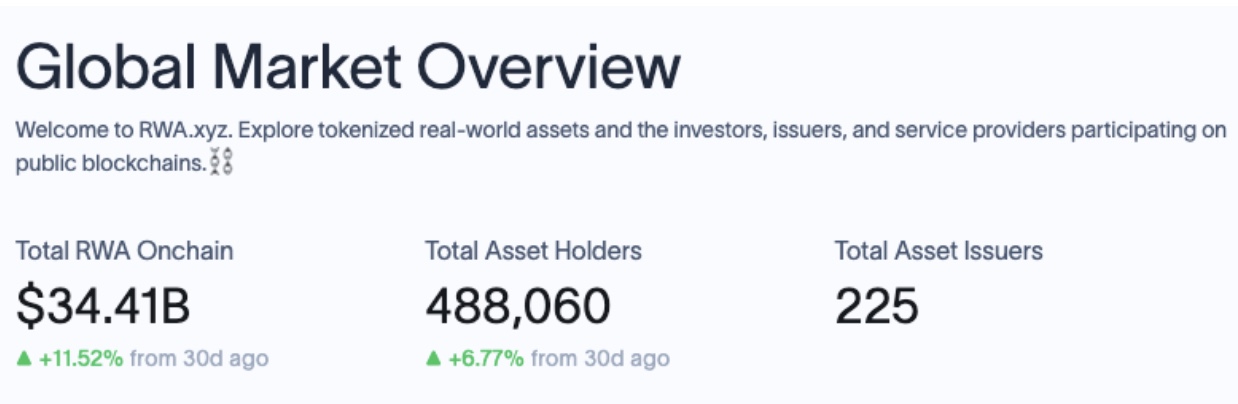

Real World Asset (RWA) sector valuation hit $34.4 billion on Saturday, October 18, marking an 11.6% increase and a $3.9 billion rise in total deposits over the last 30 days, according to RWA.xyz data. 🎉💸

RWA Market Overview | Source: RWA.xyz, Oct 18, 2025 📊

The ongoing U.S. government shutdown, combined with Gold’s record-setting rally above $4,200, has created a flight-to-safety narrative that boosted RWA inflows despite broader crypto weakness. 🚨📈

The crypto market suffered its worst month since May after President Donald Trump’s tariff call on China triggered a $19 billion liquidation event on October 10. Another $1.2 billion wipeout followed on October 17, pushing Bitcoin below $104,000, its lowest level since July. 🐍📉

However, the Real-World Assets sector remained resilient. Tokenized debt, commodities, and private credit products continued attracting inflows as investors sought yield stability amid macro uncertainty. 🏦💼

U.S. Treasuries and Gold-Backed Assets Lead Inflows 🪙

Private credit remains the largest RWA category, representing 51.4% of the total market at $17.3 billion. Data from RWA.xyz shows U.S. public debt and commodities accounted for nearly half of the $3.9 billion in new deposits. 📈

Total RWA Value | Source: RWA.xyz October 18, 2025 💰

Since the start of October, Tokenized U.S. debt instruments rose from $7.5 billion to $8.3 billion, reflecting accelerated tokenization of U.S. securities following the US government shutdown. Gold’s historic rally to $4,200 last week also impacted on-chain movements, with Commodities-backed RWAs rising from $2.1 billion to $3.2 billion. 🏛️🔥

Combined, U.S. Treasuries and Commodities saw $1.9 billion in inflows, accounting for 51% of all newly tokenized assets in the last 30 days. 📊

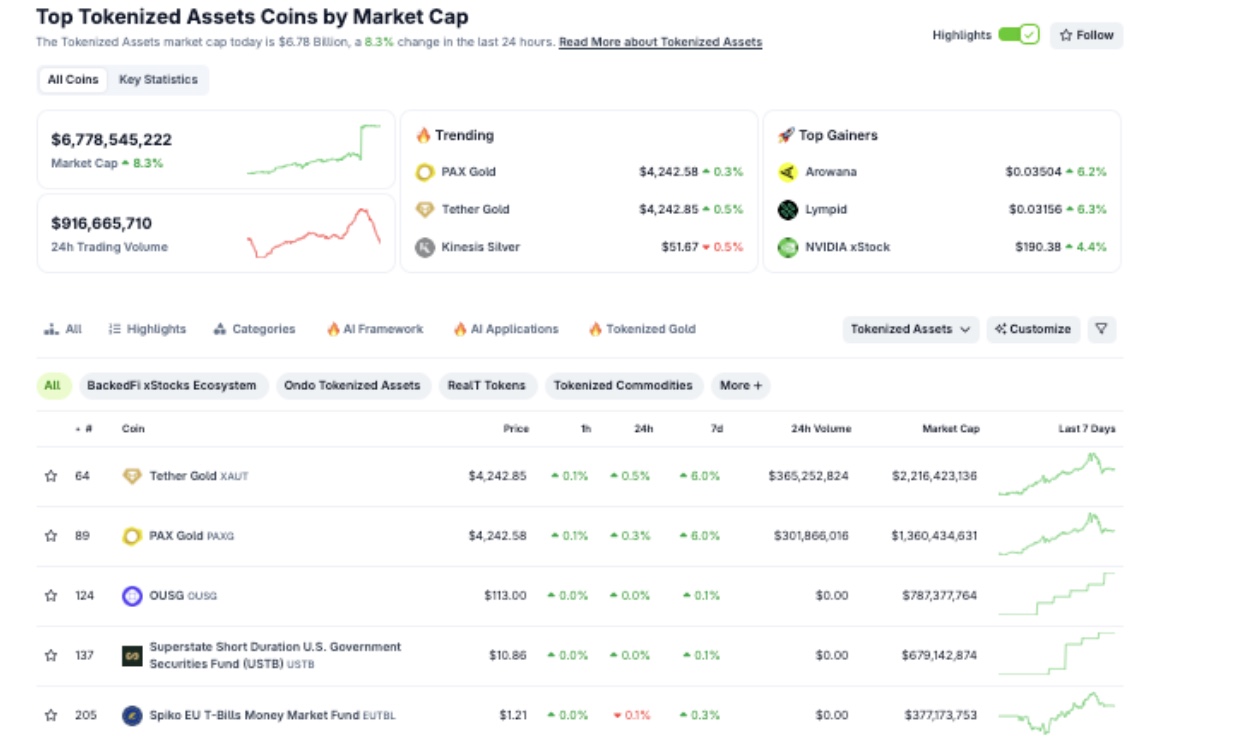

Tokenised Assets by Market Cap | Coingecko: Oct 18, 2025 📈

Increased liquidity in the sector has generated significant gains for token holders, defying recent crypto market turbulence. 🚀

CoinGecko data shows the aggregate market cap of tokenized projects rose to $6.78 billion, gaining 8.3% intraday, compared to the broader crypto market’s 0.6% uptick. 📈📉

Read More

- Gold Rate Forecast

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Web3’s Global Tango: Asia’s Retail Flair Meets Western Institutional Swagger

- Harvard Sage’s Bitcoin Blunder: Rogoff’s 2018 Prophecy Spectacularly Implodes 🚀😂

- USD HKD PREDICTION

- Brazil Ditches Cash?! 💸

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- Trump Jr.’s Crypto Gamble: $1M Bitcoin & 2,500 Doge Miners! 🐕🚀💸

- USD IDR PREDICTION

- Bitcoin’s Wild Ride: A Tall Tale of $HYPER Hype & $BTC Lunacy 🐍

2025-10-18 23:22