In the twilight of Bitcoin’s latest dance with gravity, the once-jaunty $90,000 mark looms like a forgotten promise. On-chain whispers from CryptoQuant reveal a curious stillness-whales, those caped crusaders of chaos, have retreated from Binance’s grand stage. No longer do they flood exchanges with BTC, their once-mighty inflows now reduced to a trickle. One might call it a truce, or perhaps a midlife crisis.

Yet, Bitcoin’s long-term arc remains stubbornly upward, a testament to the resilience of dreams-or perhaps the delusions of the desperate.

Whale Exodus: Binance’s Quiet Rebellion

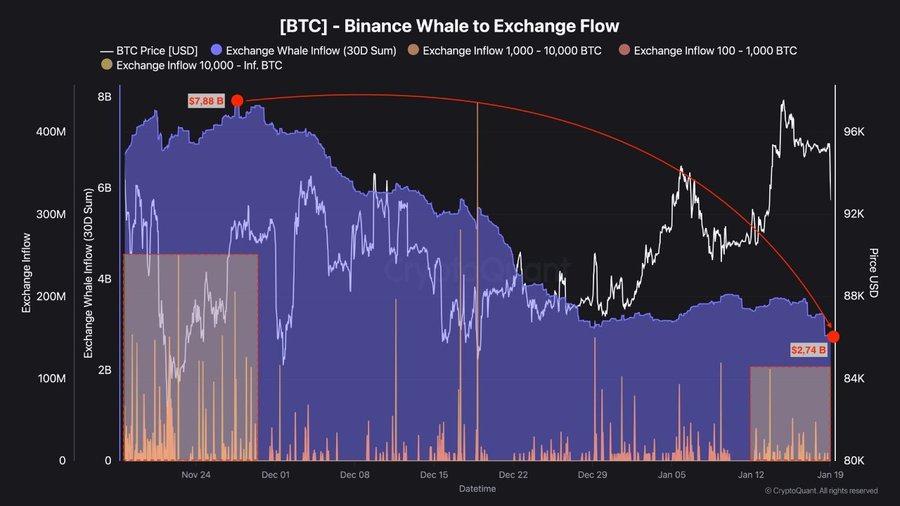

CryptoQuant’s ledger tells a tale of retreating tides. Whales, those self-appointed stewards of market mayhem, have slashed their Binance inflows by nearly 3x since November’s frenzied climax. From $8 billion to a paltry $2.74 billion, their sell-offs have softened like a deflated balloon at a child’s birthday. Even the largest transactions-those 10,000+ BTC monstrosities-have gone radio silent.

The categories? A bureaucratic trifecta: 100-1,000 BTC, 1,000-10,000 BTC, and above 10,000 BTC. All three now whisper rather than roar, as if the whales themselves have grown weary of their own theatrics.

Perhaps they’ve finally realized that selling everything at once is less a strategy and more a cry for help.

The Great Pause: Why Whales Now Nibble

The chart, that sacred relic of market truth, now shows a stark divide. Whales, once frenetic as a caffeinated squirrel, have adopted the patience of a monk in a monastery. No more liquidation carnage; no more 22,918 BTC sold in one fell swoop, triggering a $500 million meltdown and a 2.5% price drop. Now, they sit, sipping tea and watching the chaos unfold like a bad reality show.

This calculated retreat? A masterstroke or a midday nap? Either way, it’s a far cry from the panic-driven sell-offs that once made headlines. Or, as one observer quipped, “It’s like watching a bear market in slow motion-just without the bears.”

Bitcoin’s Balancing Act

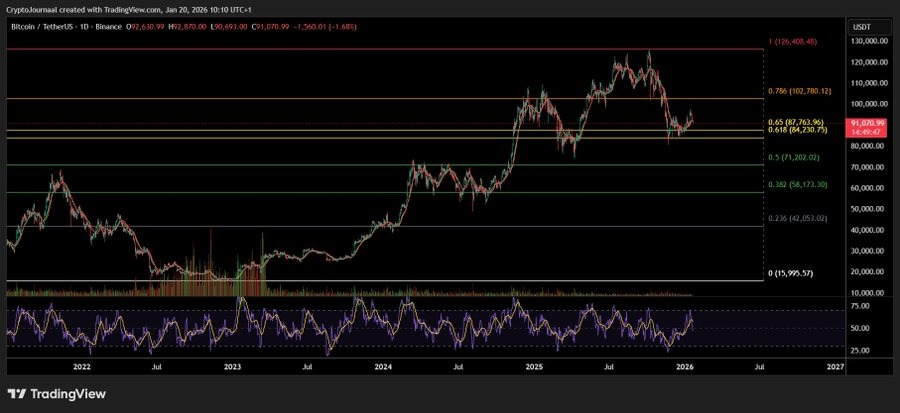

Bitcoin, ever the tightrope walker, clings to its long-term uptrend. From $83,000 to record highs, then a stumble at $126,000, it now wobbles between $84,000 and $92,000. A sideways shuffle, yes, but one that hints at either a triumphant leap or a face-plant into the abyss.

Break above $92,000, and the bulls might just rediscover their courage. Drop below $84,000, and the bears will throw a party with confetti made of shattered dreams. As always, the market waits for no one-unless, of course, it’s waiting for the next whale to surface and remind us all why we should be afraid.

Read More

- Crypto’s Wall Street Waltz 🕺

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Centrifuge Hits $1B & My Mother Finally Asks “What’s a Token?” 😱

- USD HKD PREDICTION

- Crypto Chaos Unveiled: Gains, Losses & More Drama Than Your Aunt’s Tea Party! ☕🪙

- Ethereum Whales on a Buying Spree: Is $3,400 ETH Price Next? 🐳📈

- Ethereum Cracks? Oh, the Drama!

- Crypto Chaos: Shiba Inu Flirts with Another Zero, Ethereum on the Brink, Bitcoin’s $100K Nightmare!

2026-01-20 14:52