Poland’s lower house of parliament, the Sejm, just passed the “Crypto-Asset Market Act” on Friday-because who doesn’t want to regulate digital assets with the same rigor as a toddler’s bedtime routine? 🕵️♂️💸

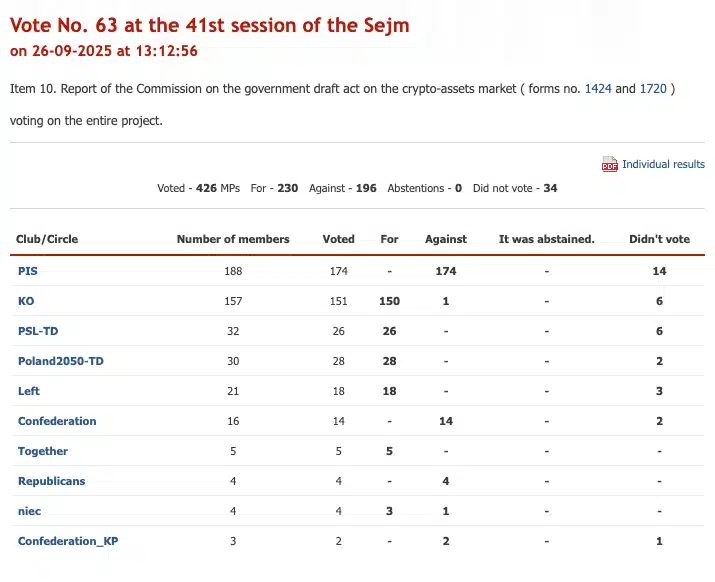

The legislation, approved with a vote of 230 in favor and 196 against-because nothing says “we’re serious about crypto” like a majority of lawmakers agreeing to something, and a minority of them disagreeing. Who needs consensus when you can have a good debate? 🗳️🔥

This move aims to implement the European Union’s Markets in Crypto-Assets (MiCA) regulation, standardizing rules across the bloc-because nothing says “unity” like forcing every country to follow the same rules, even if they’re as clear as a foggy day in London. 🌫️🌍

Poland’s Crypto Legislation Overview

The legislation, detailed in Bill 1424, officially designates the Polish Financial Supervision Authority (KNF) as the primary oversight body for the crypto sector. This places digital asset companies under the same supervisory umbrella as institutions like banks and insurers-because nothing says “trust us” like having your crypto managed by the same people who handle your mortgage and your grandma’s savings. 🏦👵

According to the official vote process, the bill passed with support from opposition parties, while the governing PiS party voted against it. The legislation will now proceed to the Senate for further consideration-because nothing says “democracy” like letting the Senate decide if they want to add more rules to an already complicated system. 🗳️🌀

What the new licensing regime means for crypto providers

Under the new act, Crypto Asset Service Providers (CASPs) operating in Poland will be required to obtain a license from the KNF to operate legally. The framework introduces guidelines and aims to standardize operations within the Polish crypto ecosystem-because nothing says “innovation” like making it harder to start a business. 🛠️📉

The law includes strict penalties for non-compliance. Violations could result in fines of up to 10 million Polish zlotys and potential prison sentences of up to two years-because nothing says “encouragement” like threatening to jail you for not following the rules. 🚨👮♂️

Broader implications for Poland’s market and EU alignment

This legislation precedes the institutionalization of cryptocurrency. By following the EU’s MiCA states, Poland looks to meet its standards, which could attract institutional investment seeking regulatory clarity-because nothing says “investment” like a government that’s as clear as a magician’s secret. 🔮💼

While the law provides a clear structure, some critics have raised concerns that the strict penalties and regulatory oversight could be perceived as overly restrictive, potentially impacting innovation-because nothing says “progress” like making it harder to be creative. 🎨🚫

The act represents Poland’s crypto industry interests, which aims to establish more regulation, so It could join a growing trend of national governments integrating digital assets into regular financial systems-because nothing says “modern” like turning Bitcoin into a bureaucratic nightmare. 🧠📉

Read More

- Gold Rate Forecast

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- USD HKD PREDICTION

- Silver Rate Forecast

- WazirX Miracle: Hacked Bucks Bounce Back! 💸😂

- Bitcoin’s Bailout: Schiff Say’s ‘Gold Alleys’ & CZ’s Snarky Comeback 😂

- Brent Oil Forecast

- Dostoevsky Discovers Google: Crypto Wallets Face Absurd Bureaucratic Fate 😱

- LINK Soars Higher: Whales Go Wild, Market Goes Bananas! 🐳🚀

- Harvard Sage’s Bitcoin Blunder: Rogoff’s 2018 Prophecy Spectacularly Implodes 🚀😂

2025-09-29 19:17