Japan & Crypto: It’s Complicated (Probably)

Basically:

Basically:

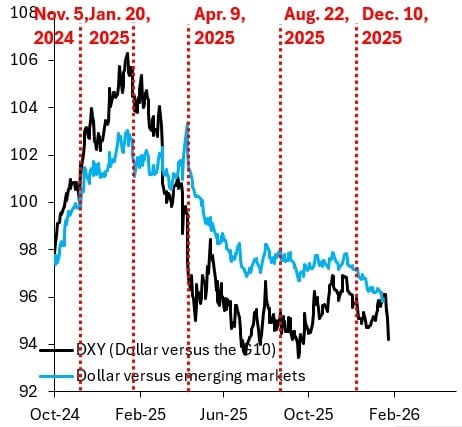

Whispers of possible intervention are in the air, because apparently, stabilizing currencies is the new black. Yes, Japan might be calling in some US backup to restore order in yen-land-fingers crossed!

Ah, the financial markets-a place where numbers dance, wallets weep, and digital asset traders sit on the edge of their seats, clutching their Bitcoins like a dragon hoarding gold. Next week promises a schedule so dense, it makes a Discworld librarian look disorganized.

Ethereum has entered a period of low volatility and reduced liquidity, which is just a fancy way of saying the market is as exciting as a spreadsheet.

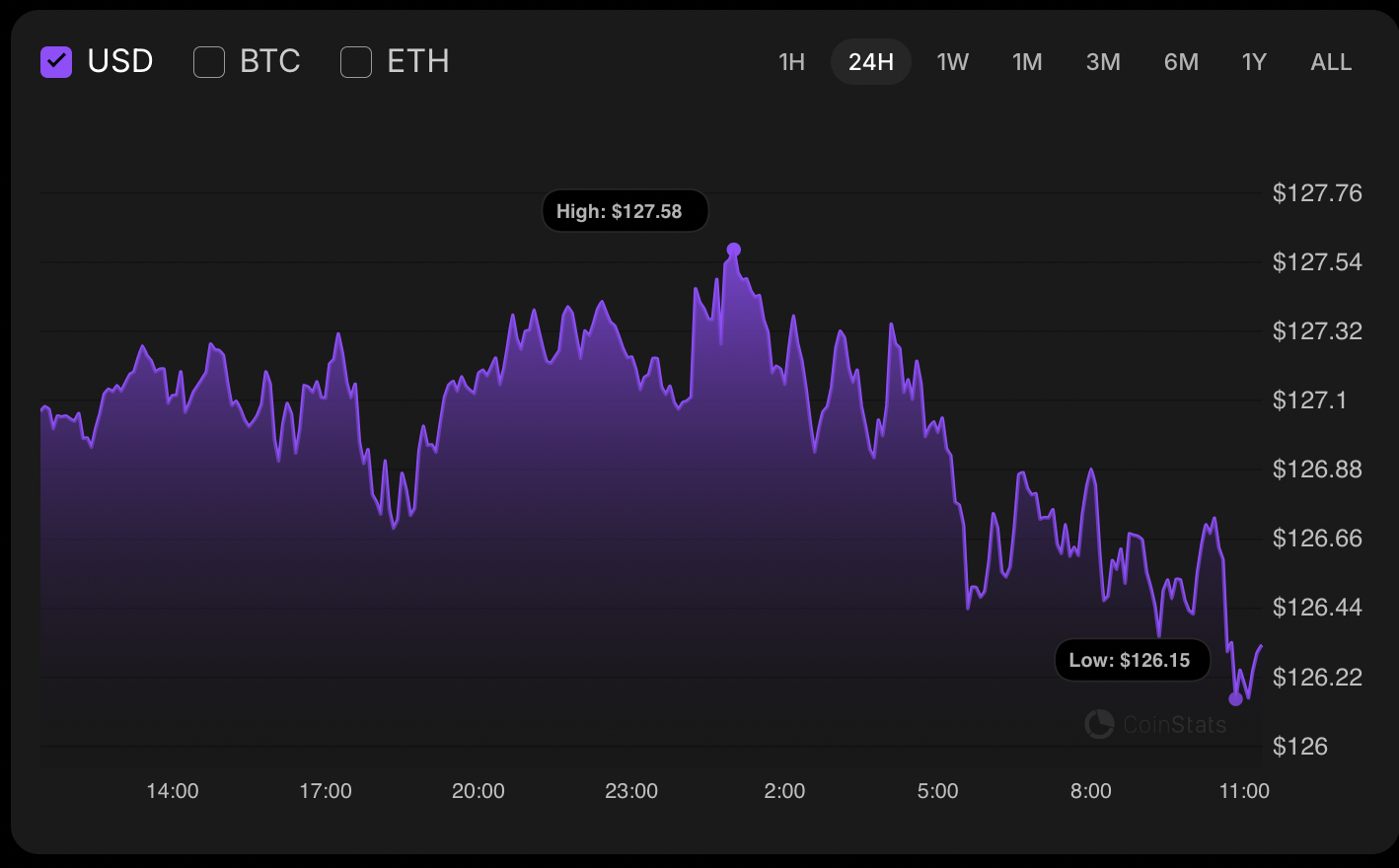

The price of Solana, that elusive specter, has waned by 0.54% since the last breath of yesterday, a quiet sigh in the market’s vast expanse, as if the gods themselves have grown weary of its antics.

The proposed ETF, seeking refuge on the New York Stock Exchange like a weary traveler stumbling into a roadside inn, promised to track the CoinDesk 20 Index. The Litecoin Foundation, in a moment of rare self-awareness, confirmed LTC would be included, as if anyone had asked.

After a hale-and-hearty period of accumulation during the illustrious Q4 2025, MYX Finance sauntered into 2026 with the confidence of a dragon smelling a nearby village. The latest push was so cheeky, candles held above the reclaimed area like vultures circling a feasting field, testing upper resistance like a mouse testing a mousetrap before optimistically nibbling at the trigger spring.

In the latest chapter of this financial fiasco, it seems that global currency markets are advancing towards a destabilizing phase, as confidence wanes and traditional defenses crumble. On the 24th of January in the year 2026, Mr. Brooks graciously shared with the public his stark analysis of the current market condition, encompassing accelerating bond turmoil and a rather alarmed capital flight.

Ah, but let us not forget the curious nature of the market, where the glimmer of speculation sparkles like a flashy bauble in a dusty old shop. Participation from those with a real stake remains as scarce as hen’s teeth, with only about 6,710 token holders standing around, seemingly waiting for a bus that may never arrive. This lack of genuine demand makes one wonder if this rally is akin to a mirage-bewildering and alluring, yet ultimately ephemeral.

In a recent chat on the When Shift Happens podcast, Chalkias pointed to Satoshi Nakamoto’s addresses, those public keys lounging in the sun and making for easy targets, if one squints at the right angle.