Doge’s Existential Market Struggle 🐕📉

Behold, the Doge, that most whimsical of beasts, has risen by 2.79% in the past 24 hours-a fleeting triumph over despair! 🐕📈

Behold, the Doge, that most whimsical of beasts, has risen by 2.79% in the past 24 hours-a fleeting triumph over despair! 🐕📈

Meanwhile, XRP’s breakout dreams have collided with a historic Bitcoin cross, Vitalik Buterin is rotating six low-cap bags into Ethereum like it’s 2020 again, and the SEC finally speaks about the mysterious $60 billion Venezuela Bitcoin stash. A tale of two coins and a very confused SEC. 🤯

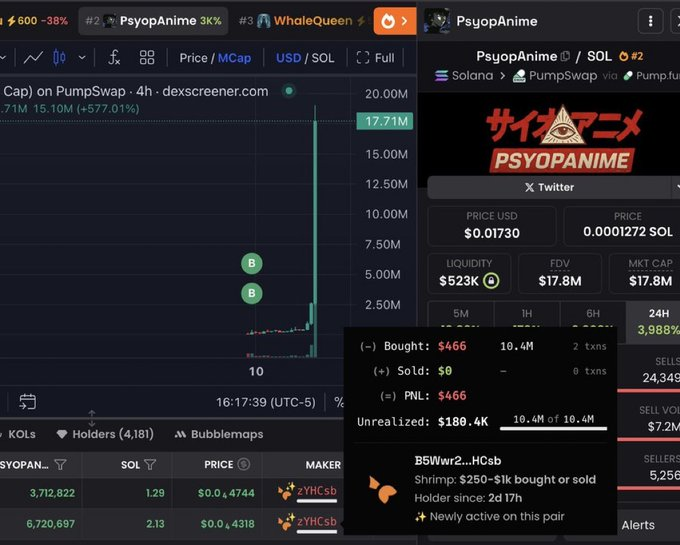

On-chain data reveals the usual suspects: one trader dropped $1,653.44 three days ago and now clutches $220k worth of tokens. A 130x return! Another genius bet $466 and now stares at $180k in gains like it’s a participation trophy. 🎉 Probably sipping champagne while the rest of us are still trying to afford champagne.

Amidst the cacophony of DeFi oversight and token classification, Columbia Business School’s Omid Malekan emerges, a voice crying in the wilderness, to declare: “Washington, thou art mired in myths!” For indeed, the debate is not of evidence, but of phantoms and shadows cast by the flickering candle of fear. 🕯️

Per the sagacious data of crypto.news, Ethereum’s price has stumbled 2.5% in seven days, a meek 5% from its January high of $3,292. At $3,115, it lingers like a ghost of its former self, a mere shadow of its August zenith-37% in the grave. One might ponder: is this the price of ambition, or merely the cost of hubris? 💸

The cryptosphere, ever the bastion of melodrama, is abuzz with whispers of treachery. Yet, the team, with a flourish of their quill, assures us it’s all part of the grand design. How delightfully enigmatic! 🎭

The price, like a factory worker under the boot of the bourgeoisie, has flushed out excess leverage and trudged through a declining channel. It now stabilizes near zones that history deems “reactive.” Resets, they say, are crucial-a moment to compress the overheated, to tame volatility, and to restore demand. Early signs of this process are visible, like a revolutionary whisper in the wind. Momentum indicators, those harbingers of hope, show RSI maintaining neutral-to-bullish levels, suggesting buyers are acting with restraint rather than speculative frenzy. How disciplined! 🤔

how to regulate stablecoin rewards (apparently, earning 5% interest on your digital pesos counts as a national crisis), who gets to boss around decentralized finance (the SEC or CFTC, neither of whom understand it), and whether elected officials should be allowed to crypto-trade while legislating crypto-shockingly, some members find this

That is why the “WW3 trade” is not a single bet. It is a sequence. In the first hours, Bitcoin often behaves like a high-beta risk asset. In the following weeks, it can start behaving like a portable, censorship-resistant asset, depending on what governments do next. 🚀

This clever jump shifted everyone’s focus from the usual frantic gambling to something quite useful-like actually settling transactions in the real world! Who knew? It’s almost as if this tech stuff might have some future-who would have guessed! 🤔