🤑 From $321 to $2.18M in 11 Days: The Madcap Memecoin Miracle! 🚀

Well, I say, old bean, a crypto trader has gone and done the unthinkable, transforming a paltry $321 into a cool $2.18 million in a mere 11 days. Blimey! 😲

Well, I say, old bean, a crypto trader has gone and done the unthinkable, transforming a paltry $321 into a cool $2.18 million in a mere 11 days. Blimey! 😲

So, XRP’s market cap just did a Usain Bolt and sprinted to $142 billion. 🏃♂️💨 Trading volume hit $6.74 billion, which means this isn’t just a fling-it’s a full-on relationship with liquidity. No thin order books here, just thick, juicy demand. Someone pass the popcorn, because this is better than a Netflix binge. 🍿

As the optimism builds, market watchers are closely watching for the asset’s next moves. While experts remain cautious, others believe the asset has the potential for strong upside.

While major altcoins are wrestling with fading conviction (and probably a few identity crises), privacy assets like ZEC are facing headwinds stronger than a Yiddish grandmother’s guilt trip. Oy vey! ZEC’s positioning? It’s clearer than a shtick at a comedy club.

As proclaimed in a press release, BitMine now boasts an impressive 4.143 million ETH on its balance sheet-a sum that could make even the most seasoned investor do a double take. This represents approximately 3.43% of the circulating supply, a hefty stake for a publicly traded miner, akin to a glutton at a buffet.

It appears our dear Michael Saylor, a man who clearly has more money than sense (though I daresay he’d protest), has decided that 1,287 more Bitcoins are precisely what the world needs. A trifling sum of $116.3 million, naturally. Paid for, of course, by selling bits of the company – a rather roundabout way of funding a hobby, wouldn’t you say? They did dabble a bit, buying just 3 then 1,283… one wonders if they were deciding if the price would drop further! The grand total now stands at 673,783 tokens. Positively extravagant.

Aster, the on-chain trading platform that’s basically the Darcy of DeFi, has announced that over 200,000 people now hold its native ASTER token. This milestone came hot on the heels of the December 2025 launch of Shield Mode, which is like the secret diary of trading-private, protected, and perfect for avoiding those pesky front-runners. 📈✨

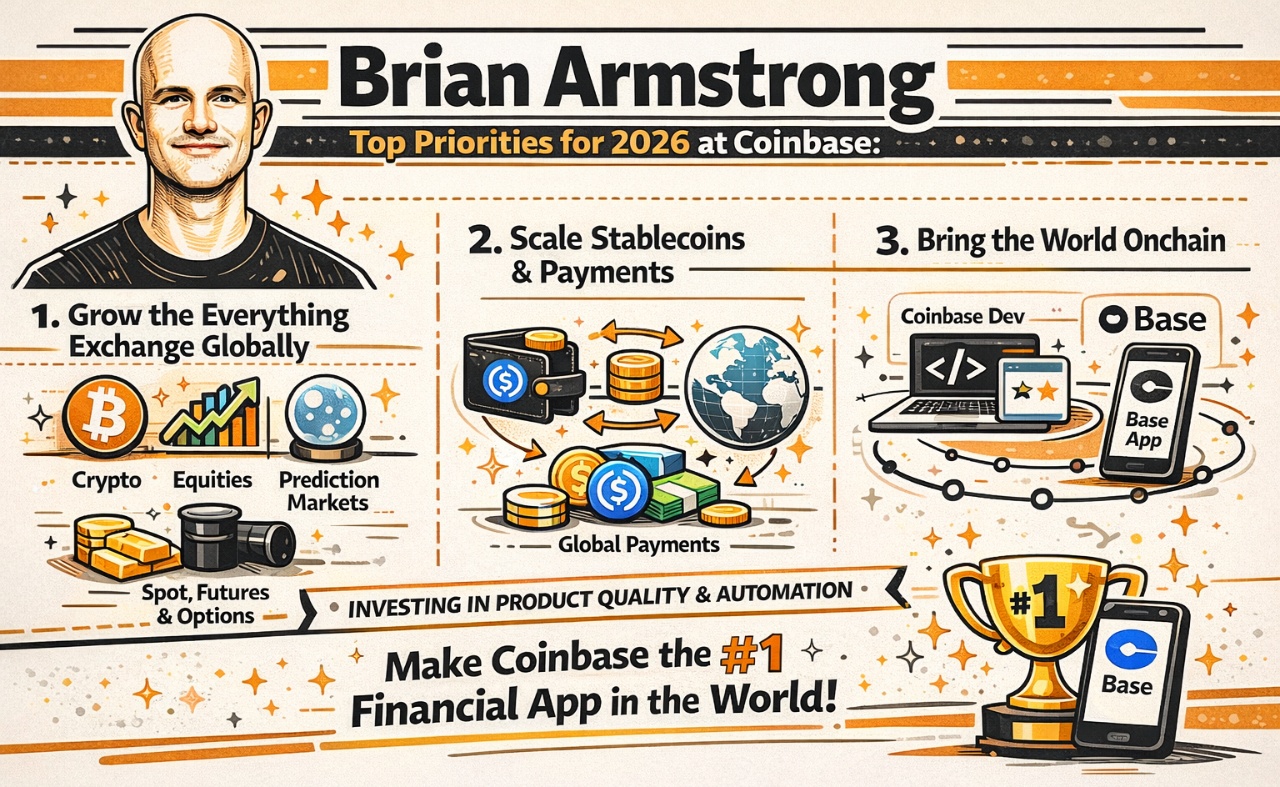

Coinbase (Nasdaq: COIN) is, it seems, experiencing a touch of grandiosity. One detects a distinct desire for broader financial dominance in 2026, signaling a rather decisive evolution. It wishes to be more than just a purveyor of digital tokens, you see. Oh, the drama! 🙄

Trading volumes, you ask? A staggering $260.42 million in a single day, up 29.5% from yesterday’s slumber. Yet, the all-time high remains a distant mirage, shimmering like a desert oasis. Rank? A mere 96th on CoinGecko’s grand stage. But fear not, for the Render Network, that decentralized GPU sorcerer, connects creators to idle computing power worldwide, turning silicon into gold. 🧙♂️✨

//media.crypto.news/2026/01/chart244.webp”/>