Upbit, Korea’s crypto juggernaut, threw RedStone (RED) into the spotlight on Friday, sending it skyrocketing by over 80%. 🚀 Because nothing screams “let’s party” like a new listing on a major exchange. 🎉

Token listings on big exchanges are like caffeine for crypto prices-instant buzz. Conversely, delistings? Well, they’re the equivalent of a hangover. 🥴

RED Hits Upbit: The Nitty-Gritty

The exchange announced the listing on September 5, allowing RED to trade on the Korean won (KRW) market and Ethereum-based transactions. Because, you know, ETH is the Netflix of blockchain-everyone’s using it. 🍿

“Only deposits/withdrawals via the specified network (RED-Ethereum) will be supported. Always confirm the network before depositing,” Upbit said, sounding like a cautious parent. 🙄

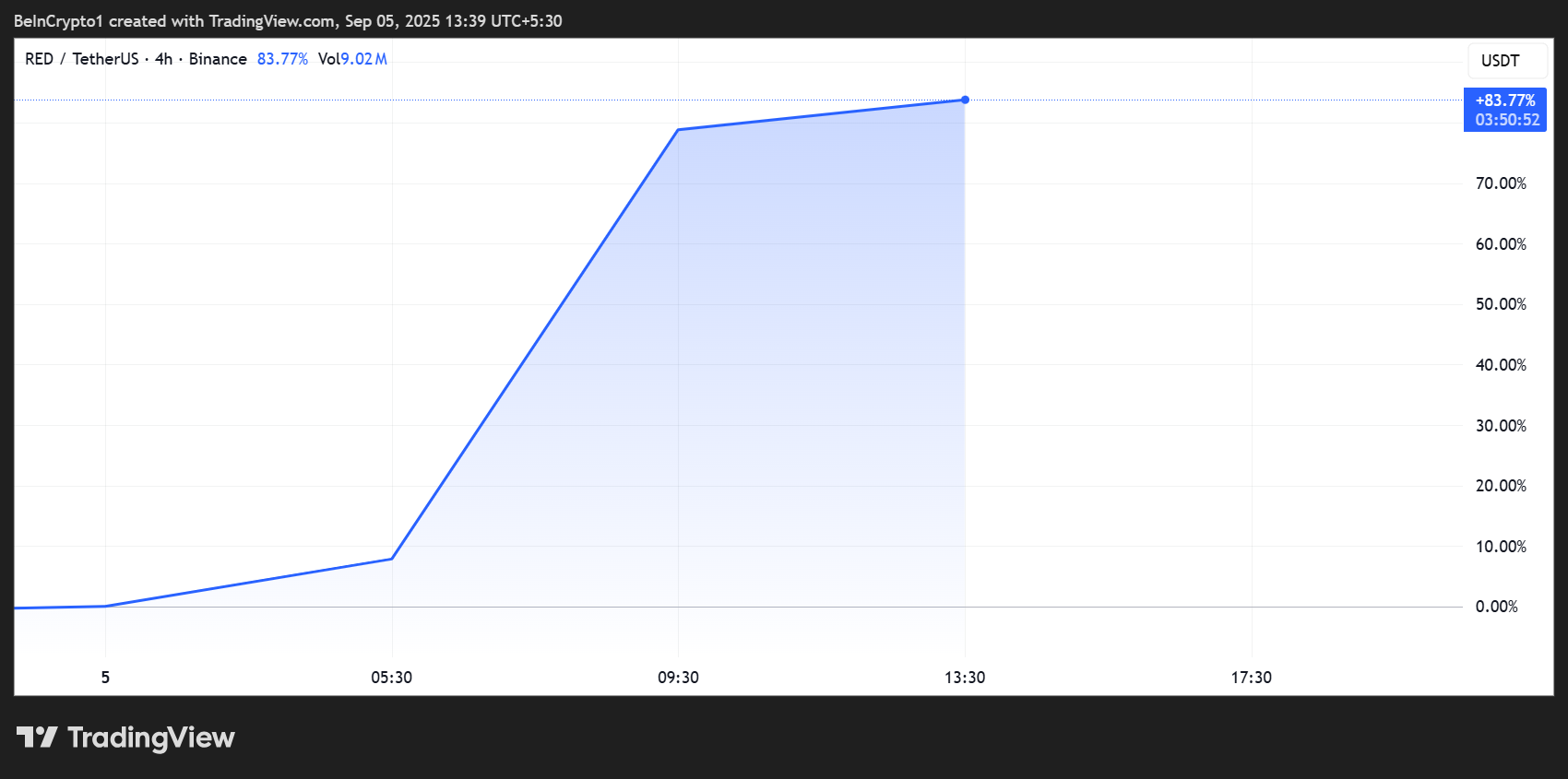

Post-announcement, RED shot up by 83%, hitting $1.1900 on Binance. Not bad for a Friday, huh? 💰 Though, let’s be honest, trading could be delayed if liquidity decides to play hard to get. Upbit’s tentative listing time is 17:00 KST-so set your alarms, folks. ⏰

For the first 5 minutes, sell orders at prices 10% or lower than the previous day’s closing price will be restricted. Because nothing says “controlled chaos” like limiting panic sells. 😅

Only limit orders will be allowed for two hours post-trading launch. So, no fancy market orders, folks-this isn’t a day spa. 💆♂️

Meanwhile, RED’s price reaction is textbook crypto behavior: listing = 🚀, delisting = 📉. Exhibit A: BAKE, HIFI, and SLF fell off a cliff after Binance’s delisting announcement. RIP. 🪦

RedStone Buys Credora: DeFi Power Move 🤝

The Upbit listing followed RedStone’s acquisition of Credora, a credit rating platform backed by Coinbase Ventures. Because who doesn’t love a good acquisition drama? 🍿

RedStone acquires @CredoraNetwork, the leading DeFi ratings provider.

This changes the status quo for DeFi risk management.

For the first time ever: Real-time pricing + institutional-grade risk ratings under one roof

– RedStone (@redstone_defi) September 4, 2025

The deal strengthens RedStone’s DeFi position, combining real-time data feeds with Credora’s credit expertise. Because nothing screams “innovation” like combining two buzzwords. 🚀

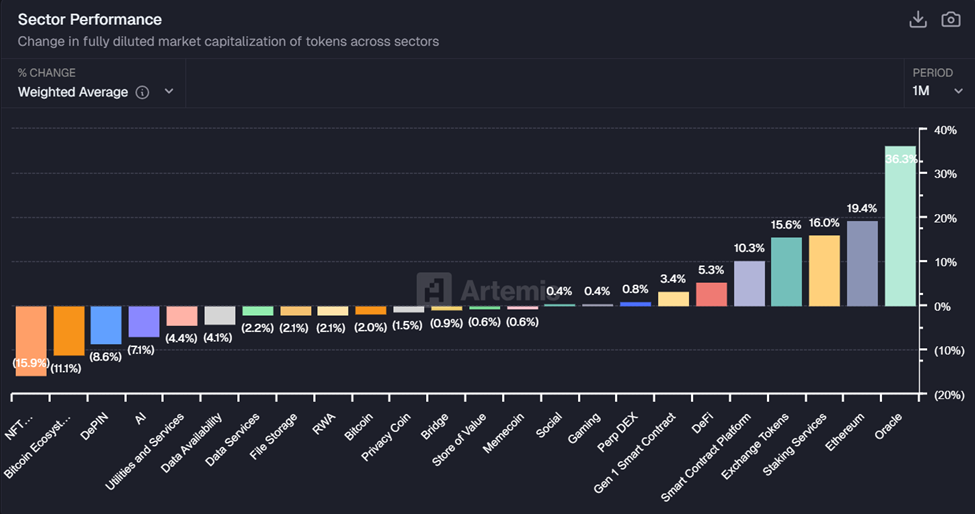

Oracle tokens have been on fire lately, with investors eyeing data infrastructure as DeFi’s next big thing. 📈

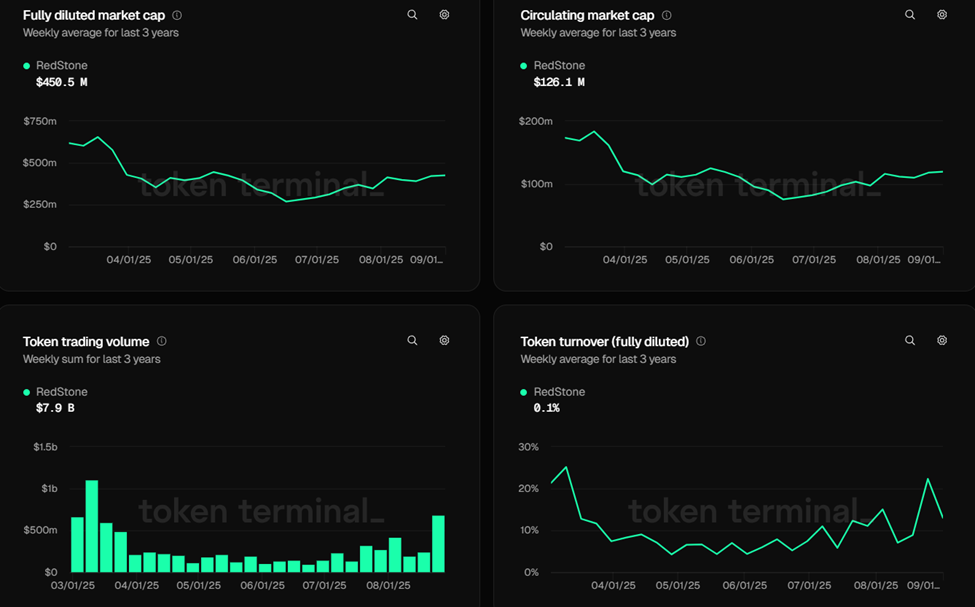

However, concerns linger over RedStone’s network activity and total value locked (TVL). Despite the token’s strong performance, usage metrics are… underwhelming. 😐

So, will RedStone’s hype translate into long-term adoption? Stay tuned. 😏

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- Ether’s Dance: A Tragic Waltz of Gain and Greed

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

- Bitcoin’s Wild Ride: A Tall Tale of $HYPER Hype & $BTC Lunacy 🐍

- USD HKD PREDICTION

- North Korean Hackers Using Deepfakes and Fake Interviews to Steal Crypto – Beware!

- Ark Invest Splurges $21.2M on Bullish Shares and $16.2M on Robinhood – Crypto, Anyone?

2025-09-05 12:26