squad (honestly, who names these departments?) BlackRock’s analysts basically said the world is getting a bit suss about holding dollars and long-dated Treasuries. Apparently, if you borrow epic amounts of money, even your besties start to look at you like, “Are you going to pay me back or just ‘forget’ again?”

While frightened masses cling to headlines as to a lifeboat—“Bitcoin Will Crash!”—Kiyosaki calls it farce, a bad circus. On the public square of X (where men, bots, and philosophers do battle for clicks), he announces:

CLICK BAIT Losers keeps warning of a Bitcoin crash. They want to frighten off the speculators. I hope Bitcoin crashes. I will only buy more.

Take care.

— Robert Kiyosaki (@theRealKiyosaki) July 5, 2025