When Gold Becomes Silver’s Sassy Cousin: A Crypto Comedy Show

But wait! Perera’s got his magnifying glass out and he’s shouting from the rooftops:

But wait! Perera’s got his magnifying glass out and he’s shouting from the rooftops:

Nick Shirley’s Minnesota daycare fraud probe (a tale of Somali-owned daycare centers where the only thing more chaotic than the children was the ensuing market frenzy), Strategy’s fresh Bitcoin buy (a testament to the alchemy of stock-funded purchases), gold-silver volatility (a tug-of-war between metals and Bitcoin, both vying for the title of “safe haven”), and Base creator coins (the new darlings of the digital age, courtesy of Zora and a dash of Coinbase glitter). 🧠

Now, if you’ve heard of Michael Saylor’s Strategy-once known by the more respectable name of MicroStrategy-you’d know they’ve been on a Bitcoin buying spree, snagging 1,229 shiny coins between December 22 and December 28. Quite the shopping spree at the local virtual coin store!

50% to the ecosystem (because sharing is caring, darling) and 25% airdropped faster than your ex’s texts after a breakup 💔.

Yes, dear reader, silver-ever the melodramatic dilettante-staged a sensational surge toward $83, flirting outrageously with a new all-time high (how dashing), only to be slapped across the face by the Chicago Mercantile Exchange. 🎭 This icy institution, in a move as romantic as a tax audit, raised margin requirements to $25,000 per futures contract starting December 29. Suddenly, leveraged traders found themselves underdressed at a billionaires’ gala-forced to sell, reduce positions, or weep quietly into their Bloomberg terminals. 💸😭

Enter Ali Martinez, the cryptocurrency analyst whose warnings carry the weight of someone who’s seen too many red candles in their lifetime. With over 160,000 followers hanging on his every tweet, Ali laid out a couple of reasons why XRP might be headed for another gut-wrenching drop-potentially by more than 55%. Spoiler alert: It’s not a Christmas miracle.

XRP is currently enduring a sell-off so severe it could make a Bolshevik blush 😬. The token has plummeted nearly 50%, from the dizzying heights of $3.66 to the more modest $1.85- a fall as abrupt as a Moscow winter. Binance, that grand bazaar of crypto, has seen Exchange Inflows surge like vodka sales on New Year’s Eve.

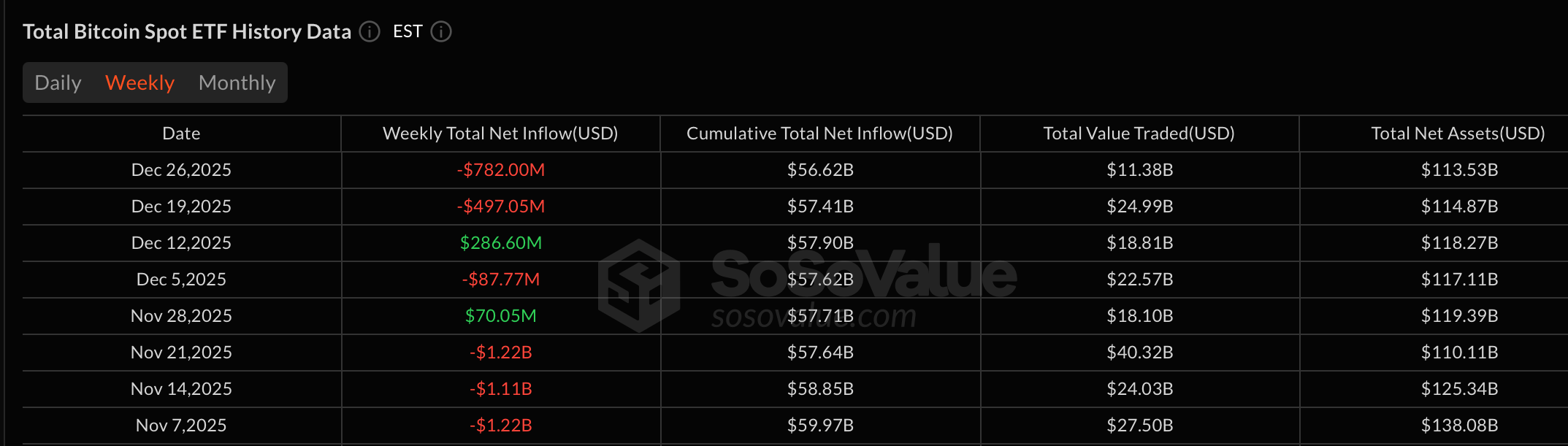

The final full trading week before year-end delivered a familiar pattern. Bitcoin ETFs bled capital, ether struggled to regain traction, yet XRP and solana continued to attract steady interest. Thin liquidity and cautious positioning defined the mood from Dec. 22 through Dec. 26. 😭

RLUSD: the year of the stablecoin 🌟