PEPE, the amphibious darling of the meme coin world, is once again making waves-though one suspects it would prefer to be making ribbits. 🐸

And why shouldn’t it? Amid a dazzling display of institutional enthusiasm for Ethereum (ETH), PEPE has emerged as the belle of the blockchain ball-or at least the most eye-catching frog in the swamp. With institutions pouring money into ETH like there’s no tomorrow, PEPE is riding the ripples all the way to the bank.

How Ethereum Became PEPE’s Fairy Godmother ✨

Let us pause for a moment to marvel at PEPE’s recent performance. It’s not just any old meme coin; oh no, it’s the star pupil of its class, outperforming such luminaries as Dogecoin (DOGE), Shiba Inu (SHIB), and Bonk Inu (BONK). Over the past 24 hours alone, PEPE has leapt nearly 10% higher, leaving its rivals floundering in the shallows.

One might say PEPE owes its success to Ethereum’s soaring flight toward new highs. After all, when capital floods into ETH, some inevitably trickles down to smaller tokens on its blockchain-and who better to catch that trickle than our slimy, green friend?

Analysts attribute this phenomenon to Ethereum ETFs crossing the $1 billion threshold in net inflows-a milestone so significant it practically demands a ticker-tape parade. BlackRock’s ETHA led the charge, proving that even Wall Street suits can appreciate the allure of decentralized finance (DeFi) and Web3 infrastructure. Truly, we live in wondrous times.

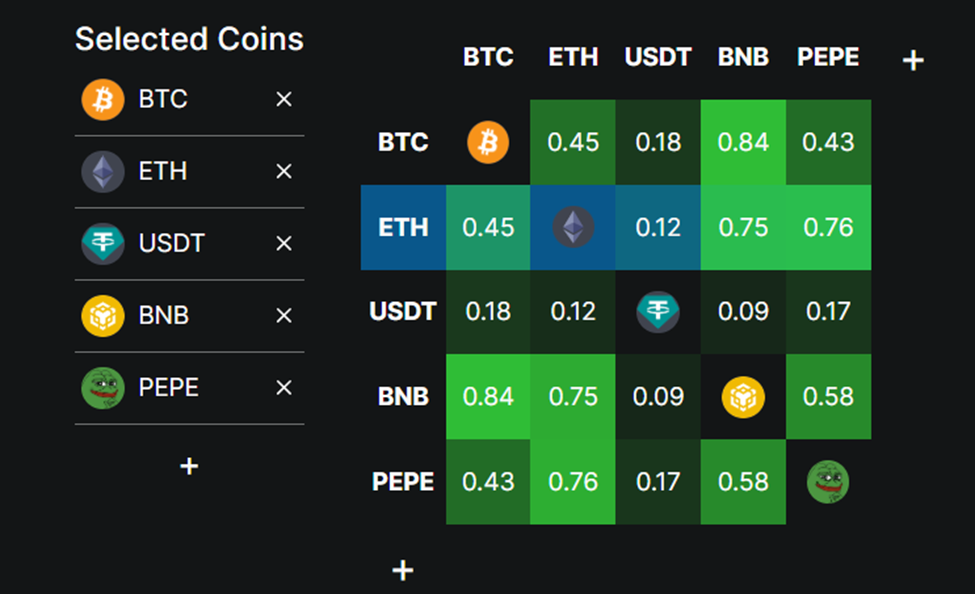

This influx of institutional interest has sparked what analysts call an “ETH accumulation wave”-a tide that lifts all boats, especially those piloted by frogs. Data shows PEPE maintains a robust price correlation of 0.76 with Ethereum, meaning if ETH continues its ascent, PEPE may well follow suit. One almost hopes for a royal wedding between the two-but alas, crypto unions are notoriously unstable.

A Growing Army of Frog Lovers 🐸❤️

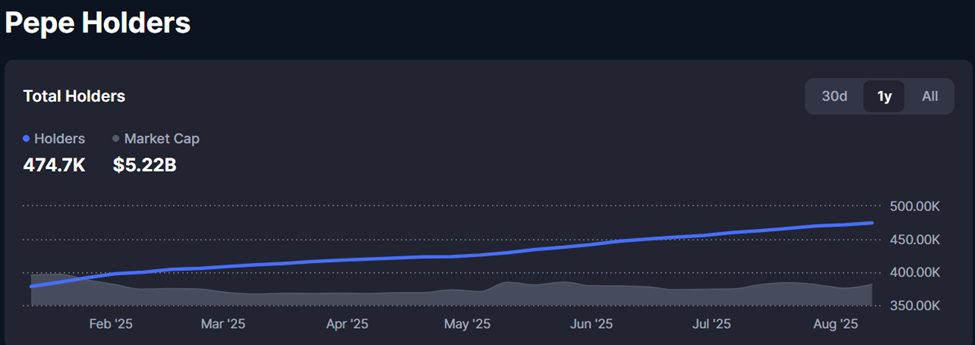

Even more remarkable is how PEPE’s fundamentals have strengthened despite its price taking a nosedive earlier this year. Wallet addresses holding PEPE have swelled by 25% in 2024, suggesting that retail investors remain smitten with the little hopper-even during leaner times.

Technically speaking, PEPE appears poised for greatness-or at least a dramatic breakout. Since January, the token has formed a symmetrical triangle pattern, which experts interpret as a harbinger of impending price fireworks. Whether these fireworks will dazzle or fizzle remains to be seen, but optimism abounds.

Still thinking that $ETH memes start to really catch a bid soon. Some sleeping giants out there and it’s probably time to pay attention to $PEPE again.

– Castillo Trading (@CastilloTrading) August 12, 2025

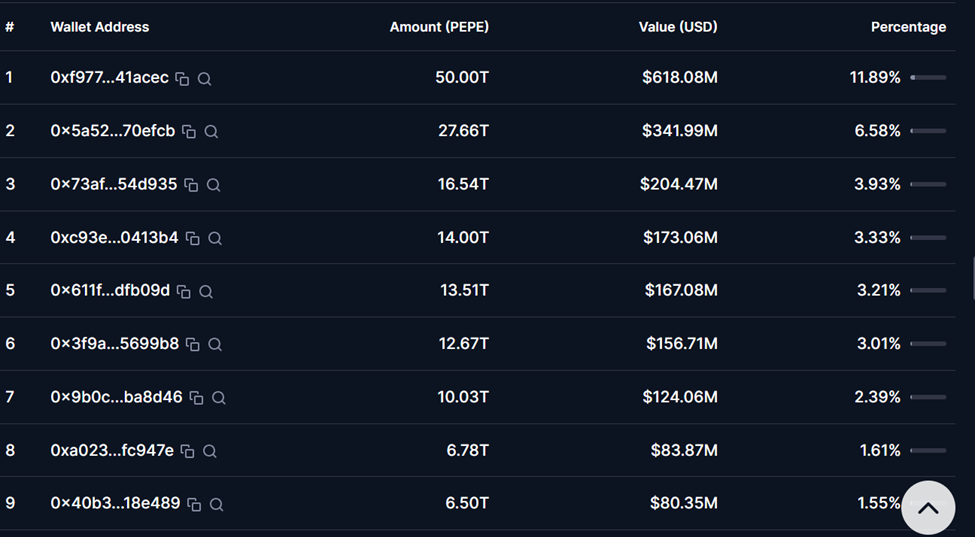

Of course, no tale of triumph would be complete without a touch of peril. On-chain data reveals that the top 10 PEPE wallets control over 37% of the token’s supply-a concentration that raises eyebrows faster than you can say “ribbit.” Should one of these whales decide to sell, the resulting chaos could send prices plunging faster than a startled frog fleeing a pond.

Indeed, large holder concentration is a recurring headache in the meme coin ecosystem. Just look at TRUMP and MELANIA tokens, where 94% of the supply rests in the hands of a mere 40 wallets. Such arrangements are about as stable as a house of cards built on a trampoline.

That said, with Ethereum ETFs gaining steam and institutional demand growing stronger by the day, PEPE seems primed to ride the wave-if it doesn’t get eaten by a bigger fish first. If ETH keeps climbing and technical patterns pan out, PEPE could experience a sharp upside move in the coming weeks. But beware, dear investor: sentiment in the meme coin market shifts quicker than Jeeves clearing a tray of cucumber sandwiches.

Read More

- Gold Rate Forecast

- USD HKD PREDICTION

- Trump Jr.’s Crypto Gamble: $1M Bitcoin & 2,500 Doge Miners! 🐕🚀💸

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- Web3’s Global Tango: Asia’s Retail Flair Meets Western Institutional Swagger

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Harvard Sage’s Bitcoin Blunder: Rogoff’s 2018 Prophecy Spectacularly Implodes 🚀😂

- Bitcoin’s Grand Finale: A Symphony of Chaos 🚀💣

- Is This the End of Crypto? Jeff Park’s Shocking Revelation!

2025-08-13 09:40